When it comes to identifying key sectors to watch in 2021, I can’t help but notice more and more market commentators mentioning areas in defence, cybersecurity, technology, and infrastructure.

These could all potentially present large opportunities as the global economy tries to push through a vaccine-led recovery throughout this year.

With this in mind, how could these macro themes somehow play to the advantage of Melbourne-based company AVA Risk Group Ltd

(ASX: AVA)?

To answer this question, here’s a deep dive into the operations of the company that has gained significant attention from investors from the back half of 2020.

Overview of AVA’s operations

AVA Risk Group is a global security and risk management business that uses world-class technology to assist its clients in protecting high-value assets in over 60 countries worldwide.

It specialises in the design, manufacturing, and distribution of fibreoptic intrusion detection systems, network security systems, and biometric access readers.

Additionally, its international logistics (services) segment is responsible for the protection of high-value assets while in the transportation and storage process.

The majority of the group’s revenue is generated in the northern hemisphere and its customers are predominantly in the military, industrials, and other government sectors.

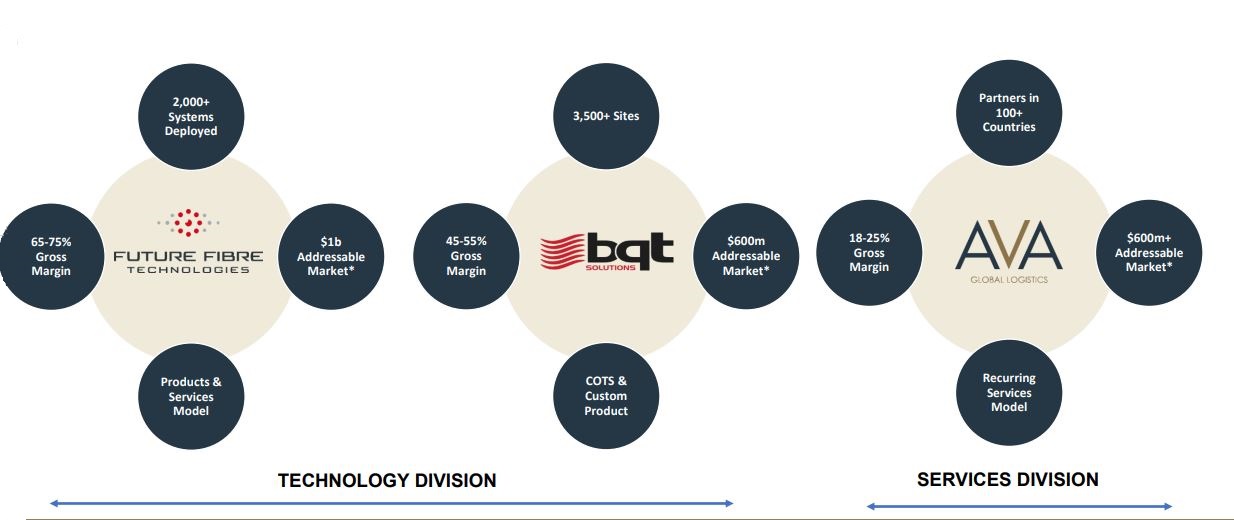

AVA operates through three segments: Future Fibre Technologies (FFT), BQT Solutions, and AVA Global Logistics.

Future Fibre Technologies (FFT)

