The Nextdc Ltd (ASX: NXT) share price is on watch after it announced new and bigger plans for its M3 Melbourne data centre.

Nextdc is data centre operator. The company builds and maintains infrastructure required by many IT companies, cloud service providers, governments and more.

Melbourne M3 data centre

Nextdc has been working on the steps required to develop an expansion of its Melbourne data centre called M3.

In its FY21 first half result released in February it announced that it had submitted its original plans to council. The company was successful in receiving planning consent and proceeded with the construction of M3.

New bigger plans for M3

Nextdc said that its has recently acquired 40,000sqm of adjoining land, this means that the M3 site has now increased to around 100,000sqm. The additional land is currently subject to planning consent.

Management said that the 40,000sqm of newly acquired land cost around $24 million and has been funded by Nextdc’s cash reserves.

The company said that it plans to develop it into a ‘hyperscale campus’ with a data centre of around 150MW of capacity. It will also house customers’ mission critical operation centres, administration offices and collaboration spaces.

The company said that the M3 site is located close to the required infrastructure in West Footscary, around 10km west of Melbourne’s CBD.

Management comments

Nextdc CEO and Managing Director Craig Scroggie said: “The upgraded development of this new hyperscale technology campus in Melbourne is driven by ongoing customer demand for premium quality data centre infrastructure.

“Nextdc looks forward to being able to offer our customers multiple availability zone solutions across our existing M1 Port Melbourne, M2 Tullamarine, as well as this new M3 hyperscale campus in West Footscray.”

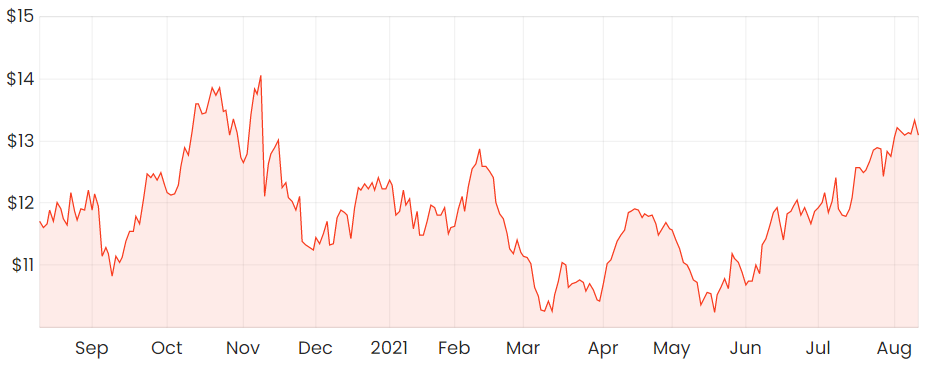

Nextdc share price volatility

Summary thoughts on the Nextdc share price

Nextdc is an interesting business and has the potential to have demand grow strongly as the world increasingly uses cloud and digital services.

However, I’m unsure what kind of future profit Nextdc can make and what the landscape in its industry will look like in 5 or 10 years from now.

The Nextdc share price closed almost 2% lower at $13.09 on Wednesday. With this announcement released after market close yesterday, it remains to be seen what market sentiment is on the back of this news.