The adoption of ethical investing continues to accelerate as investors seek investments that align with their own Environmental, Social, and Governance (ESG) views.

Podcast: What is ethical investing?

There are several ethical ETFs on the Australian market, creating a wide spectrum of options for investors wanting to add an ethical dimension to their portfolio. Each differs in their ESG investment process, therefore understanding what makes the ETF ethical is integral to choosing an investment congruent with your ESG perspective.

Below are three ethical ETFs to watch in 2021 for investors considering exposure to ethical investing – from the investor looking for an ethical overlay to those wanting a more rigorous ESG investment process.

Vanguard Ethically Conscious International Shares Index ETF (ASX: VESG)

Launched in September 2018, VESG offers exposure to the world’s largest companies listed in developed markets. The VESG fund uses an eligibility screen to exclude companies with material business activities in:

- Fossil fuels

- Nuclear power

- Alcohol

- Tobacco

- Gambling

- Weapons

Additionally, VESG excludes companies based on severe controversies. The eligibility screen reduces the number of holdings from 2,025 to 1,629, which form the index.

VESG has returned 8.37% since inception. The majority of holdings are domiciled in the United States (68.70%), with smaller holdings in Japan (9.00%) and the United Kingdom (3.30%). Prominent holdings include Amazon.com Inc. (NASDAQ: AMZN), Facebook Inc. (NASDAQ: FB), and Alphabet Inc. (NASDAQ: GOOG). With a modest management fee of 0.18%, VESG offers a core alternative for those looking for a diversified global fund with an ethical overlay.

Get our free VESG ETF review.

BetaShares Global Sustainability Leaders ETF (ASX: ETHI)

ETHI offers exposure to 200 large global stocks that are climate change leaders. ETHI’s investible universe is determined through a two-step process; an eligibility screen and a climate leader score. The ESG screen used by VESG (above) is applied in addition to the following excluded activities or industries:

- Junk foods

- Destruction of the environment

- Human rights or supply chain concerns

- Lack of board diversify

Next, companies are graded on three criteria relating to climate leadership:

- Does the company have low total greenhouse emissions from operations?

- Does the company commercialize technology that has net positive climate benefits?

- Does the company have low involvement in the fossil fuel industry?

Only companies in the top one-third of performers relating to the above questions will be admitted to the ETHI fund.

ETHI has a one-year return of 21.35% and a three-year return of 19.43%. The underlying index that it tracks has returned 20.13% since inception.

Most companies are located in United States (71.90%), with major sector allocation to Information Technology (38.30%), Consumer Discretionary (14.70%), Healthcare (14.70%), and Financials (14.20%). ETHI has an annual management fee of 0.59%. Notable holdings include Apple Inc (NASDAQ: AAPL) and Tesla Inc (NASDAQ: TSLA).

ETHI places a stronger emphasis on climate leadership relative to VESG, making it a great option for investors wanting tactical exposure to large global companies creating a positive impact.

Get our free ETHI ETF review.

eInvest Future Impact Small Caps Fund (ASX: IMPQ)

IMPQ offers investors an actively managed ETF that predominantly invests in Australian and New Zealand listed small and medium companies. Th IMPQ fund seeks businesses with a strong focus on positives outcomes and sustainability in sectors such as healthcare, education, and renewable energy.

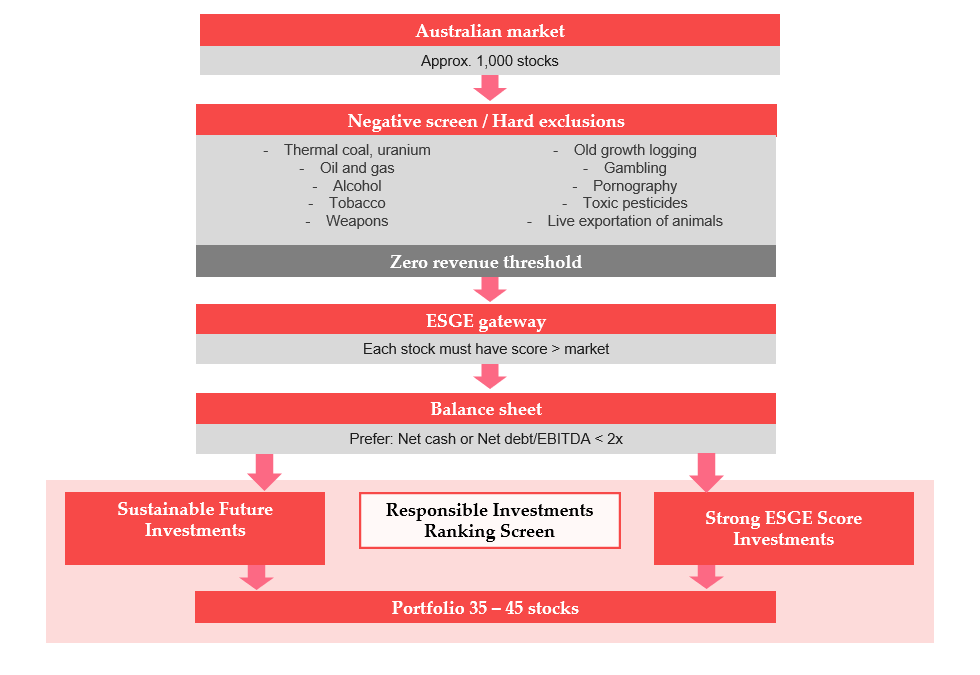

Like VESG and ETHI, IMPQ uses an eligibility screen to remove certain industries and activities from their investment universe. However, rather than a materiality criteria, the fund uses a zero-revenue threshold, meaning even firms with minimal operations in the aforementioned criteria will be removed.

The IMPQ fund then scores each company based on its efforts towards ESGE, with the final ‘E’ standing for Engagement. Unlike passive ethical funds, analysts at IMPQ engage with management to grasp a further understanding of their ESGE activities and offer recommendations to improve ESGE activities. For example, the fund recently engaged with a company regarding its lack of board diversity and offered a list of potential candidates.

Only companies that exceed the market benchmark score are admitted to the fund’s investment universe. After the two-step ESG process, the fund actively chooses companies based on fundamental analysis with an emphasis on balance sheet strength and sustainable growth investments.

IMPQ has returned 17.60% since inception in May 2019, outperforming its benchmark by 11.10%, proving there is no return trade-off to invest with a focus on ESG. Notable holdings include Resmed Inc (ASX: RMD), New Energy Solar Ltd (ASX: NEW), and Netwealth Group Ltd (ASX: NWL).

With a management fee of 0.99%, plus an additional performance fee of 20%, this fund could be a good option for investors who are seeking active management with a strong emphasis on companies contributing to positive outcomes.

Get our free IMPQ ETF review.