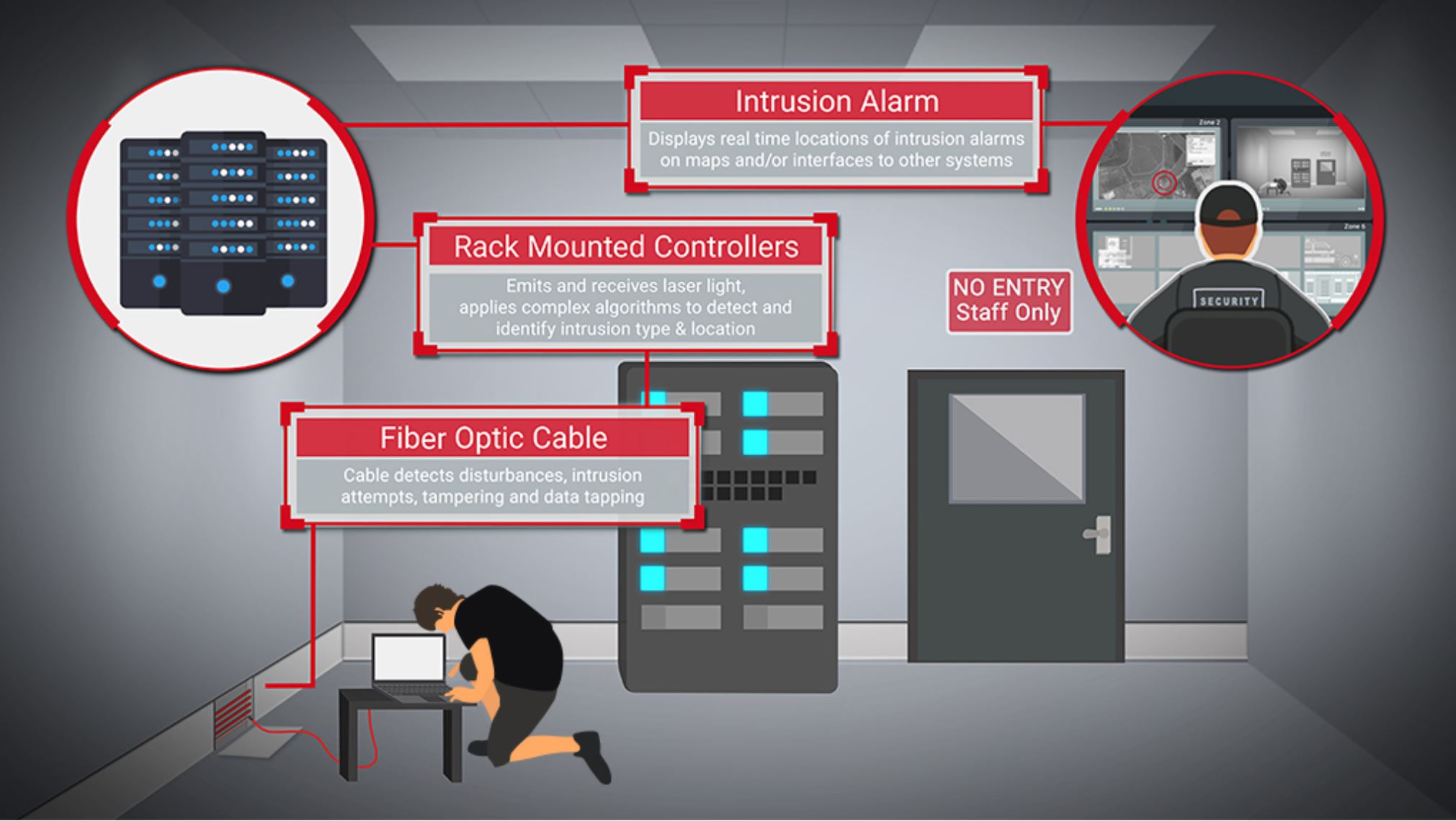

FFT designs, manufactures, and distributes fibreoptic intrusion detection systems that can be used in multiple applications to secure high-value assets and critical infrastructure.

For example, these systems are mainly used in perimeter protection, data network tapping, and oil and gas pipelines.

The underlying technology behind these systems is complex, but the overall idea is actually relatively simple to understand: Fibreoptic cable is placed around whatever is trying to be protected (e.g., a perimeter fence or gas pipeline) with beams of light being shot down and back up the cable.

If an intrusion does occur (e.g., a person attempting to jump over the fence or an excavator digging in close proximity to the pipeline), this will cause vibrations that will change the way in which light travels through the cables.

AVA’s sensors will be able to detect this change and can pinpoint the precise location of the intrusion and send this information to a central control room to alert authorities of the intrusion.

Recent FFT growth – IMOD contract

A significant contract win recently has been a large-scale supply of AVA’s Secure Link technology to protect more than 40,000 km of data communication cables for the Indian Ministry of Defence (IMOD).

Given the nature of the project, there’s quite a bit of information that hasn’t been disclosed to the public. But we do know that the project is covering one of the world’s largest closed user group data networks, exclusively used by more than one million military personnel.

