The National Australia Bank Ltd. (ASX: NAB) share price continues to rise and it may continue today. The budget will be unveiled today and this could propel the NAB share price.

NAB’s competitors, Commonwealth Bank of Australia (ASX: CBA), Australia and New Zealand Banking Group Ltd (ASX: ANZ), and Westpac Banking Corp (ASX: WBC) stand to also benefit from such news.

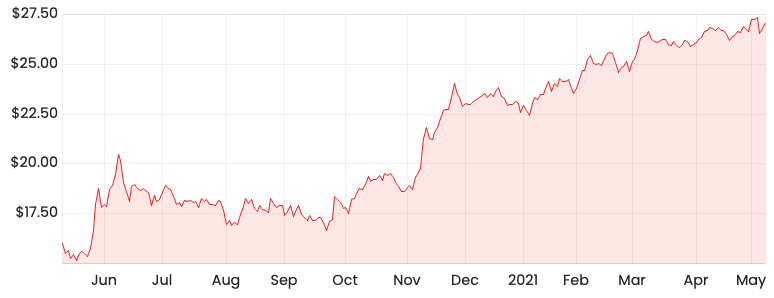

NAB share price

Higher demand for loans on the way?

The government announced it will provide assistance to single parents to purchase property by guaranteeing 18% of the purchase price.

This scheme will be available to around 10,000 people.

As a result, single parents with dependent children will only need to contribute 2% towards a deposit.

The government also noted this scheme will be spread out over four years.

Is it happy days for the banks?

The continual rise in demand for property as covered in my article on REA Group Ltd (ASX: REA) and Domain Holdings Australia Ltd (ASX: DHG) has pushed up the volume of residential home loans.

These new measures will likely benefit NAB and its competitors over the long term.

Whilst such announcements are important, investors should also consider whether NAB offers a good dividend yield.

As part of the Rask Investment Philosophy, I prefer to find businesses that operate in structurally growing industries. In saying this, ASX dividend shares is a valuable string to add to one’s investing bow.