The Latitude Financial Services Group Ltd (ASX: LFS) share price surged and closed at $2.70 yesterday. Here is what I think about the management team and how it may affect the Latitude share price.

Latitude offers lending products like credit cards, personal loans and insurance.

A leader with a strong pedigree

The managing director and CEO of Latitude, Ahmed Fahour has extensive experience in the financial services industry given his roles as CEO of National Australia Bank Ltd. (ASX: NAB) and CEO of Citigroup Alternative Investments in New York.

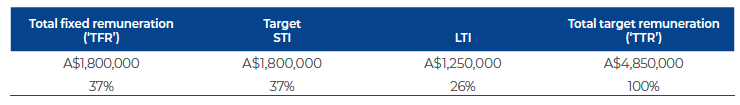

As outlined in the Latitude prospectus, Fahour’s fixed remuneration stands at $1.8 million. The below table outlines the short-term and long-term incentive arrangement for Ahmed Fahour.

Short-term incentive

This means Fahour is eligible for a $1.8 million bonus if he meets performance conditions over the short term. If he outperforms, then he will be entitled to a maximum of 125% of the target STI or $2.25 million.

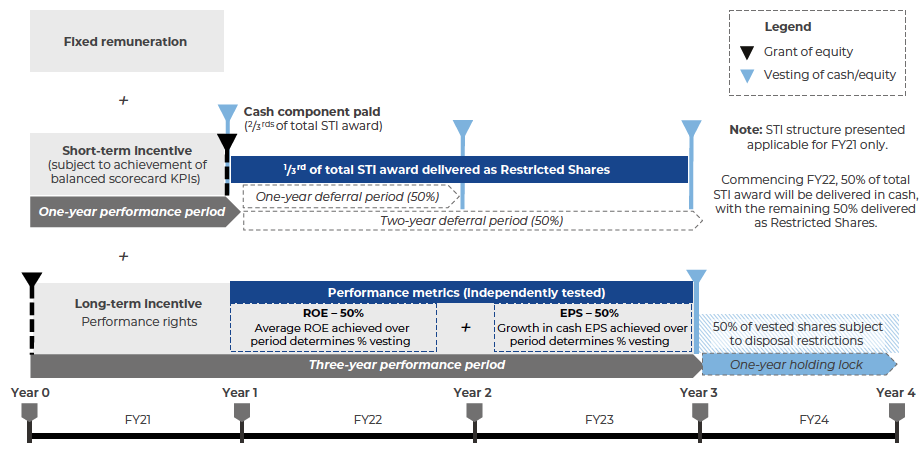

The short-term incentive bonus will be comprised of cash (67%) and equity (33%). However, Latitude intends to adjust this to a 50/50 split from 1 January 2022.

Long-term incentive

Latitude notes Fahour will be eligible to receive performance rights in the value of $1.25 million. What is a performance right?

Think of performance rights as entitlements to shares but subject to Fahour meeting performance conditions over a set period of time.

In this case, Fahour’s long-term performance objectives are focused on return on equity (ROE explained) and earnings per share (EPS explained). These objectives are weighted 50/50.

Should Fahour meet or exceed these objectives, he will be entitled to $1.25 million of equity. He will also be required to hold 50% of these shares for 12 months before he can sell them.

My takeaway

It’s encouraging to see that Latitude intends to provide more equity as part of the STI bonus, which is more aligned with shareholder’s interests.

Investors should be mindful that ROE excludes debt or leverage. So, in Latitude’s case, debt is being used to grow the business.

As a result, if debt continues to be used, then ROE will seem higher as it doesn’t account for debt. Given the nature of the business, I would have preferred an alternative metric like return on investment (ROI explained).

I would monitor the LTI to determine whether management is truly aligned with shareholders.

Investors should also keep in mind three other aspects of the business.

If you are interested in other ASX growth shares, I’d recommend signing up for a free Rask account to gain access to our stock reports.