By the end of the contract, it will have generated approximately $16.7 million in revenue. The deal was announced back in 2018, but revenue will continue to be recognised on AVA’s financial statements until the fourth quarter of 2021.

After the contract ends, AVA will still be able to generate IMOD revenue through an additional maintenance contract with estimated further revenues of $4.8 million.

One of the most important aspects to note from the IMOD contract is exactly how the project is being carried out and its effect on AVA’s bottom line.

Rather than AVA paying to manufacture the detection systems and distributing them to its client as it would normally do, AVA has partnered with an Indian manufacturing partner, SFO Technologies, which is responsible for the whole manufacturing process, associated working capital, and delivery under the contract.

AVA has been receiving a licence fee for each system supplied for the project. This means revenue generated is essentially on a 100% EBITDA margin, as AVA is not responsible for the cost of goods sold (COGS) in the manufacturing process.

Latest FFT developments – Aura IQ

While big contract wins are always great to see, it’s also worth noting some of the recent innovations in AVA’s FFT segment and what this means for other industries and applications.

Aura IQ is the latest weapon in its arsenal and uses the same underlying fibreoptic technology behind its intrusion detection systems. However, AVA plans to use Aura IQ to monitor the status and health of conveyor belts, mainly in industrial applications such as mines.

Industrial conveyor belts are long (>5km), can have thousands of bearings, and often break down, resulting in high outage costs while the source of the problem is identified.

With the same fibreoptic technology, faults in bearings are able to be precisely identified prior to being completely broken. This can result in lower outage times and significant cost savings for the owner of the conveyor.

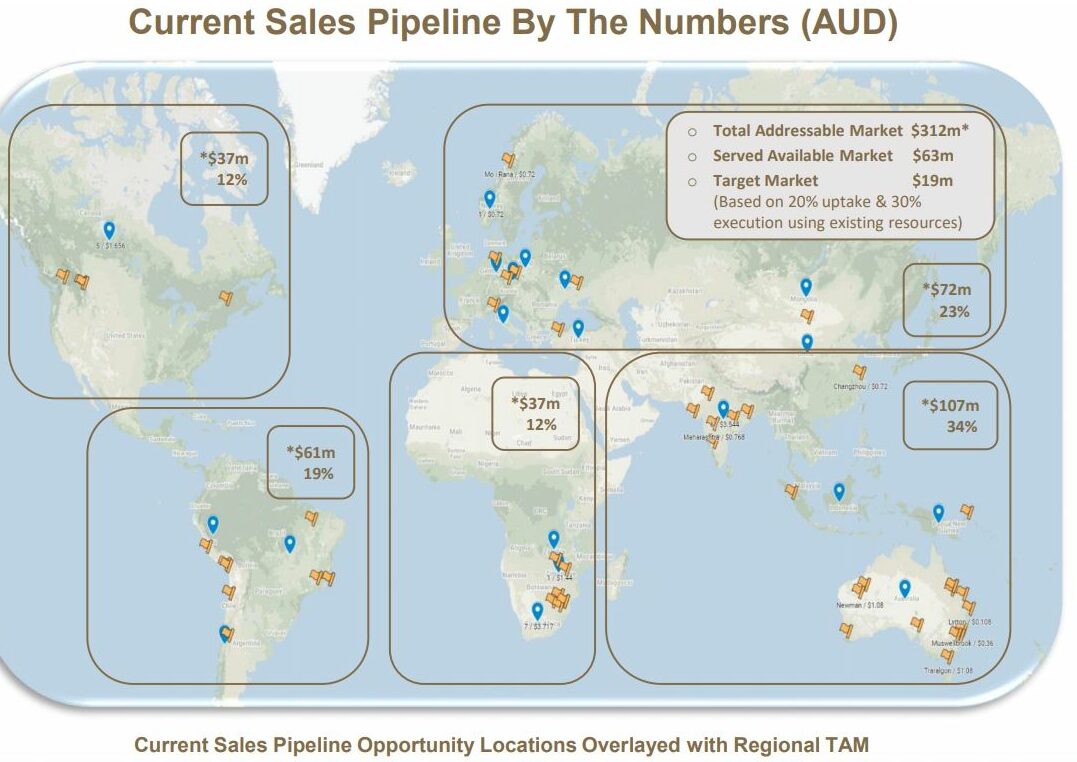

The development of Aura IQ is relatively new and as such, it is yet to translate into sales at this stage. However, multiple proof of value (POV) trials have been completed around the globe, which has indicated an estimated addressable market of over $300 million and significant commercial interest in the product.

