The Resmed CDI (ASX: RMD) share price has been a star performer on the ASX recently, up over 50% in just a few months.

Last week, the California-based company released its Q4 results which revealed sales had risen as a result of “incredible demand”.

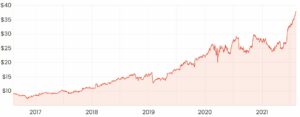

The long-term view of the company looks even better as you can see from the chart below. The ResMed share price has rallied as the company has been able to grow its earnings (profit) consistently over several years, causing its share price to move in the much wanted “bottom left to top right” direction.

Q4 results recap

The recent spike in demand for ResMed products in the US was largely the result of a product recall by one of its largest competitors. Even still, ResMed has been unable to meet the current demand and has been trying to source parts from various suppliers.

Across the quarter, revenue increased by 14% to $876.1 million, or up 10% on a constant currency basis. Gross margin was squeezed slightly to 56%, but it still managed to increase its quarterly dividend by 8% to $0.42 per share.

Looking beyond the numbers – Company culture

Companies that have a positive work culture are able to retain talent and deploy resources more efficiently into other areas of the business.

Websites like Glassdoor can be useful to gain some insight into aspects of the company’s culture as well as the strength of its management team. The larger the company (more reviews), the more insightful this information usually is.

ResMed has over 600 company reviews, with over 81% of employees saying they would recommend it to a friend and over 93% approving of the current CEO. Constantly mentioned in the reviews are aspects such as RedMed’s positive work environment and culture. Of course, websites like Glassdoor don’t paint the full picture – but quite often, you’ll notice that financially successful companies also have a great work culture.

ResMed’s durable advantage

As a long-term investor, I’m looking for companies that have some sort of durable advantage. This keeps competitors at bay.

In ResMed’s case, how likely is it that sleep apnea, chronic pulmonary diseases, and similar illnesses will be around in say, 5-10 years?

Unfortunately, these sorts of illnesses are more prevalent than most would think. Obstructive sleep apnea (OSA) is estimated to affect around one-seventh of the world’s adult population.

Given the large market opportunity and its competitive position, I imagine ResMed will likely be around for many more years to come, barring any catastrophic events within the company. So long as it keeps making industry-leading products at a competitive price, its advantage should enable it to earn respectable returns on capital.