The Nuix Ltd (ASX: NXL) share price continues to fall after the release of its half-year (HY21) results. So what are some reasons for the drop in the NXL share price… and can it go back up?

NXL share price

Tech hype and high growth expectations

Nuix listed on the ASX in late December of 2020, when technology stocks were all the rage, which still continues to be the case today but to a lesser extent. When you combine this tech obsession with a new stock on the block that is recording a high compound annual growth rate of 25.9% over the last three financial years, a hefty price tag is often attached to it.

Nuix’s IPO was offered at 9x projected revenue for 2021, about $193.5 million, or 24.7x projected earnings of $63.6 million. The projected revenue increase equates to an estimated 9.7% jump on FY20 revenue.

Nuix faces an uphill battle to achieve this projected revenue as revenue for HY21 fell by 4% compared to the prior corresponding period, HY20.

Why was Nuix’s revenue down?

Nuix generates 55% of its revenue in the US, which was adversely impacted by the weakening of the $US against the $AUS. The foreign exchange loss equated to a $2.4 million hit on revenue for HY21.

This explains why revenue fell but it doesn’t tell us why revenue growth has stalled.

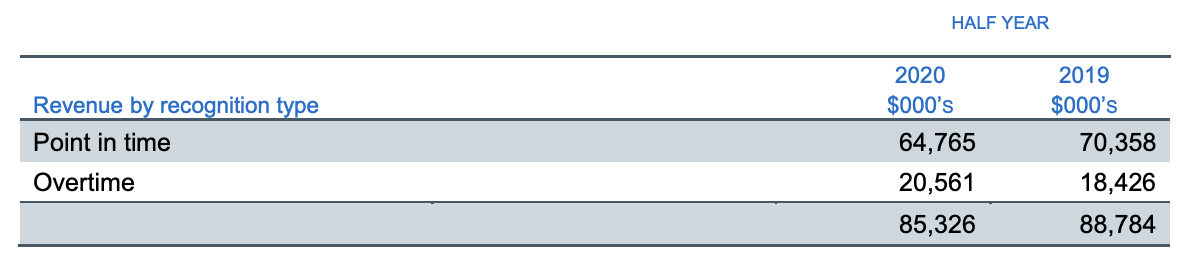

The company noted there was a continual trend of customers changing from on-premise software licencing to consumption-based licencing. This results in a reduction in licencing revenue in the short term, as revenue recognition changes from an upfront recognition to overtime recognition. This shift is illustrated below.

As you can see, upfront revenue has reduced quite a bit and over time revenue has slightly increased. As more customers continue to move to consumption-based licencing, upfront revenue will decline as overall revenue will become more spread out.

This has the potential to enhance Nuix’s ability to increase prices in time because a periodic payment is usually more appealing than a large lump sum payment for customers.

Revenue down but customers up

If you look beyond the drop in revenue, Nuix still managed to secure 49 new customers across the US, UK, and Europe. Another encouraging sign of the strength of Nuix’s software is that churn decreased from 4.7% in FY20 to 4.2% in HY21.

Nuix’s CEO, Rod Vawdrey seems optimistic about the future, as he said, “Strong customer engagement, a maturing and growing pipeline, and low customer churn (4.2%) are expected to boost ACV for the second half of FY21 with a return to more certain operating conditions anticipated in Q4 FY21. This gives us confidence that we can meet FY21 forecasts set out in our IPO Prospectus.”

My thoughts

As outlined in my other article, Is Nuix (ASX:NXL) the next ASX growth share darling, there was a huge amount of optimism priced into Nuix. I think the hype was mainly attributed to Nuix being a software business and the expectation that revenue would continue to accelerate.

Given the upward trend of customers switching to consumption-based licencing, I think investors ought to brace for a slower rate of growth in revenue. Investors should also be mindful that most of the revenue from the 49 new customers is likely not reflected in the HY21 results if most of them opted for consumption-based licencing and will be reflected over time.

Whilst overall revenue may appear lower due to the switch from upfront revenue to over time revenue, the consumption-based licencing model may enable Nuix to lift prices and ultimately generate greater revenue over the long-term.

Despite the fall in the share price, I think Nuix’s fundamental software offering remains strong given the new customer acquisitions and low customer churn. However, the share price is still too high for my liking and I will continue to sit on the sidelines for this one.

If you are interested in other ASX growth ideas, I suggest getting a free Rask account and accessing our full stock reports. Click the link below to join for free and access our analyst reports.