Looking for exposure to software companies? Here are three worth taking a look at for June.

Altium

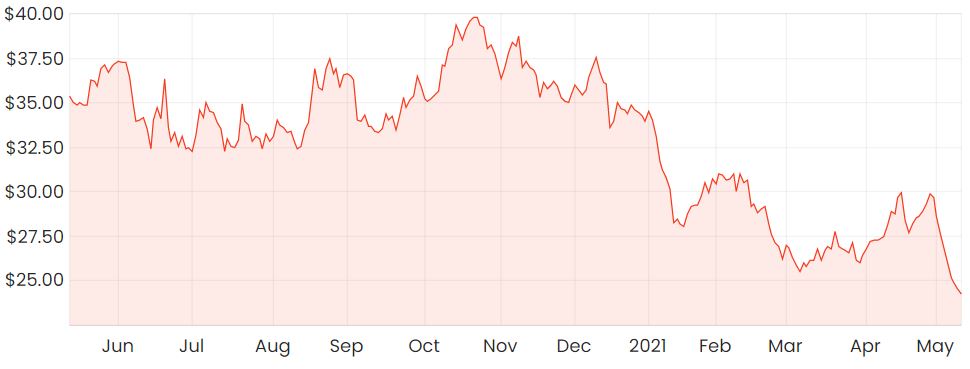

Software provider Altium Limited (ASX: ALU) could a long-term buying opportunity at current levels with its shares still down 30% from their highs last year.

ALU share price

Altium has many quality characteristics I’d look for in an investment, including a compelling product, experienced management and macro tailwinds working to its advantage.

Its valuation was fairly stretched at one point last year, but I think at these levels the valuation is much more reasonable.

Altium struggled last year partly due to transitioning its customers from on-premise models to recurring revenue models while COVID-19 occurred simultaneously. The former has resulted in less revenue being recognised upfront, but this could prove to be better in the long run.

As an investor with a long-term outlook, I’m happy to look past what’s happened last year as I believe these issues are transitory in nature.

Objective Corporation

Another company I’m liking at the moment is Objective Corporation Limited (ASX: OCL), which has a suite of products that streamline efficiencies across bureaucratic activities.

Its shares have been a strong performer recently and are up 33% since the start of the year.

Like any software-as-a-service (SaaS) business, Objective Corp has some quality features including a high amount of recurring revenue with government clients that are quite often on multi-year contracts.

The thematic around digitisation and efficiency is likely to act as a nice tailwind for the adoption of Objective Corp’s products. Part of what they do is remove the need for paper-based practices, which is surprisingly common despite how far technology has come.

For more reading on Objective Corp shares, click here to read: Why I think Objective Corporation (ASX: OCL) is one ASX growth share to watch.

Xero

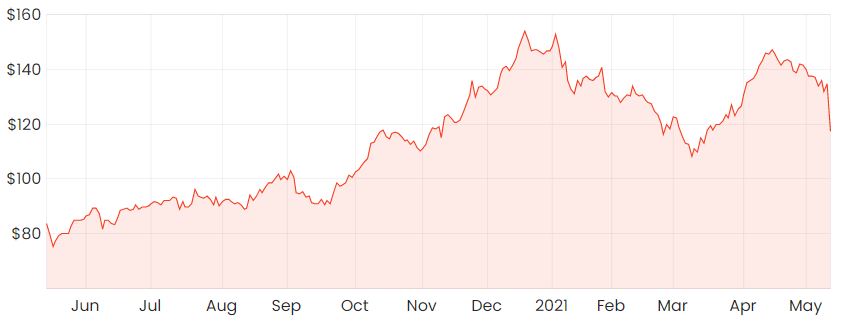

Out of all three companies mentioned in this article, I’d likely consider Xero Limited (ASX: XRO) to be of the highest quality. With shares at over 20x sales, I’d also think it could be the most optimistically priced.

XRO share price

Valuation aside, Xero boasts some of the best unit economics compared to other software business. By this, I refer to the amount of value that’s able to be extracted from a customer and how this compares to the amount needed to acquire them.

The direction Xero’s going with its international expansion appears to be going well, with various acquisitions that complement its core accounting offering.

For Xero’s recent full-year results, click here to read: Xero (ASX: XRO) share price stabilises on FY21 results – my take.