The current sales pipeline for Aura IQ consists of over 50 sites and has estimated revenues of more than $50 million over the first three years of deployment.

Management has indicated that 2021 will be an exciting year for sales interest in the product, although not much more information has been provided to the market as of yet.

Latest FFT developments – FOSS 5.0

One thing I’ll touch on a bit later is the fact that AVA relies on repeat customers in its services division and new customers in both its FFT and BQT divisions to drive sales growth.

In order to start generating more consistent recurring revenues, FFT’s software team has developed a software platform called FOSS 5.0, which will be used in conjunction with many of FFT’s intrusion detection systems.

A common problem with most forms of intrusion detection systems is nuisance alarms (false alarms) being triggered unnecessarily. In the case of fibre optic systems, something like heavy rainfall or a plane flying overhead could be enough to trigger an alarm.

FOSS 5.0 utilises machine learning and innovative data capture tools to improve the event classification process in order to reduce the frequency of nuisance alarms.

FOSS 5.0 will be offered on a Software-as-a-Service (SaaS) model to customers. And according to the most recent H1 FY21 update, the first shipments of the platform were delivered during the half-year.

BQT Solutions

In terms of revenue generation, BQT Solutions is AVA’s smallest segment. It is responsible for the design, development, and distribution of biometric and access card readers.

While FFT focuses on outside applications such as perimeters, BQT’s product range adds that extra level of internal security with a range of fingerprint and iris scanning bio-verification technology, as well as card readers and locking mechanisms.

Some notable contracts include the supply of its custom encrypted access control technology for the Australian Department of Defence across facilities and bases all around Australia.

BQT’s products are also used in high-security prisons, with readers being deployed in Waikeria Prison in New Zealand.

Unlike the licencing model used in the IMOD contract, these products are manufactured in Australia and New Zealand and typically generate a lower gross margin of around 45-60%.

Due to the nature of these products, it’s understandable why management can’t go into specifics regarding technical aspects. But it has been indicated that there is a level of competitive advantage through more advanced encryption technology and technology patents.

AVA Global Logistics (Services)

The services segment provides international logistics of high-value assets on a fully insured door-to-door basis.

If you’ve ever seen an armoured vehicle transporting things such as cash or gold, this segment of AVA provides these sorts of logistics support as well as storage and inventory management services.

However, AVA outsources all of the operations to various partners in multiple countries. This means AVA is not responsible for any of the working capital or other overhead costs associated with these operations.

While this is a relatively safer method of operation, it’s important to note that this is also typically quite low margin compared to its other segments, with a gross margin usually between 21-27%. In FY20, revenue from its logistics segment accounted for 54% of group revenue, but only made up 32% of group EBITDA.

Customer concentration also seems to be apparent in its logistics segment. In the FY20 annual report, management stated that one customer in this segment generated $9.8 million of sales, representing roughly 20% of the group’s total revenue.

Stability of earnings in this segment relies on the assumption that customers will use AVA Global on a recurring basis. While AVA does appear to have strong relationships with its customers, this is by no means guaranteed, so it’s definitely a risk that must be considered.

Further growth is also expected to partially come from some recent market consolidation between competitors in the same industry.

Last year, services company Brinks announced the acquisition of G4S, which will result in some closed operations in the consolidated business.

AVA management has indicated that it will be well-positioned to grow its market share in areas where competitors previously operated.

Sale of Services division

Back in March 2019, AVA announced it had received multiple expressions of interest from potential buyers in secure logistics regarding the purchase of AVA’s service division.

AVA’s management appears to be highly incentivised to complete the transaction as a result of a performance plan that will allow senior AVA staff to share in a pooled allocation of up to 32.7% of the exit value of the services division in excess of $5 million.

The valuation of the segment is still relatively unknown at this point. But based on industry feedback and comparative transactions, the consensus seems to be between an EBITDA multiple of 7.5x and 10.5x.

