It’s easy to focus on the biggest supermarket players, Coles Group Ltd (ASX: COL) and Woolworths Group Ltd (ASX: WOW) and forget about Aldi.

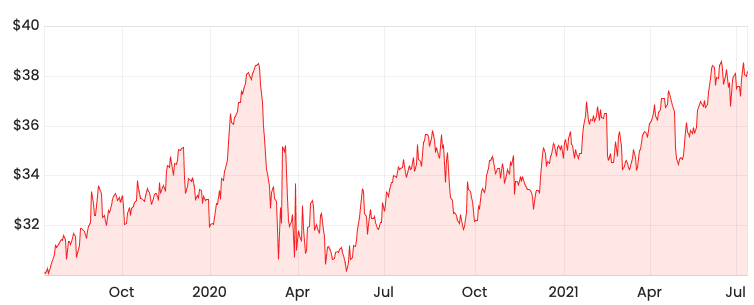

Whilst Woolworths has demerged Endeavour Group Ltd (ASX: EDV), Coles is steadily approaching pre-pandemic highs.

It’s great to hear both Coles and Woolworths chugging along but they should monitor Aldi closely.

COL share price

WOW share price

Online grocery shopping

This is an area where Coles and Woolworths have a leg up on Aldi.

Personally, I tried Woolworths’ free one month trial of online delivery offer and slowly warmed to it over time. It has become so convenient and time-efficient that its become a habit. Well done Woolworths, you managed to convert a cynic!

Out of interest, I looked at what Coles had to offer and they only offered one delivery for free, so you have to immediately pay after this first introduction.

I think this presents a lot of customer friction and Coles is banking on customers falling in love with online delivery in their first experience.

What I like about the free one month trial is that it offers customers the opportunity to adopt online shopping as part of their lifestyle.

As for Aldi, it’s still considering whether to sell alcoholic beverages, food and groceries online.

Different but is it good?

‘Good different’ has been Aldi’s mantra.

And that’s certainly the case as it intends to develop a new small-store format, known as Corner Store, so it can expand into heavily populated urban locations.

This is despite Coles advising that its CBD stores are underperforming and Woolworths recently wrote down the value of its CBD store portfolio.

Aldi Chief Executive Tom Daunt said they’re optimistic about the long-term trends rather than based on the last 12 to 15 months of COVID.

My thoughts

Aldi’s new strategy to open small stores in urban locations means more competition.

Greater competition tends to lead to lower prices, which eats into margins.

Woolworths still leads in terms of market share but investors should also monitor what Coles and Aldi are up to.

Monitoring competition allows you to identify any interesting opportunities that competitors are pursuing because optionality brings more revenue. And when I say optionality, I mean what can these supermarkets offer to create new money-making avenues.

If you are interested in Coles, you should check out Lachlan Buur-Jensen’s article.

However, if you’re on the hunt for ASX growth shares, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.