Douugh Ltd (ASX: DOU) was one of the most traded shares on the ASX last week as the Douugh share price jumped more than 300% in just three days.

The market seems to like this one, and there has clearly been a lot of sentiment driving this rally. Here are a few ways I analyse this company.

What does Douugh do?

Douugh is a neobank, which means it operates exclusively online and doesn’t have a physical presence, unlike a typical commercial bank. The company has developed a mobile banking application that helps customers better manage their finances. It offers a checking account, a linked Mastercard debit card and various other ‘financial wellness’ services.

Douugh does not operate like a typical authorised deposit-taking institution (ADI). This means it won’t have an account with the relevant central bank of the country it operates within. Instead, it will partner with a commercial bank that will be able to perform deposit-taking transactions.

Within the last month, Douugh has entered the ASX through a reverse listing of a failed Australian telco called ZipTel. ZipTel acquired 100% of the company, and then changed its name to Douugh. It raised $6 million in equity from an over-subscribed pre-IPO.

Douugh is currently focused on growing its userbase and recurring monthly revenues in the US through a partnership with Choice Bank. It has further plans to commence operations in Australia through a partnership with Regional Australia Bank. Long-term goals include providing banking services to small-to-medium enterprises (SMEs).

Performance of other neobanks

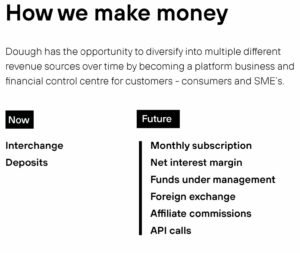

The ideas behind it all sound very exciting, but what’s important to understand is how the business plans to make money.

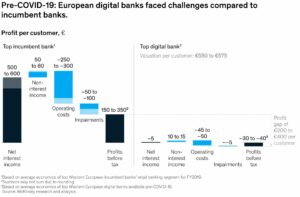

Taking a look at digital banks broadly, recent research from McKinsey & Company suggests that digital banks have struggled with profitability even in favourable economic conditions prior to COVID-19.

This is due to the fact that neobanks typically offer far fewer services than commercial banks, which can generate income from multiple sources beyond transaction fees (see figure below).

How neobanks make money

Neobanks don’t usually offer services that generate high levels of revenue such as packaged accounts, commercial and consumer credit products, mortgages, and investments.

Instead, they rely on revenue streams such as transaction fees and commissions, which according to the above unit economics, aren’t extremely profitable in some cases.

To add to this concern, the below image shows Douugh’s revenue sources, many of which don’t stack up well compared to higher generating assets that commercial banks have.

Short-term concerns I hold

Comparing the research from McKinsey to Douugh’s presentation (above) on its revenue channels, this could indicate that at least for the short-term, Douugh might not be profitable for quite some time. The company would also be relying on generating recurring monthly revenues, which according to McKinsey often isn’t able to be achieved.

The research further indicates that due to many digital banks having a cash-consumptive business model, they often require ongoing funding rounds from investors. The below table confirms this research, showing the number of funding rounds for various other neo-banks.

My thoughts on Douugh shares

The point of all of this isn’t to say that Douugh isn’t a good company and won’t do well in the future.

The point is to outline the fact that it’s still very early stages, and by the looks of things, Douugh will require additional funding in the future.

Perhaps the services offered are in fact much broader than other neobanks, which will help Douugh generate more diversified revenues streams. But, even Douugh’s own presentation outlined that it will take time to be able to branch into other revenue streams.

In my view, the most important (and hardest) aspect is valuation. This company isn’t tracked by analysts, as there is quite literally nothing that is able to be tracked. At this point, a valuation is extremely hard to arrive at. The institutions valued Douugh shares at $0.03 each, but now the market has collectively valued shares at $0.31 each (at the time of writing).

There are no prior or predicted cash flows to input into a financial model. There is no earnings or revenue guidance. You have similar companies which could be useful comparatives, but it’s still very speculative no matter which valuation method you use.

Again, this is not a criticism of the company itself. It could do extremely well for all I know, and I hope it does. But it’s important to point out that the market has collectively valued Douugh’s equity at $100 million, yet the company currently makes no money.

When there’s a lot of expectation built into a share price, it can often turn out to be a very asymmetric return with a lot more downside than upside. I would like to be proven wrong on this one, but I’m sitting out for now.