The Fatfish Group Ltd (ASX: FFG) share price is making a splash today as shares emerge from a trading halt.

After soaring as much as 16% higher in early morning trade, sentiment has turned and Fatfish shares are trading flat at the time of writing.

Who is Fatfish Group?

Fatfish describes itself as a tech venture firm with a focus on various sectors of video games, esports, fintech and consumer internet technologies.

The company has business interests in Southeast Asia and the Nordic European regions, and owns a majority stake in Albeco Investment Group, which trades on the Swedish stock exchange.

What’s been happening with the Fatfish share price?

Before we get into today’s announcement, let’s set the scene and take a quick look at some recent developments.

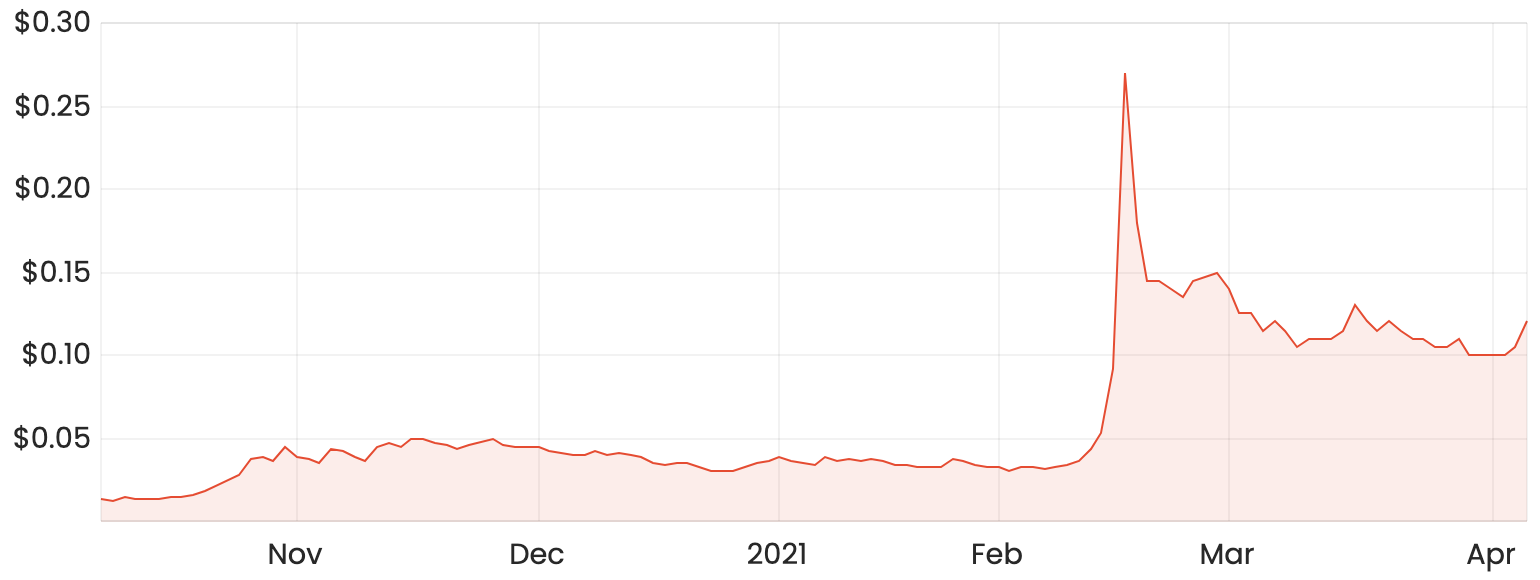

The Fatfish share price caught the attention of investors in February, with shares rocketing from 3 cents at the start of the month to 27 cents in mid-February – a whopping 800% gain.

Fatfish share price chart

The rapid rise was seemingly driven by momentum, but the company did provide an update in early February about Smartfunding, a subsidiary aiming to release a corporate buy now, pay later solution into the Southeast Asian market.

In the update, Fatfish said that Smartfunding had completed the development of its online platform in preparation for the roll-out of its BNPL service, with the launch date set for 18 February 2021.

Fatfish owns a 19.9% stake in Smartfunding directly, while its majority-owned Swedish subsidiary Abelco owns a further 58.8%.

Venture funding

Now, onto today’s news. This morning, Fatfish announced that RightBridge Ventures, a subsidiary of Abelco, has raised SEK 55 million – roughly A$8.4 million – in a funding round led by Scandinavian fund Modelio Equity.

The funding round was completed at a post-money valuation of SEK 145 million (A$22.1 million) for RightBridge, which Fatfish said will have a positive impact on Abelco’s balance sheet.

Post completion, Abelco will own roughly 53% of RightBridge.

RightBridge acquires strategic stake in Epulze

In conjunction with the funding round, Rightbridge is acquiring a strategic 10.7% stake in global e-sports platform Esports Pulze, also known as Epulze.

The Swedish-based company operates epulze.com, a platform that reportedly has more than 400,000 registered users and has hosted over one million matches.

The acquisition adds to RightBridge’s portfolio of esports investments, which includes Lilmix – a professional esports team – and game publisher iCandy Interactive.

Now what?

The Fatfish share price was thrust into the spotlight in February and has been bouncing around ever since. Today’s announcement illustrates the complexities of the company’s operations, with a range of interlinked subsidiaries and related party transactions.

Personally, an investment in Fatfish is too speculative for my liking but if I were looking to dive deeper into the business, I’d start with trying to untangle this web and get familiar with Fatfish’s history.