The Worley Ltd (ASX: WOR) share price is storming higher today after the engineering company handed in its half-year results.

The Worley share price jumped 7% in early morning trade to an intra-day high of $11.32, before pulling back slightly to sit at $10.90 at the time of writing, up more than 3%.

Worley provided a trading update earlier in the month, so the market’s expectations heading into these results were tempered.

Worley feeling the COVID pinch

Chief executive Chris Ashton said the first half of FY21 was a challenging period for the business as COVID-19 impacted its customers, particularly in regard to demand in their end markets.

As a result, Worley has seen project deferrals, primarily in the Americas, but minimal cancellations.

Starting at the top line, Worley generated $4,876 million in revenue during the half, down 29% from $6,901 million in the prior corresponding period of HY20.

The energy sector reported aggregated revenue of $2,127 million, also down 29% on the pcp, while the chemicals sector experienced a 20% fall in aggregated revenue to $1,745 million.

Worley’s resources sector suffered a 25% fall in aggregated revenue to $226 million, impacted by COVID-related site shutdowns in Africa.

Turnings to earnings, underlying EBITDA tumbled by 43% compared to the pcp, driven by volume reductions due to deferrals and site access restrictions. The company was also impacted by the strengthening of the Aussie dollar throughout the half.

Worley’s backlog also took a hit, reducing from $16.8 billion at 30 June 2020 to $13.5 billion at the end of 2020. The company said that the impact of lower activity on long-term contracts and foreign exchange accounted for almost 75% of the backlog reduction.

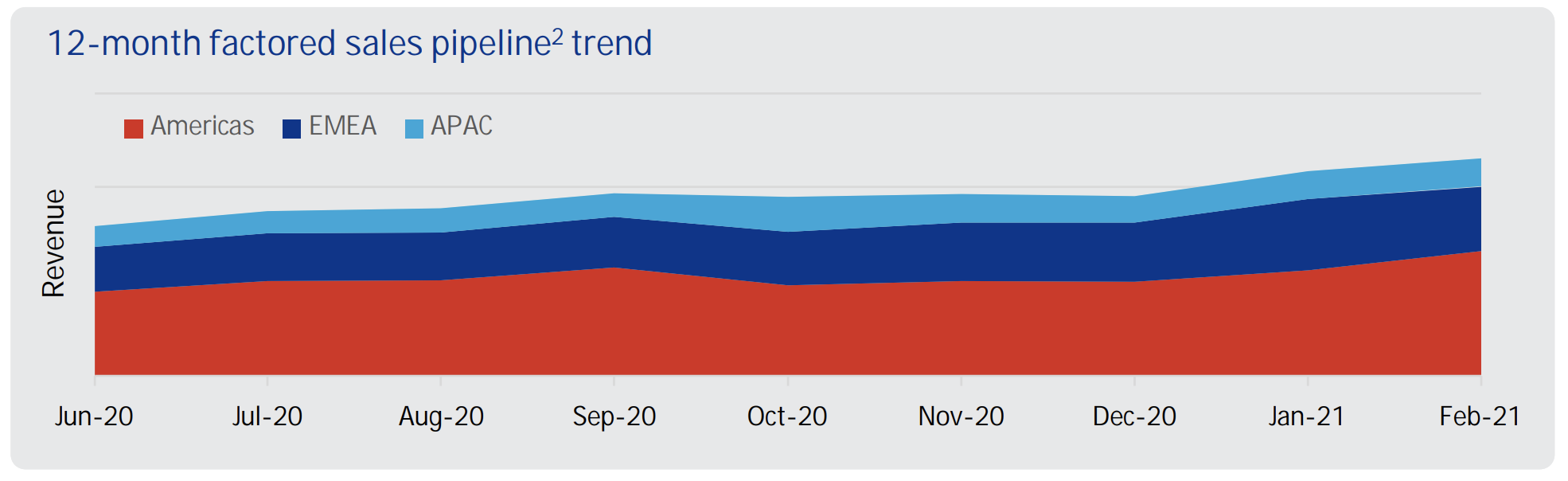

On a positive note, Worley’s 12-month factored sales pipeline is increasing, as shown in the chart below. This includes the acceleration of sustainability opportunities at a more favourable gross margin percentage than the company’s historical services.

Worley finished the period with net debt of $1,206 million, the lowest level of net debt since the ECR acquisition.

Dividend maintained

Worley declared an unfranked interim dividend of 25 cents per share.

This is in line with the dividends paid in the prior two periods, and means Worley shares are trading on a dividend yield of around 4.6%.

What lies ahead?

Worley believes its strong cash result, cost savings programs and sustainability pivot have set the business up for the future.

Commenting on the latter, chief executive Chris Ashton said:

“Our sustainability pivot provides the structural framework for growth. The contribution of sustainability projects is already sizeable, delivering $1.2 billion of revenue in H1 FY21, around 30% of Group revenue. Energy transition and circular economy opportunities in particular are accelerating . . . We’re pleased with the level of work (and resulting margins) we’re winning in line with our strategy”

To date, the company has delivered $286 million of operational savings and has increased its target to $350 million annualised savings by June 2022.

The company said it is also on track to deliver the $190 million ECR acquisition cost synergy target by April 2021.

Worley is expecting improved EBITDA in the second half of FY21 compared to 1H21, underpinned by recent project awards and the full-year impact of cost reductions implemented in the first half.

To keep up to date with the numerous reports this February, make sure to bookmark Rask Media’s reporting season hub and ASX reporting season calendar for all the latest.