The Mayne Pharma Group Ltd (ASX: MYX) share price soared by 17% last Friday but has dropped slightly today. What is happening with Mayne Pharma share price?

Mayne Pharma develops, manufactures and markets branded and generic pharmaceutical products globally.

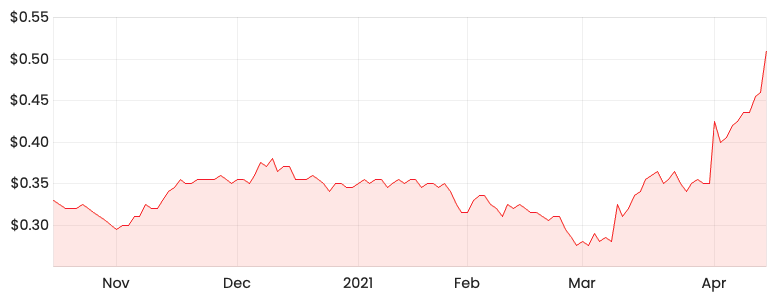

MYX share price

Mayne Pharma gains FDA approval on a new drug

The meteoric rise in the Maybe Pharma share price is due to the US Food and Drug Administration

(FDA) approval of its new oral contraceptive, Nextstellis.

Mayne Pharma estimates the commercial launch of this new product to occur by the end of June 2021.

Nextstellis was developed by Mirtha Pharmaceuticals and is the only contraceptive pill containing estetrol, a native estrogen, now produced from a plant source.

The company advises estetrol is the first new estrogen introduced in the US in more than 50 years.

According to one professor at the University of California, it provides fewer side effects for patients compared to alternative options.

Mayne Pharma has paid US$11 million in cash as well as 85.8 million in shares to Mirtha for receiving this FDA approval.

My thoughts

As part of the Rask Investment Philosophy, I focus on companies that are within my circle of competence.

Given my limited knowledge about the pharmaceutical market, I tend to stay well away from biotech companies.

Whilst there have been big success stories in this space like CSL Limited (ASX: CSL), it is difficult to identify data points to monitor because financial performance is mainly driven by successful experiments.

I would rather monitor these 2 ASX growth shares covered in my article.

I’d also suggest getting a free Rask account to access our full stock reports.