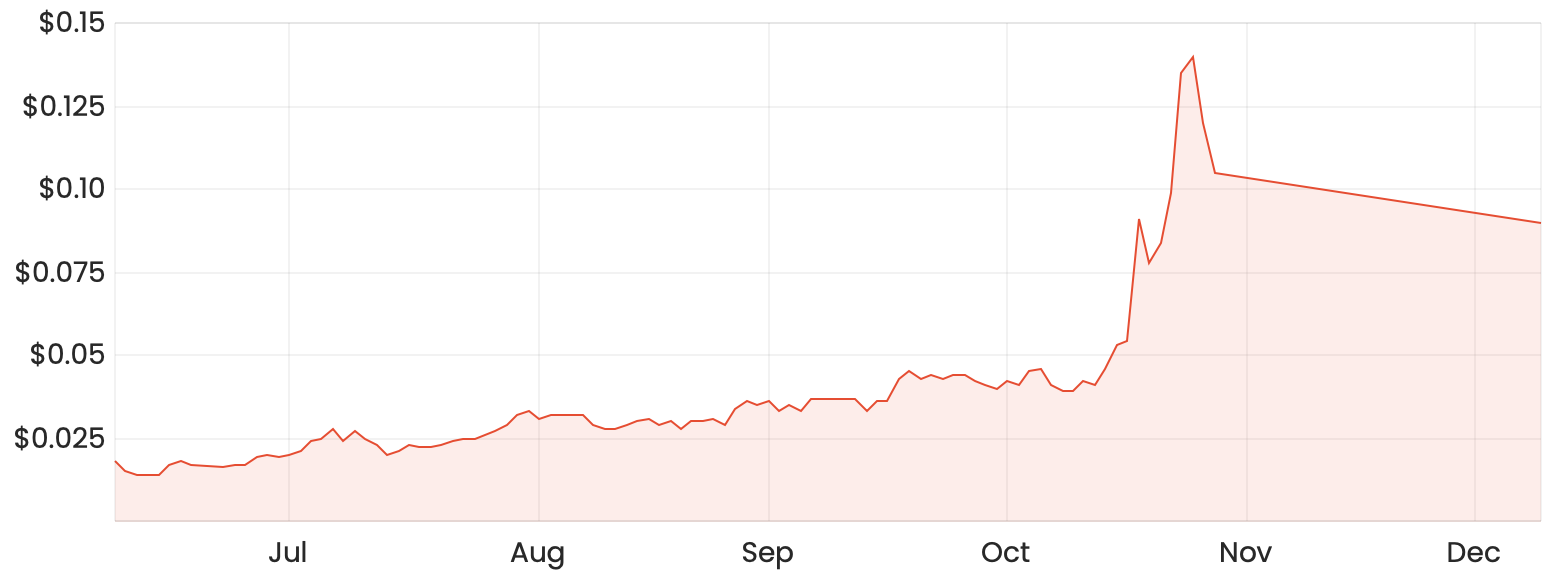

Shares in eSports operator Emerge Gaming Ltd (ASX: EM1) made their long-awaited return to the ASX yesterday after being in a trading halt for over a month.

Soon after yesterday’s open, the Emerge Gaming share price plummeted over 46% to around 5.2 cents. The selling price gradually crept up throughout the day and finished at around the 9 cents mark.

EM1 share price chart

At the time of writing, the Emerge Gaming share price is up another 22% today to 11 cents per share.

Background

Emerge Gaming has developed an online eSport and gaming tournament platform which focuses on skill-based tournaments and matches. Players are able to compete to enhance their rankings which can be exchanged for digital merchandise within the platform.

Emerge’s new platform, Miggster, is intended to become the world’s biggest online gaming community with tools including chat, friends and team functionality.

What’s happened

In October, Emerge announced that its new Miggster platform had achieved over six million pre-registrations.

There were some concerns into the legitimacy of these numbers and the company’s shares were officially suspended from the ASX for over a month.

On Tuesday evening, Emerge provided an update to the market with updated subscriber numbers for the Miggster platform.

As of 7 December, Emerge had sold 25,674 subscriptions across the platform with the following breakdown:

- Annual Packages – 20,615

- Bi-annual Packages – 1,662

- Monthly Packages – 3,397

The cost of the subscription packages vary depending on the billing frequency, but based on the prices quoted in the announcement, these subscriptions could come to a little over $3 million in annual revenue.

Net revenue will be equal to gross subscriptions received less direct taxes and other directly-attributable platform costs. Emerge will then earn 64.5% of net revenue, split between Technologia de Impacto Multiple SL (TIM), which helped market the platform.

Is the Emerge Gaming share price a buy today?

I still think it’s very early days for Emerge Gaming and there are a lot of assumptions and omitted risks in the above hypothetical revenue example.

Personally, I’m still sceptical of the subscriber count given the transparency of the company’s past announcements. Current users may be subscribed as of today, but this also doesn’t mean that they will continue to be a paying subscriber later on.

Keep in mind that Emerge will have to pay out prize money from US$125,000 to $250,000 as well as additional operational costs to run the business. I think it could be likely that this $3 million in potential revenue translates to an amount substantially less after accounting for the associated costs.

With a current market capitalisation of $92 million, I believe this valuation seems stretched given the potential earnings based on this rough example.

Emerge might be able to grow its subscriber base significantly, but until it does, I’ll be holding off buying any shares for the time being.

For some other shares I believe offer compelling value right now, check out this article: 3 ASX growth shares to watch in December.