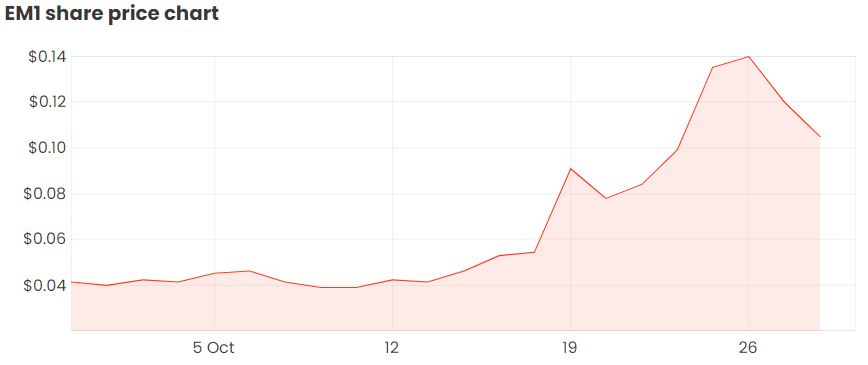

Shares in Emerge Gaming Ltd (ASX: EM1) were among some of the most traded on the ASX last week.

In just 2 weeks, shares have surged over 150%, but are currently suspended from trading pending a response to ASX queries.

Emerge Gaming has developed an online eSport and gaming tournament platform which focuses on skill-based tournaments and matches. Players are able to compete to enhance their rankings which can be exchanged for digital merchandise within the platform.

The front page of the company’s website states that the eSports market had revenues of USD$493 million in 2016 and is projected to grow to USD$1.48 billion by 2020.

What’s caused the recent jump in the share price?

On the 19th of October, the company announced that its new Miggster platform had achieved a milestone of 3 million pre-registrations. Then on the 28th, it was announced that an additional 3 million users had pre-registered for the new platform offered by Emerge Gaming.

The miggster mobile subscription fee is $USD8.50 per month, however, there hasn’t been any hard evidence to suggest that any of these pre-registrations will result in any of the users following through with the monthly subscription.

Recent concerns regarding the numbers

There’s been some questioning into the legitimacy of the number of pre-registration users that were announced recently.

Emerge gaming partnered with Technologia de Impacto Multiple SL (TIM) to help promote the new platform, however, it’s been revealed that TIM is part of the wider Impact Crowd Technology Group (IPT), which is known to be a multi-level marketing company (pyramid scheme) that’s run into some troubles in the past.

The concern is that Emerge Gaming has stated to investors that affiliated parties were incentivised and rewarded for attracting subscribers by promoting the miggster platform. At this point, the nature of the 6 million pre-registrations is still very unclear and it’s unknown how many users will go ahead with the monthly subscription.

Shares in EM1 went into a trading halt on the 28th and had until the 30th

to provide reasoning as to why. Today, EM1 placed itself in voluntary suspension, with no further information provided to investors.

Buy/sell/hold?

I’m sitting out on this one. Personally, this just isn’t my style of investing. The pre-registration numbers could result in real future cash flows, or they might not. Regardless, it’s really speculative to be pricing the equity of the business when there’s very little financial information to base the valuation on.

I hope the company does well, but the legitimacy behind the pre-registration numbers and its affiliated parties is concerning, to say the least.