This division has been experiencing some rapid growth recently. Based on AVA’s most recent H1 FY21 results, it seems reasonable that this division alone could reach EBITDA of over $8.4 million for the full year, which gives a rough valuation of the segment between $63 million and $88.2 million.

It’s also unknown exactly when this transaction might take place, but at this stage, investors should know roughly by July 2021.

Why I like AVA

This is a fairly comprehensive overview of AVA’s current operations and it’s easy to see why investor sentiment has also been running high in recent months. The group is operating in a growing industry and it will be extremely interesting to see how this future growth story unfolds through its latest developments mainly through its FFT segment.

We know for a fact that governments around the world are starting to take security and cybersecurity more seriously. This is evidenced by the Australian Government’s 2020 Cyber Security Strategy, which promises to invest more than $1.67 billion over 10 years for the protection of critical IT infrastructure from potential threats.

While AVA is not predominately involved in cybersecurity, its FFT segment seems to be well-placed to take advantage of additional spending on protecting data networks on a global scale.

Even though the IMOD contract is only one customer and has a finite series of revenues, the fact that governments and organisations protecting high-value assets are willing to pay huge amounts of money for these services is a testament to AVA’s technology.

I believe this thematic could be one of the driving forces behind the continued success in the FFT segment. It’s still early days, but it would be nice to see some more large-scale contracts being signed through the remainder of FY21.

We also know that coming out of a recession, many economies try and build their way out of it through infrastructure spending.

If governments are prepared to spend billions on high-value infrastructure, it would make sense that they’d want to protect it from outside threats. It’s hard to say for certain whether or not AVA will turn out to be a beneficiary of this spending, but this certainly appears to be working in the group’s favour rather than against it.

I like that AVA is using its FFT technology in applications outside of security systems. Aura IQ is gaining significant commercial interest, which is promising, but it would definitely be nice to see how this translates into any meaningful sales action this year.

An interesting podcast with CEO Rob Broomfield revealed some additional applications that could use the same underlying fibreoptic technology.

Rob mentioned that tunnels and roadways often are already installed with fibreoptic cables for communication networks. These can essentially be turned into a sensor which can be then used to monitor traffic flow or pinpoint car accidents.

Additionally, power cables running across rivers or into the ocean often include a fibreoptic cable which can be used to sense boats passing beneath them. This information can then be passed on to the owner of the cable to better manage their assets and prevent any damage from occurring.

AVA’s competitive advantage

Like many other technology companies, AVA’s range of products in both its FFT and BQT segments are protected by various patents.

While I do think this puts AVA in a competitive position to an extent, it’s worth noting that AVA has not come up with the idea behind optic fibre intrusion detection systems. As such, there are various other companies globally that offer similar products with slightly different technical aspects.

Therefore, I don’t think it would be entirely fair to say that AVA has products or technology that are impossible to replicate.

However, I think AVA’s new Aura IQ product has much more of a leg up on the competition in the form of a first-mover advantage. Using fibre optic sensing in conveyor belt monitoring is something that is proven to work, but is yet to be fully adopted commercially.

Aura IQ is actually the result of a strategic alliance between AVA and Mining3 – a leading global mining research and innovation company.

Under the three-year agreement, AVA will use its advanced fibreoptic sensing platform in combination with Mining3’s signal processing algorithms to create the new product under its FFT segment.

It’s important to note though that this agreement was signed nearly two years ago, but still hasn’t translated into any sales as of yet.

Overall, I would rate AVA’s economic moat as moderate. While the underlying technology is complex and requires advanced technical knowledge, it will always be a possibility that a competitor may design a slightly different variant to avoid the patent issue, or alternatively come up with a completely new, superior product that could potentially render AVA’s product range obsolete.

High risk, high reward

When an intrusion detection system or access card reader is installed, it doesn’t need to be installed again (unless the system is replaced).

This means the only opportunity for AVA to generate recurring revenue from the same customer is through additional maintenance costs or replacing the existing system.

With no breakdown of maintenance income in the company’s financials, it’s extremely hard to get an idea of how meaningful any of these recurring revenues are. As a result, it seems to me that AVA heavily relies on the installation of brand new security systems from new customers to drive growth.

As mentioned earlier, its logistics segment relies on repeat customers to generate recurring revenues. This isn’t guaranteed and it’s a common headwind in services businesses.

