Shares in Australian wealth platform Netwealth Group Ltd (ASX: NWL) are up after the company released its June quarter business update.

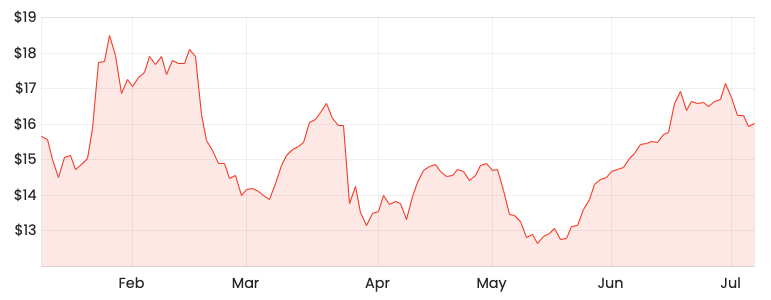

NWL share price

Net inflows spur growth in FUA, FUM

Funds Under Administration (FUA) increased $5.3 billion or 12.7% to $47.1 billion compared to the March quarter.

Of the $5.3 billion, $2.2 billion was attributed to market movement and $3.1 billion to net inflows.

On a full-year basis, FUA has increased 49.6% or $15.6 billion.

Positively, market movement only accounted for $5.8 billion of the $15.6 billion. The majority of the increase resulted from net inflows of $9.8 billion signalling growth is sourced mainly from new customers rather than increases in asset values.

Fee-paying FUA remained steady at 65.6%. The level of cash as a percentage of FUA was 6.9%.

Quarterly Funds Under Management (FUM) increased $1.2 billion or 11.9% to $11.7 billion, led by $0.7 billion net inflows to managed accounts and a 5.8% increase in total member accounts.

Full-year FUM increased $4.5 billion or 61.4%.

The Netwealth’s client base remains well-diversified with the largest inflow contributor accounting for 12% of net inflows.

Netwealth eats incumbents lunch

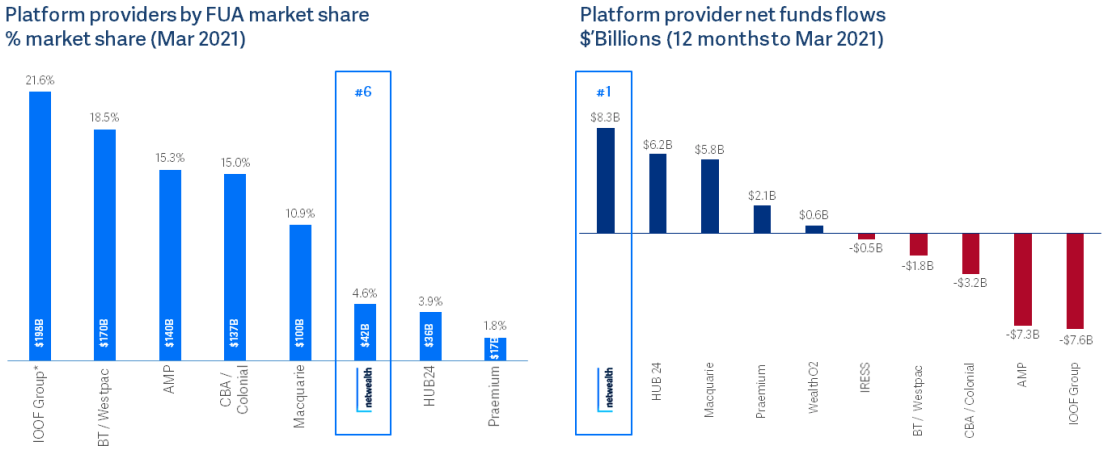

As a result of strong growth in FUA and FUM for FY21, Netwealth increased its Australia wealth platform market share to 4.6%. This is up 100 basis points from 3.6% in March 2020.

Impressively, the business recorded $8.3 billion in net inflows to March 31, scoring it first place against competitors.

The trend of digital disruptors such as Netwealth and Hub24 Ltd (ASX: HUB) taking market share from incumbent wealth providers remains unchanged.

The four largest platforms – IOOF Holdings Limited (ASX: IFL), BT Financial Group, AMP Ltd (ASX: AMP) and Colonial First Estate, all experienced net outflows.

Not just impressive numbers

In addition to the strong operational results, Netwealth has received a number of industry awards.

The company retained its number one rating for overall satisfaction among users awarded by Investment Trends for the ninth straight year in the June 2021 Planner Technology Report. This is in addition to being awarded first place for transaction tools, reporting, product offering and decision support tools in the Investment Trends 2020, Platform Benchmarking Report.

Moreover, Netwelath won the Chantwest Best Advised Product for the fourth year in a row.

My take

Another quarter and another impressive result for Netwealth. Today’s update validates the acceleration of FUA and FUM during COVID-19 was not a one-off event.

The company offers a superior product for advisors and clients illustrated by the aforementioned industry awards and net inflows.

Management provides clear and transparent disclosures. Additionally, shareholder interests align with the executive team given the high insider ownership by the founding Heine family.

Currently, I have Netwealth on my watchlist. I’ll be waiting until the FY21 results release in August before making a buy decision.