The A2 Milk Company Ltd (ASX: A2M) share price has been pushing higher recently after a Chinese policy change.

It’s not just A2 that’s had a boost in sentiment though. Shares in Bubs Australia Limited (ASX: BUB) and Synlait Milk Limited (ASX: SYN) have also bounced on the news announced earlier this week.

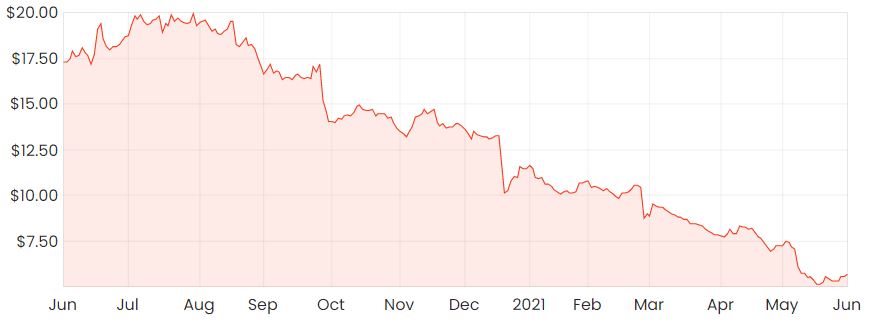

A2M share price

Policy change

China’s government will soon scrap the policy that previously allowed couples to two children. This rule was introduced back in 2015 – prior to that, couples were only limited to one child.

Back then, the rationale behind the decision was that it would curb explosive population growth. But now, concerns over an ageing population and record low population growth has caused the Chinese government to amend its policy on the matter.

Why could A2 stand to benefit?

Keeping in mind the vast majority of A2’s growth has come from its infant milk products (baby formula) bought by Chinese customers, the implication is that there could be an increased demand for A2’s products as more children are being born.

If this were to happen, I’d imagine there’d be a significant time lag between now and when demand would increase, so I don’t think there’s too much of a rush to buy in now based on this news.

Things to consider

If birth rates pick back up under the new policy, it might not necessarily mean that mothers are guaranteed to choose A2’s products. In fact, recent information suggests that there’s been an increasing trend of mothers preferencing domestic brands over international brands like A2.

One local brand, China Feihe is a large competitor that plans to supply around one-third of the market for formula products by 2023.

Since listing on its local stock exchange at the end of 2019, its shares have been going gangbusters as it’s been winning back market share.

Time to buy A2 shares?

China’s policy change probably wouldn’t be enough for me to change my mind on A2 for the moment. Due to the competitive space in China at the moment, I think A2 is going to be up for some challenges even when international borders open along with its daigou channel.

As part of the Rask investment philosophy, we often try to look for companies that operate in structurally growing industries.

For an example of these types of companies, click here to read: My top 3 ASX software shares for June.