While the FFT technology looks promising in Aura IQ, I also think it would be risky to invest today with the assumption that this will in fact translate to meaningful sales figures. In my view, it would be safer to wait and see if/when the first Aura IQ contract is signed, to try and get an idea of the potential success behind the new product.

One point of difference in Aura IQ is that AVA intends to use a Software-as-a-Service (SaaS) pricing model. This could provide the company with much-needed recurring revenue that would overcome the previously mentioned downfall of relying on new customers to fuel growth.

I also think it’ll be interesting to see if AVA can secure some more big contract wins on a licencing model similar to the IMOD contract.

Part of the reason AVA has been able to hit that inflection point on a profitability basis has been because it’s generated nearly $16 million in revenue on a 100% EBITDA margin.

If growth is expected to remain on this upwards trajectory, AVA needs to sign more licencing contracts, in my view. If the IMOD contract turns out to be a once-off deal with no more in the pipeline and Aura IQ doesn’t translate into meaningful sales, I would consider selling my shares in AVA.

H1 FY2021 results

AVA recently updated the market with unaudited H1 FY21 results, which saw the share price up 30% on the day. Here were some of the key points for the group:

- Group sales revenue up 70% compared to the prior corresponding period (PCP) to be in excess of $35 million for the half-year;

- EBITDA up 450% PCP and expected to exceed $12 million for the half-year;

- All business units profitable for the half-year; and

- Cash at bank as at 31 December of $13.4 million.

It’s important to note that the revenues from the IMOD contract contributed $7.7 million for H1 FY21 (22%) and there’s not much more left in the contact to be recognised as revenue. There is the maintenance contract worth $4.8 million, but there’s no indication if this will be recognised upfront or over time and when exactly this will occur.

