Out of ideas for ASX growth shares? Here are three that could be worth adding to your watchlist this week.

Jumbo Interactive

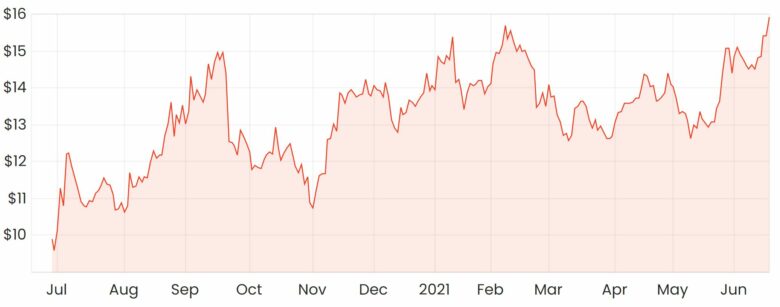

Shares in lottery company Jumbo Interactive Limited (ASX: JIN) have made a strong recovery recently along with the broader tech sector. Jumbo’s shares currently trade for $15.9 – a jump of around 20% in the past month.

JIN share price

While Jumbo has a mature business here in Australia, it’s recently been trying to establish itself overseas through its Powered by Jumbo (PBJ) software-as-a-service (SaaS) platform.

Aside from the usual quality features of a SaaS business, the overall thematic around lotteries and charities seems to be positive, which could be further sustained through increased online adoption.

For some more reading on Jumbo’s shares, click here to read: Up 20% in 1 month: Time to buy Jumbo Interactive (ASX: JIN) shares?

Fineos Corporation

Another growth share to watch is Fineos Corporation Holdings PLC (ASX: FCL).

Fineos is a global software provider of core systems for life, accident and health insurers that has 7 of the 10 largest group life and health carriers in the US as well as 6 of the largest life insurers based in Australia.

The industry seems to still be structurally growing as insurers are still in the process of transitioning from old legacy systems to more flexible cloud-based solutions.

As an added bonus, CEO Michael Kelly still owns the majority of the company’s shares, which suggests strong shareholder alignment.

To read more, click here to read: Why Fineos (ASX: FCL) could be an ASX growth share to watch closely.

Globe International

One last ASX growth share to watch is Globe International Limited (ASX: GLB) – a retailer that operates through brands such as FXD Workwear, Impala and Globe.

The business has gone gangbusters from the onset of COVID-19. Unsurprisingly, its shares are up over 400% over the past year.

GLB share price

Globe’s Impala brand has been one of its key growth drivers recently. They offer a range of high-quality skates, inline skates and skateboards.

While Impala’s sales likely experienced a COVID-related boost as consumers have taken up new hobbies, management reckons the surge of popularity for the sport was accelerating well before COVID.

Similar to Fineos, Globe also has a high level of insider ownership. Founders Stephen and Peter Hill both still hold over 12 million shares (~30%) each.

For some more reading on Globe, click here to read: Why the Globe International (ASX: GLB) share price has surged recently.