Airtasker (ASX: ART) made its debut on the ASX yesterday, with shares finishing up 61.5% from their offering price of 65 cents per share.

The Sydney based company’s IPO was oversubscribed and raised $83.7 million through the issuance of 23.1 million new shares. Airtasker’s market capitalisation now sits at roughly $412 million.

What does Airtasker do?

It might be easy to think of Airtasker sort of like Uber Technologies Inc (NYSE: UBER) or Airbnb Inc (NASDAQ: ABNB), except it operates as a two-way marketplace for labour-based services.

If you (the customer) want something done, you can list the job on Airtasker’s platform, and someone else (the tasker) who wants to work will complete the task after a fee has been negotiated between the two parties.

Airtasker generates revenue on both sides of the transaction, with the majority made through charging the tasker a service fee, which is a percentage of the agreed task value.

The customer is also charged a booking fee, which is calculated using a similar method.

Airtasker calls itself an “almost infinitely horizontal” marketplace due to its broad range of workers and the types of tasks that can be completed through its platform. It’s commonly used for jobs such as home cleaning, handyman jobs, gardening, removalist jobs and marketing.

How has the business performed?

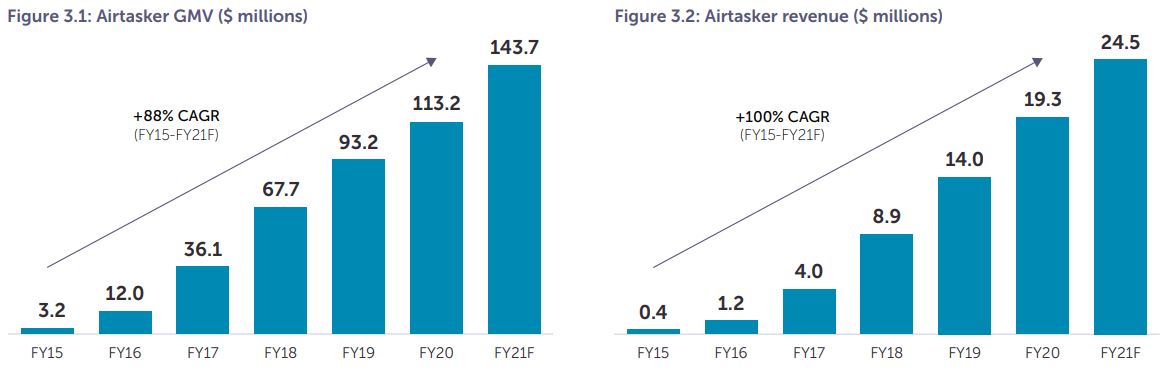

The growth story thus far has been undeniably impressive, with gross marketplace volume (GMV) growing at a 88% compound annual growth rate (CAGR) over the last six years. Airtasker’s revenue is mainly a function of GMV as it earns a percentage of this amount called the “take rate”.

Recent growth has been driven by a larger proportion of repeat users, as well as increased brand awareness through its digital marketing efforts.

It also appears that Airtasker’s average task value has been steadily increasing over several years. Management indicated this was the result of its platform offering more complex tasks completed by people such as tradespeople, accountants and lawyers.

Future growth will be partly driven by continued marketing initiatives to increase customer and tasker acquisition, as well as leveraging its existing technology platform to continue its international expansion plans.

The majority of Airtasker’s revenue comes from within Australia as marketplaces in New Zealand, Singapore and Ireland were only recently established. Operations in the US will commence later this year.

What’s to like about Airtasker?

Airtasker appears to have a fairly capital-light business model with high gross margins that could potentially scale well if revenue can continue on its strong upward trajectory.

Ideally, as the business grows and improves its reputation, the company will be less reliant on direct marketing and sales staff. Instead, it may experience some benefits from potential network effects as its perceived value increases over time.

Things to consider

In order to get a rough idea of how well a company like Airtasker might perform in the years to come, it can often be a good idea to look at a company with a similar business model to understand why that company might’ve done well.

There are lots of marketplace exchanges that could be used as a comparison company, but I think it’s worth taking a look at eBay Inc (NASDAQ: EBAY), which will make a bit more sense in a moment.

Similar to Airtasker, eBay earns part of its revenue as a percentage of the transaction value, which works extremely well in its favour in a bidding-style system. Due to human psychology, bids often exceed what we might consider a product’s intrinsic value, but luckily for eBay, this only means a larger commission collected.

Now compare eBay’s bidding style system to Airtasker.

Airtasker also has a bidding system, except it works in the opposite direction where taskers compete by offering to complete the job for a lower price. There are two possible negative outcomes from this in my view.

Firstly, as Airtasker earns a percentage of the total task value, this doesn’t work in its favour and is a headwind on revenue.

Secondly, if a job’s price has been negotiated significantly, this could possibly lead to poorly performed work as there is a smaller financial incentive to the tasker than there was previously.

A quick glance of Trustpilot shows 2,775 reviews of Airtasker’s service with an average of 1.6 stars. This isn’t always the best measure of the whole picture, but it does highlight that some customers and taskers have had some issues along the way.

What else?

It’s also worth considering that taskers and customers have the ability to undercut Airtasker’s platform entirely.

As an example, if I wanted a builder to come and do a job and I was later satisfied by the quality of their work, I could take their number and establish an ongoing relationship outside of its platform.

I would save on the booking fee, and the builder would also save on their service fee. A win-win for both of us, but unfortunately only to Airtasker’s detriment.

Summary

This will be an interesting one to watch from the sidelines, but I won’t be chasing Airtasker’s shares at these levels.

Investing in IPO stocks is fairly risky in general, with many stocks underperforming shortly after listing.

I’ll be interested to see how Airtasker can continue to execute its growth strategy and leverage its technology platform. Without a longer demonstratable track record of performance, Airtasker is a hold from me.

For more share ideas, click here to read: 3 ASX growth shares I’d happily buy this week.