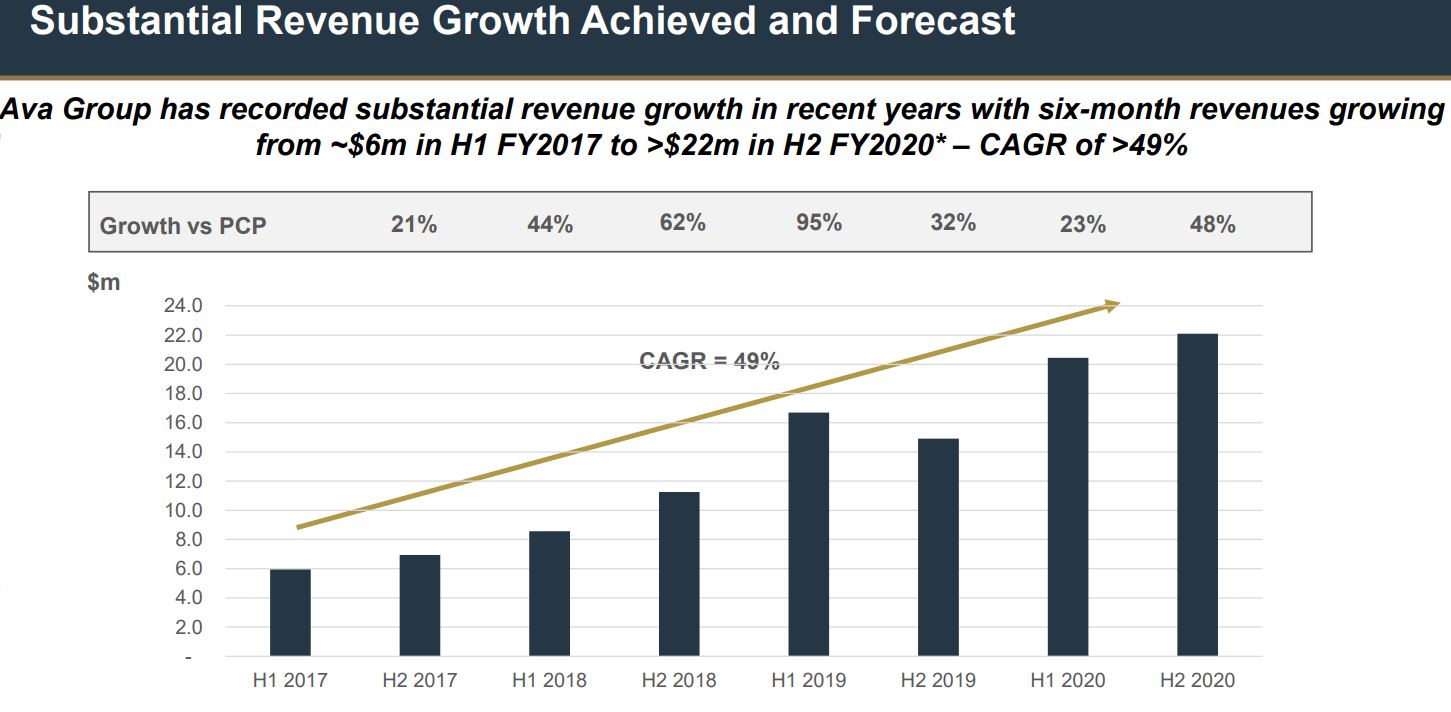

Even without the IMOD contract, however, sales growth is undoubtedly accelerating (FY20 revenue was $46 million), gross margins are expanding and the company has won some smaller contracts on the side. These are great results and confirms the upwards growth trajectory over the last few years.

The below image demonstrates the company’s consistent half-yearly revenue growth. Full-year FY20 revenue actually came in higher than the forecast, and keep in mind H1 FY21 revenue will be around $35 million, up 70% PCP.

Management and valuation

While a founder-run business is ideal, AVA Group has been the result of multiple mergers and acquisitions of various companies over the years.

The current CEO, Rob Broomfield, has extensive experience working with security companies. He was originally the CEO of FFT when it was its own separate company. Since becoming the consolidated group, Rob was the Chief Operating Officer of the FFT segment and became the group CEO in July last year.

Rob is one of the top 20 shareholders of the company, holding 2,525,637 ordinary shares, which represents 1.07% of the company’s shares on issue.

At AVA’s current share price of around 58 cents, this gives the group a market capitalisation of $141 million. For a company with FY20 revenue and net profit of $46 million and $4.94 million, respectively, this puts AVA on a trailing price/sales (P/S) ratio of 3.1x and price/earnings (P/E) ratio of 28.5x.

With H1 FY21 revenue of $35 million, it seems reasonably likely that AVA will beat FY20 in both revenue and profit, however, no guidance has been given as of yet.

As mentioned earlier, AVA has just reached an inflection point in FY20 on a net profit basis, which partially explains why it looks expensive using a P/E multiple.

With no earnings or revenue guidance, it’s hard to project the current valuation forward or to take any potential sales into account through the new Aura IQ product. Even with FY20 figures, however, the current valuation seems reasonably fair relative to its revenue.

Earnings (profit) is probably not the best metric to use, as AVA is going through a growth phase where earnings are most likely going to be fairly low. So purely from a sales perspective, the valuation doesn’t look too stretched at current levels, in my view.

As of 31 December 2020, the company had $13.4 million cash in the bank with a debt-free balance sheet, however, it had trade payables and leases worth around $6 million.

Summary

There’s little doubt that AVA is an exciting growth story that should be watched closely in 2021. However, right now, I think there are a few things yet to play out that will ultimately prove if this is a sustainable growth story.

For the reasons outlined above, it’s imperative that AVA is able to continue to win additional large-scale contracts, preferably on a licencing model similar to the IMOD contract.

Additionally, commercial interest alone in Aura IQ will most likely not be enough to keep the AVA share price afloat. The market is expecting sales to flow through in 2021 and if it doesn’t, I’d expect some downwards action in the share price.

One last thing to watch is the development of the FOSS 5.0 platform. One of the main thesis busters for AVA, in my eyes at least, is the need for repeat customers in its services division and new customers in BQT and FFT, which don’t result in recurring revenues.

If FOSS 5.0 proves to be successful and is able to generate consistent recurring revenues, my conviction would be vastly stronger and the overall investment case would likely improve significantly.

Today, however, I believe AVA shares would likely be closest to a hold for anyone with a low to moderate amount of risk aversion, or a very speculative buy if you’re willing to put faith in some of its latest developments that are yet to translate into sales.

Whatever the decision, AVA is undoubtedly one ASX tech share for the watchlist in 2021.