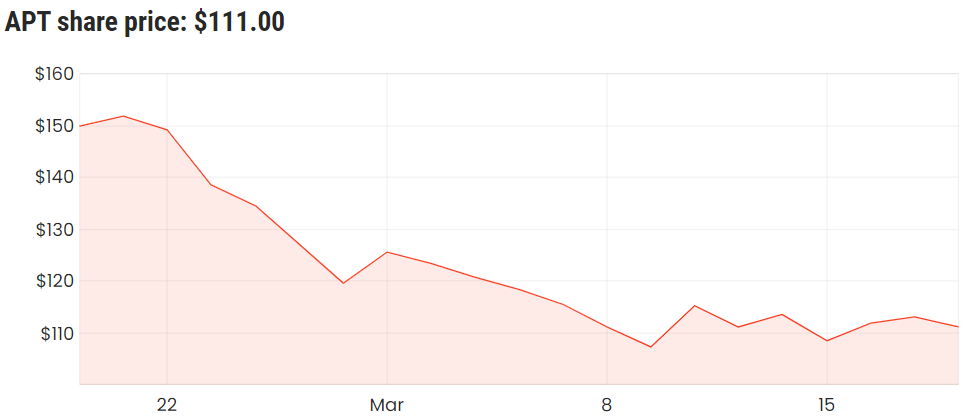

The Afterpay Ltd (ASX: APT) share price is down another 3%. Is it now a bargain?

The Afterpay share price is suffering

It has been a difficult few weeks if you own Afterpay shares, it has suffered a drop of almost 30% in just one month to under $108.

What has happened during this period?

On 25 February, Afterpay released its FY21 half-year result to investors. Investors were probably expecting what was reported.

Looking at the numbers, the operational and revenue side of things looked good. Underlying sales increased by 106% to $9.8 billion, which drove Afterpay income higher by 108% to $374.2 million. Most ASX 200 shares would be very happy with that type of increase over one year.

Active customers rose 80% to 13.1 million and active merchants increased by 73% to 74,700. Afterpay’s gross loss as a percentage of underlying sales improved to 0.7%, which was better than the 1% from the prior year. The buy now, pay later business said that its net transaction margin was up 110% to $213.9 million. Underlying EBITDA (EBITDA explained) shot higher by 521% to $47.9 million.

Afterpay also announced that it was looking to increase its ownership of Afterpay US with a convertible note offering of $1.25 billion, which was then upsized to $1.5 billion.

General weakness in BNPL

It’s not just the Afterpay share price that has been suffering in recent weeks. Most of the buy now, pay later industry has seen their share prices sold off significantly over the last month or so including Zip Co Ltd

(ASX: Z1P), Sezzle Inc (ASX: SZL), Humm Group Ltd (ASX: HUM), Splitit Ltd (ASX: SPT), Ioupay Ltd (ASX: IOU), Openpay Group Ltd (ASX: OPY) and so on.

So I don’t think that it can be much of a surprise that Afterpay is also down as well.

There has been a lot of market talk about interest rates and inflation this year. The fear is that the economic recovery in Australia, the US and in many places across the world is happening quicker than expected, which could lead to central banks ending the emergency settings and support earlier than expected. It’s not normal for interest rates to be this low unless it’s necessary.

We’re already seeing some asset values climb to exceptionally high levels. Not only could interest rates have a negative outcome on share prices, but buy now pay later business rely on debt funding to pay for the money that customers use to doing the buying. Higher interest rates would reduce BNPL profitability.

What’s fair value for the Afterpay share price?

It’s very hard to value Afterpay shares. Is it going to keep (or grow) the margins that it currently has? That might be tricky with more competition entering the sector such as Commonwealth Bank of Australia (ASX: CBA). PayPal’s offering is also coming to Australia.

How many times will users re-use Afterpay? Will longer-term users utilise BNPL more and more as they become loyal customers?

Does potential regulation need to come into valuation thoughts?

Even using a basic 10x revenue valuation, which some people like to use for high-growth tech shares, doesn’t get you close to the current Afterpay market cap. At some point Afterpay won’t be revealing such large underlying sales growth and that’s when profitability will come under more scrutiny than it already is.

Afterpay’s management have done a wonderful job of getting the business out into the world. It has changed the retail landscape. Afterpay has even created ‘Afterpay Day’. But as investors I think it’s important to always think about what the market may value the business now and in the future.

I do like some ASX growth shares in the payments space such as Pushpay Holdings Ltd (ASX: PPH) and EML Payments Ltd (ASX: EML).