AVA Risk Group Ltd (ASX: AVA) shares have quietly gone under the radar up until these last few months.

Here’s an overview of the company and an explanation as to why it’s surged in popularity recently.

AVA Risk Group is a market leader in risk management services and technologies that are distributed on a global scale. Some of its main customers include military, governments, industrial and commercial. The business is divided into three main segments: Future Fibre Technologies, BQT solutions and global logistics.

Future Fibre Technologies

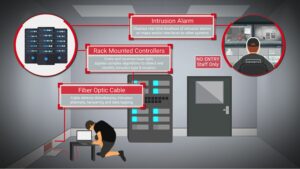

Future Fibre Technologies (FFT) manufactures devices that are used in intrusion detection. This technology can be used to monitor perimeters and data networks that hold high-value assets or critical infrastructure. It can also monitor pipelines that are susceptible to threats from accidental or deliberate digging.

FFT works by sending real-time locations of intrusion alarms to a central control room which alerts the user of the intrusion. The below image shows how FFT can be used to protect data network infrastructure.

BQT solutions

The BQT segment designs and manufactures security card and biometric readers, electromagnetic locks and related security products. Some of these products include fingerprint scanners and iris recognition machines, all built to a military-grade standard.

Global Logistics (Services)

The services segment provides international logistics of high-value assets on a fully insured door-to-door basis. If you’ve ever seen an armoured vehicle transporting things such as cash or gold, this segment of AVA provides these sorts of logistics support as well as storage and inventory management services.

AVA has indicated that it will potentially sell the services segment at around 8x EBITDA at some point in the future, although it’s unclear if the company still intends to go ahead with the sale.

Why the AVA share price has taken off recently

In the Q1 FY21 announcement, the company reported that sales revenue had increased by 73% to $17 million compared to the same period last year. EBITDA increased by 522% to $7.7 million and the company was holding a cash balance of $11.6 million.

To put this result into perspective, the FY20 EBITDA result was around $6.3 million, and AVA has just made more than that in one quarter alone.

Despite COVID-19 restrictions, the results demonstrated the highly scalable cost structure of the business that has allowed margins to improve over time through economies of scale.

One of AVA’s big clients is the Indian Ministry of Defence (IMOD), which uses a large scale data network protection program through its FFT segment. This contract alone provided $3.6 million of revenue recognised for the quarter, however, the value of the total IMOD contract is $16.5 million. IMOD has essentially paid for a licence fee to use AVA’s technology, which means revenue is on an extremely high margin.

One thing to point out is that a large portion of AVA’s revenue is non-recurring, particularly in the services segment. This means that AVA has to continually generate large amounts of sales just to keep up with previous levels.

AuraIQ

One of the latest developments from the FFT segment is AuraIQ – a monitoring system that is used in industrial conveyor systems. Traditional failure detection methods are said to be extremely time-consuming, unreliable and labour intensive. AuraIQ aims to provide a quicker, safer and more reliable solution that reduces planned downtime, resulting in substantial cost savings.

AuraIQ is still in early stages, but the company has indicated there has already been significant interest with a diverse portfolio of rollout opportunities spread across six regions, 21 countries and five industry sectors, totalling over $50+ million in potential total contract value.

Macroeconomic outlook

There’s a massive structural tailwind that is hopefully going to drive further growth for years to come. As long as we have businesses and governments that store critical assets and infrastructure, there will be a need to monitor, maintain and protect these high-value assets.

In August, the Australian Federal Government released the 2020 Australian Cyber Security Strategy, which promises to invest over $1.67 billion over 10 years in the protection of critical IT infrastructure from potential threats. Ideally, AVA would be well-positioned to be in the crosshairs of this funding, but the point is more to emphasise the importance of the protection of infrastructure as the amount of data we create and store increases.

Summary

As I mentioned earlier, a large portion of AVA’s revenue is non-recurring. It would be nice to see a higher concentration of revenues that are recurring in nature. Having said this, multi-year long contracts such as the IMOD contract are great because revenue is recognised over multiple financial years. However, it is unclear at this point if the IMOD contract will be resigned after the current agreement.

If AVA can win some more big contracts, this will contribute nicely to stable earnings over time rather than lumpy, inconsistent revenues that are heavily concentrated on a small number of clients.

Having said all this, AVA ticked a lot of boxes for me. The company is profitable, debt-free, has significant inside ownership and is being propelled by a macro shift in the need for security services and products. The interest in the AuraIQ product range looks promising, but it will take time to know for sure if it translates into consistent cashflows.