The Woodside Petroleum Limited (ASX: WPL) share price is edging lower today after the oil and gas company handed down its half-year FY20 results. Here’s what Woodside reported.

Key points from Woodside’s HY20 result

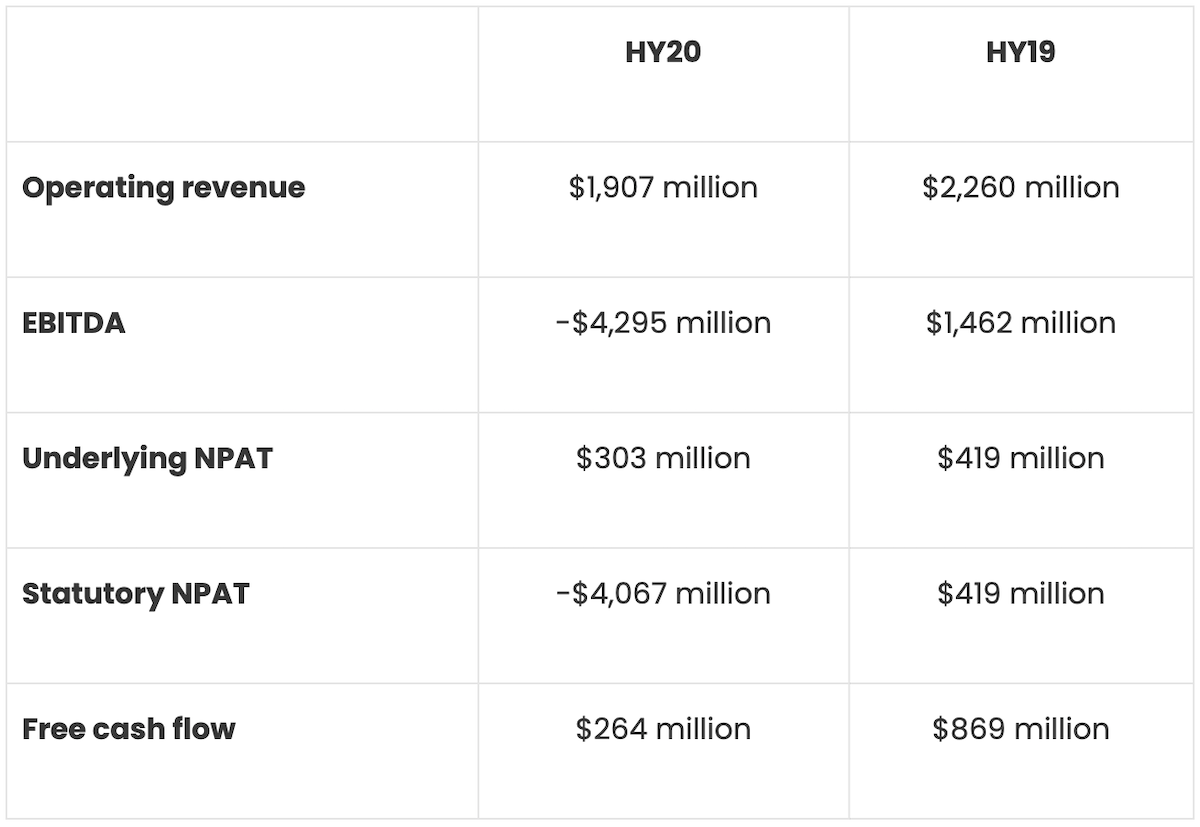

The big difference between underlying and statutory net profit after tax (NPAT) was due to the impact of oil and gas properties and exploration and evaluation assets (US$3,923 million), as well as an onerous contract provision (US$447 million).

Woodside already flagged these write-offs last month, which you can read about here.

Explaining the result, Woodside said the first half of 2020 was characterised by unprecedented disruptions to its operations and markets in Australia and around the world.

“I would rate the external conditions created this year by the COVID-19 pandemic and oversupply in global oil and gas markets as the most difficult I’ve seen in nearly four decades in the industry”

– CEO Peter Coleman

Despite these challenges, the company achieved its highest-ever first-half production of 50.1 million barrels of oil equivalent (MMboe).

Woodside noted that throughout the period, oil and gas prices were negatively impacted by geopolitical dynamics, economic uncertainty and energy demand destruction brought about by COVID-19.

The oil price infamously crashed as much as 80% from the start of the year and LNG spot prices have seen historic lows. However, oil prices have now recovered to around 65% of pre-COVID levels.

At the end of the period, Woodside had US$7,552 million of liquidity, an increase of 43% from the first-half of FY19. The company completed a $600 million syndicated facility during 1H20 with a term of seven years.

What next?

Woodside didn’t provide much in the way of outlook. In its investor presentation, the company said there have been early signs of recovery, including increasing economic activity and supply and demand rebalancing. As a result, it expects prices to firm.

Commenting on the company’s advantages over its competitors, Woodside pointed to its resilient base business, strong free cash flow and liquidity, and fully-funded capital commitments. It also believes it is well-positioned to opportunistically grow, and is actively future-proofing its business.

To get up to speed on the companies that have reported so far and find out what’s in store for the rest of the month, check out Rask Media’s ASX reporting season calendar.