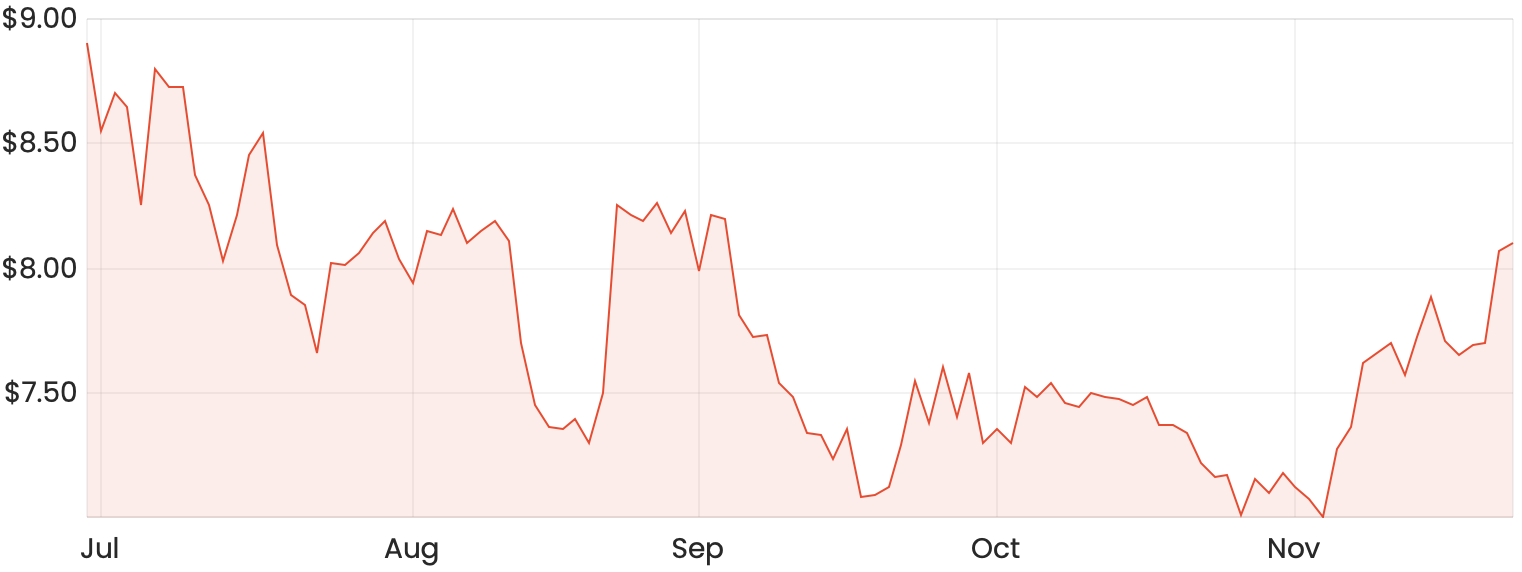

Since the completion of its merger earlier this year, the TPG Telecom Ltd (ASX: TPG) share price been trending down, recently bottoming out around the $7 mark. Are TPG shares a buy today?

TPG share price chart

What does TPG do?

TPG is a telecommunications and IT company that was born out of a merger between TPG and Vodafone Hutchison Australia in July 2020.

TPG is the nation’s second-largest internet provider with around 22% of the total Australian market share. It’s the parent company of many other well-known brands such as Westnet, iiNet, and Internode.

More upside in the TPG share price?

I think it would be likely that TPG could benefit from the general unwinding of restrictions and an open economy. While services such as broadband connections were fairly resilient compared to others in the COVID environment, TPG was mainly let down by its mobile sector.

The intuition here is fairly straight forward: less overseas travellers resulted in a significant fall in roaming fees and prepaid connections. Additionally, new mobile connections dropped significantly due to fewer students arriving to study in Australia. It seems likely that these numbers will return to normal at some stage, although when this will be is still the million-dollar question.

Some market commentators have also pointed out that TPG should be able to expand its margins through realising cost synergies from the recent Vodafone merger. Keep in mind that in this kind of industry, keeping up with the most advanced technology is extremely capital intensive compared to others. Margins are typically low due to this reason, but also because it’s very competitive, so I think cost savings will definitely be the much-needed boost TPG needs to grow its earnings.

It’s also important to note that realising cost synergies can take quite some time, and it’s likely that even with a successful vaccine, international travel at full capacity might be still quite some time away.

TPG: buy/hold/sell?

For the above-mentioned reasons, I would be holding on TPG shares at this point in time. However, if I had to pick between TPG and Telstra Corporation Ltd (ASX: TLS), I think I’d go with TPG.

This is because Telstra has traditionally had a monopoly in telecommunications in Australia. While new competitors emerge such as TPG, Telstra could struggle to retain its market share, and it certainly can’t increase its market share if it already had a monopoly in the first place.

For this reason, in situations like these, I’d prefer to go with the newer entrant.

For some more share ideas, here are 3 ASX growth shares I’m really liking at the moment.