The share price of Xero Limited (ASX: XRO) along with other ASX tech shares struggled this morning. Let’s take a look at the Xero share price.

Xero share price

Can Xero keep growing?

Xero started off as a cloud-based accounting platform alternative to MYOB and it has become more than that.

It has continued to broaden its accounting platform, striving to create the best possible platform to meet as many accounting and business needs as possible.

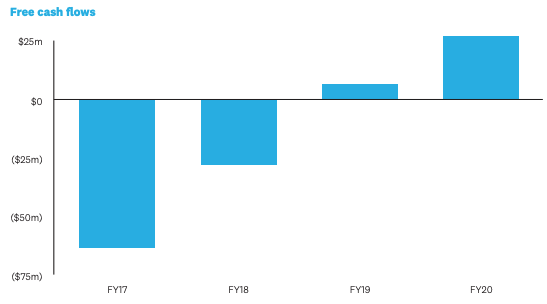

The extraordinary growth in the Xero share price since the pandemic last year is because investors have recognised that it’s a free cash flow generating machine.

As you can see, Xero first recorded positive free cash flow in FY19, hitting a key inflection point.

My thoughts

Xero is generating significant amounts of free cash flow, which provides the business with a lot of capital to deploy. As a result, Xero has been constantly bolting on acquisitions to optimise its platform.

This is the beauty of a business hitting an inflection point.

Once a business generates constant free cash flow, it can strengthen its competitive advantage to attract more market share.

My colleague, Patrick Melville provides a great analysis of Xero here.

If you are interested in other ASX growth shares, I’d recommend signing up for a free Rask account

to gain access to our stock reports.