Dicker Data Ltd (ASX: DDR) shares have backed up its strong FY20 results with a positive market update. Are Dicker Data shares the next quiet long term compounder?

Dicker Data is a wholesale distributor that focuses on IT hardware, software, and cloud products of large, global technology companies.

It generates around 93% of total revenue in Australia and the rest in New Zealand.

DDR share price

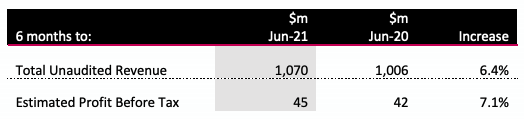

Positive update for HY21

Despite experiencing a flat first quarter for FY21, it delivered a strong second quarter with solid jumps across revenue and profit.

This encouraging update also comes off the back of a stellar HY20 when it recorded 18.2% revenue growth on HY19.

Management believes the unprecedented spike in demand for devices in 2020 will continue in 2021.

The company also identifies the growth in the adoption of automation, machine learning and data capture and analysis by businesses and governments to be strong catalysts for future growth. It also flagged 5G connectivity as another driver of growth across the government, enterprise and education sectors.

However, Dicker Data also noted the global chip shortage is expected to continue for the foreseeable future as manufacturers work to manage the available inventory.

My take on Dicker Data

Dicker Data is riding a huge tailwind as the pandemic has accelerated the adoption of technology with organisations embracing remote working.

Its competitive advantage stems from its portfolio of high-profile IT vendors, protected by high barriers to entry. It requires high upfront costs to secure large vendors.

I think Dicker Data will continue to generate high growth in revenue due to strong secular tailwinds.

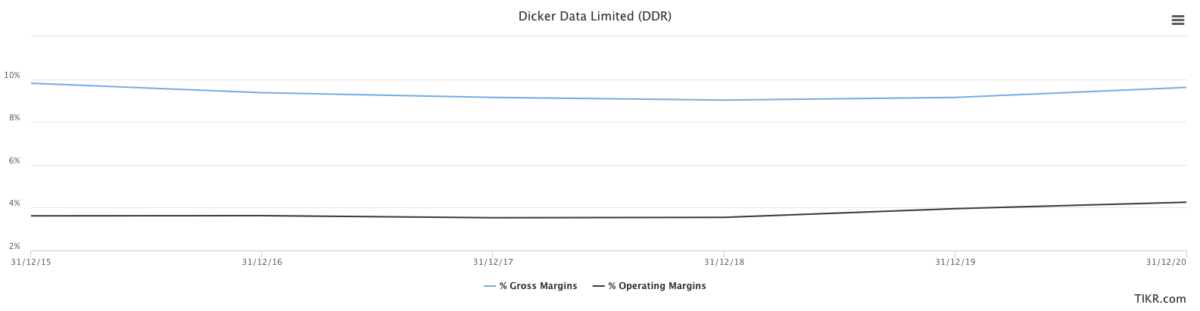

In saying this, investors should note margins in distributor type businesses are low, so the unit economics are not great.

As you can see below, both gross margins and operating margins have remained steady in the last five years.

Despite low margins, Dicker Data is managing to keep growing its earnings per share, which is another key metric to monitor as the business grows.

If you’re looking to become a better investor, I’d recommend signing up for a free Rask account to gain access to our stock reports.