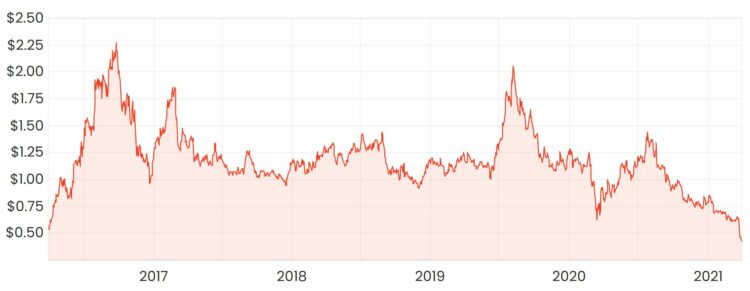

The share price of gold miner, Resolute Mining Limited (ASX: RSG) has dropped nearly 50% since the start of this year. Here’s what’s happened within the company recently.

RSG share price

Resolute Mining background

Resolute has over 30 years of experience as an explorer, developer and operator of ten gold mines across Africa that have produced over 9 million ounces of gold since inception.

Resolute’s current portfolio consists of three mines, which are Syama in Mali, Mako in Senegal and Bibiani in Ghana.

Bibiani lease termination

Last week, Resolute announced to the market it had received a letter from the Ghanaian Minerals Commission that advised the mining lease for the Bibiani mine had been terminated. All operations and activities were instructed to be ceased as a result.

No further updates have been provided since this announcement, but the company has said it’s seeking clarification from the Minister’s office and will also seek legal advice on the matter.

Late last year, Resolute announced it had agreed to divest its interest in the Bibiani Mine to Chijin International Limited in a $105 million deal, which was expected to be completed in the coming weeks.

Given the lease termination, it remains unknown if the transaction will proceed.

How has the business been performing?

Resolute’s FY20 results revealed a 15% jump in group revenue mainly due to higher gold prices. Production remained constant on the prior corresponding period (PCP) at around 395,175 ounces over the year.

Group underlying earnings before interest, tax, depreciation and amortisation (EBITDA) came in at $269.7 million, up from $144.3 million in FY19.

Net profit after tax (NPAT) was $5 million, up from a $78.5 million loss in the previous year.

Production guidance for FY21 was revised to between 350,000oz to 375,000oz at an all-in sustaining cost (AISC) of $1,200/oz and $1,275/oz ($1,074 FY20).

AISC is comparable to a company’s cost of goods sold (COGS), so ideally, the lower this number is, the better.

Are Resolute shares a buy?

The termination of the Bibiani mine lease highlights the dangers of sovereign risk that investors can be exposed to when investing in companies with operations in foreign countries.

I’m not well-versed on the subject of mining regulation in African countries, so I’d find it hard to assess the potential risks involved.

Aside from this, I’d typically rather invest in more proven businesses rather than price-taking commodities producers.

If you also prefer more proven businesses, check out this article: ASX tech shares were hit hard yesterday… I’d happily buy these 3: JIN, XRO & ALU.