The share price of Commonwealth Bank of Australia (ASX: CBA) may rise today on the back of a positive update. So, what does this update mean for the CBA share price?

CBA share price

Strong operating performance

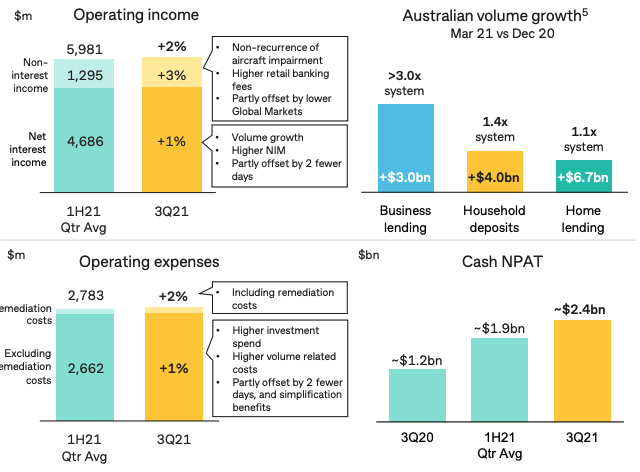

The big 4 bank posted a strong increase of 2% in operating income for the third quarter of FY21. This was primarily driven by continued growth in domestic business lending, household deposits and home loans.

Home lending will likely receive a boost as a result of the government’s assistance to single parents to purchase property by guaranteeing 18% of the purchase price.

CBA benefited from the recovery in consumer spending as this drove up retail banking fee income. This offset the lower income derived from insurance due to higher claims as a result of adverse weather events.

Improved economic outlook

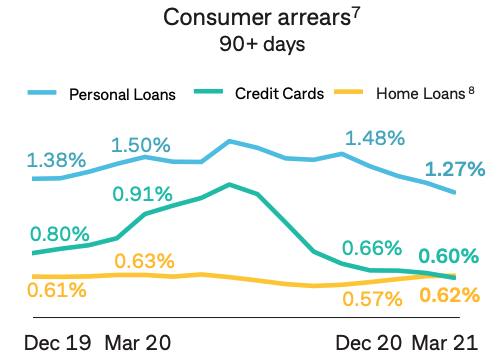

The gradual economic recovery seen in Australia and New Zealand has resulted in a reduction in the volume of consumer arrears in terms of personal loans, credit cards and home loans.

Thoughts on CBA

It’s encouraging to see that net interest margins are growing, which is the key driver of growth for banks generally.

Investors should also monitor its fellow competitors, Australia and New Zealand Banking Group Ltd (ASX: ANZ), National Australia Bank Ltd. (ASX: NAB) and Westpac Banking Corp (ASX: WBC).

If you are interested in learning how to value CBA’s shares, click here.

And if you are on the hunt for more ASX dividend shares, read Jaz Harrison’s 2 ASX 200 shares I’d buy for dividend income.