It seems the Zip Co Ltd (ASX: Z1P) share price has stabilised for the time being.

It was the second most traded share on the ASX last week according to Commsec, with high buying volume suggesting that many are taking advantage of the price weakness.

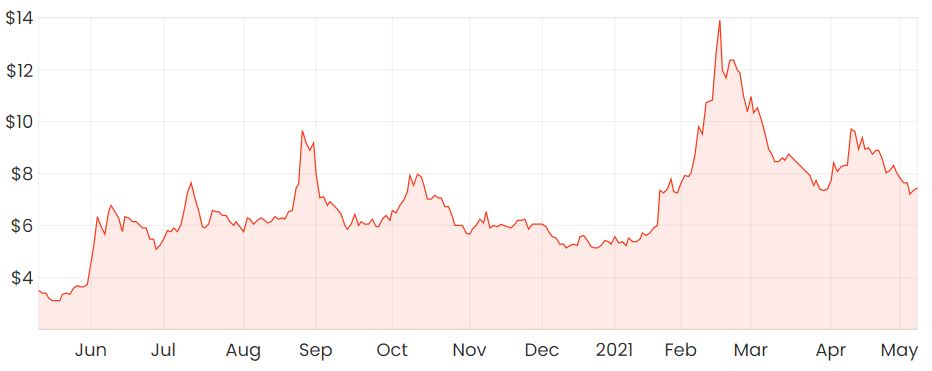

Z1P share price

No surcharging – for the moment

Zip and the entire buy-now-pay-later (BNPL) industry are safe for the time being from surcharge reforms

, which have previously prevented merchants from passing on surcharges to their customers.

Why does this matter?

Companies like Zip and Afterpay Ltd (ASX: APT) charge merchants around 3-4% of the transaction value, which is much higher than credit and debit cards. If this merchant fee was passed onto the customer, this could hurt sales as customers look for a cheaper alternative.

The Reserve Bank of Australia (RBA) noted the reason behind its decision was that it wants to form a regulatory environment that encourages innovation.

Due to BNPL merchant fees taking up a small percentage of the payments in the economy, the RBA said there isn’t a strong public interest case at the moment.

International expansion

Zip announced two acquisitions last week that further establishes the company in European and Middle Eastern markets.

Twisto is a BNPL provider based in the Czech Republic that also operates in Poland and has plans to expand to Romania. It generates around $12 million in revenue and Zip has just purchased the remaining shares in it for $140 million.

Twisto has a European Institution Payments Licence, so there might be more expansion within the European Union.

Zip has also gained some exposure to Middle Eastern markets through its acquisition of Spotii, which has operations in the United Arab Emirates and Saudi Arabia.

Spotii is a start-up with just 650 merchants and 40,000 customers and has an implied enterprise value (EV) of around $26 million.

Time to buy Zip shares?

Zip seems to be continually showing signs of growth, which is encouraging to see. Given the explosive run the BNPL industry experienced last year, it’s worth considering how much growth might’ve already been factored into its current valuation.

Something else to consider might be the switching costs involved with using various BNPL offerings. Higher switching costs are preferred, as it becomes costly to switch to an alternative.

A good example of companies with high switching costs would be companies like Altium Limited (ASX: ALU) and Xero Limited (ASX: XRO), which you can read about here: My top 3 ASX software shares for June.