It seems Mr Market was at peace in respect to the Pushpay Holdings Ltd (ASX: PPH) share price despite recording solid results for FY21. Here’s how I look at the Pushpay share price.

PPH share price

Cross-sell is the name of the game

Whilst the number of total customers only went up by 2%, I think investors should bear in mind that it’s been a difficult environment to acquire new customers due to COVID.

This is why it’s important for businesses to have cross-sell opportunities, which is a much easier way to bring in more revenue.

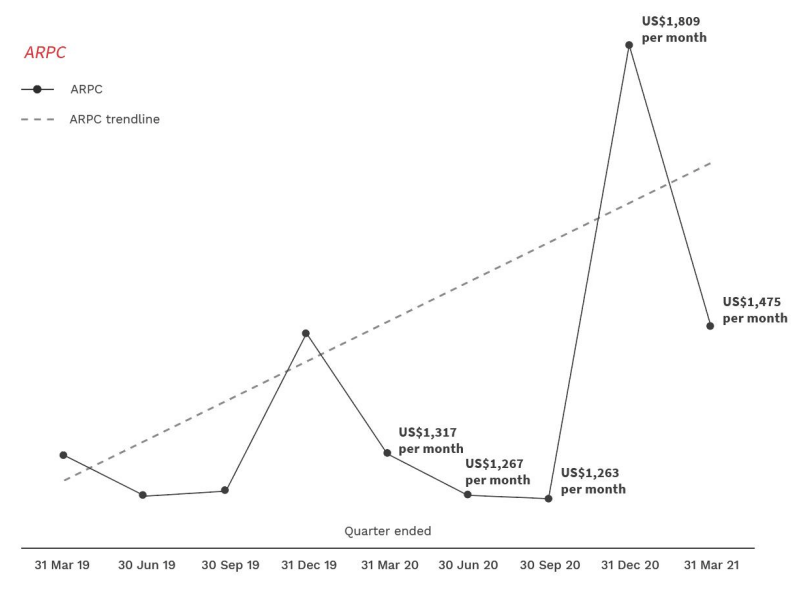

A strong indicator of a business successfully making cross-sales is the average revenue per customer (ARPC) as seen below.

It’s important to track the ARPC on a prior corresponding period basis. The ARPC jumped from US$1,317 per month for 31 March 2020 to $1,475 per month for 31 March 2021.

Structural change in how people donate

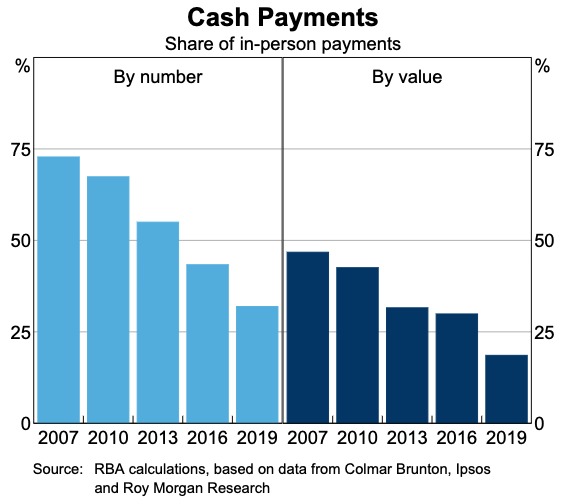

People are carrying less and less cash today. It’s just easier to use either your card or mobile to pay for things.

This is reflected by the following RBA statistics showing a downward trend in the use of cash in terms of both number and value.

The shift away from cash to digital money still acts as a long term driver of growth for Pushpay as more churchgoers embrace digital donations.

Push into the Catholic segment

I would continue to monitor the levels of investment into developing and enhancing the customer proposition for the Catholic segment of the US faith sector.

Pushpay expects to deploy US$6 million to US$8 million in this segment. Two-thirds of this will be for product design and development and the remaining balance will be allocated to sales and marketing.

I think it’s important to monitor the return on investment in this space to evaluate whether its a value accretive strategy.

Can it keep pushing forward?

As part of the Rask Investment Philosophy, I tend to prefer businesses that operate in structurally growing markets. I think there is still a lot of room for growth as more churches embrace a digital approach.

However, I would also monitor the declining rate of growth in new customers.

Other competitors may be taking market share away from Pushpay, so it’s important to also consider how they are performing.

If you are interested in more ASX growth shares, I suggest getting a Rask account and accessing our full stock reports. Click this link to join for free.