It’s been a bumpy ride but Commonwealth Bank of Australia (ASX: CBA) shares have come out stronger than ever. And CBA’s latest move could push its shares even higher.

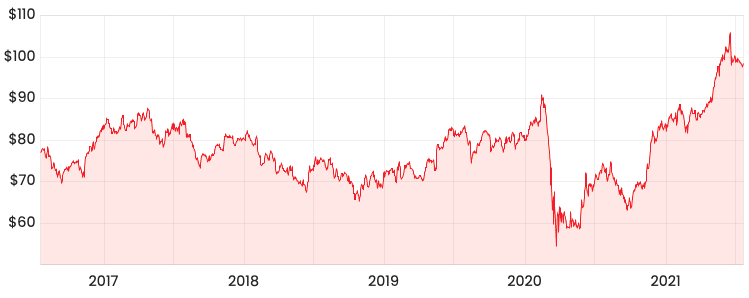

CBA share price

It’s time to cross-sell

If you bank with CBA, you will be able to access discounted broadband now. Yeah, that’s right, broadband!

CBA discloses it will acquire a 25% equity stake in NBN providers, More Telecom and Tangerine, which have 90,000 customers. More Telecom and Tangerine were established in 2013 and are growing due to their wholesaler relationship with Vocus Communications.

7 million CBA app users will get exclusive access to special telco deals.

According to the Australian Financial Review, CBA’s investment stands at around $10 million. If the partnership is a success, the telcos will pay CBA a referral fee as CBA offers discounted plans to its customers.

Another important value addition is CBA could provide special broadband offers as customers purchase a new home.

My take

I think this is a sound play as CBA tries to offer more value for customers and provide a differentiated banking app compared to its peers.

Not only do CBA need to deal with the big banks but Afterpay Ltd (ASX: APT) has released its new money and lifestyle app, ‘Money by Afterpay’. A more in-depth discussion can be found in this great podcast.

Given the immense competition to become the leading digital banking platform, I expect CBA to make more of these investments.

Whilst it’s always encouraging to see a business deploying capital, it’s important to monitor whether such investments provide a high level of return on capital.

Valuation should also be considered given there is a high level of optimism baked in the CBA share price.

If you are interested in valuing CBA shares, check out this article on 2 ways to value them.