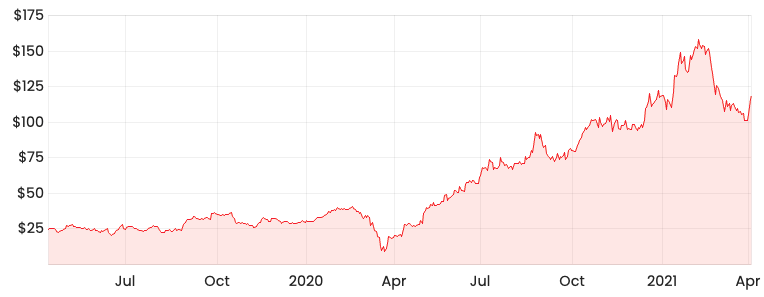

The Afterpay Ltd (ASX: APT) share price has experienced meteoric growth since the COVID induced market crash. It’s easy to get excited about Afterpay, it’s plastered across nearly every retailer window you walk past.

Investors seem obsessed with growth numbers, but future growth often arises when businesses capitalise on new verticals and markets.

New verticals and markets provide businesses with optionality, which I think will be key to the sustainability of Afterpay’s future growth.

Afterpay share price

Afterpay Money & Westpac

Afterpay remains focused on trying to offer budgeting and saving tools for customers joining Afterpay Money. This new app will leverage the new Westpac Banking Corp (ASX: WBC) digital bank as a service platform.

The partnership with Westpac will enable Afterpay customers to manage their cash and budgeting through Westpac savings accounts.

Afterpay-backed AP Ventures recently invested $10 million in data capture company, Basiq. Basiq has a referral partnership to assist fintechs access bank data in Australia and the US.

This investment will strengthen Afterpay’s platform as Basiq provides technology that helps categorise transactions and create personalised customer experiences.

One practical application of Basiq’s technology is the potential to use it to conduct credit checks on Afterpay customers.

So what’s the hidden value in all of this? Well, the more data that Afterpay can get on customer spending behaviours, the more insights it can potentially sell as a service to its merchant customers.

Sponsorship potential

Afterpay has a record of generating between 15 to 20 million customer lead referrals per month to its merchant partners, through its store directory app.

If Afterpay continues to grow its customer lead referrals, its store directory app could become the go-to place to choose a brand rather than going online.

Once merchant customers, in particular retailers, recognise the value of Afterpay-led customer traffic, Afterpay could monetise this by offering sponsored placement. For example, some brands may be willing to pay a premium to ensure it takes the top spot on the store directory app.

One other way Afterpay could try and entice customers to the shop directory app is by offering exclusive sales and offers on the platform.

My final thoughts

Mr Market is currently optimistic about Afterpay’s future growth, so it will need to find new avenues of growth. I think people are focusing too much on the competition over market share when comparing Afterpay with Zip Co Ltd (ASX: Z1P), Sezzle Inc (ASX: SZL), and Splitit Ltd (ASX: SPT).

Whilst market share remains important, investors should also consider the willingness of businesses to experiment and fail.

I believe Afterpay has acknowledged that purely focusing on market share is likely not going to end well, so it’s encouraging to see management thinking about other avenues of growth.

The best businesses like Amazon.com, Inc. (NASDAQ: AMZN) and Apple Inc (NASDAQ: AAPL) were able to constantly innovate and reiterate. Amazon started off as an e-book retailer, now it’s become much more than that. Apple initially set its sights on becoming the best computer operating system, now it’s a leader in phones.

So, when comparing Afterpay with its direct competitors, I would channel energy towards analysing how it’s attempting to enhance its optionality relative to other players.

If you are interested in other ASX growth shares, I suggest getting a free

Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.

To learn more about how we invest at Rask, jump over here.