The Afterpay Ltd (ASX: APT) share price was trading 9% higher today as more enthusiasm returns to the local market.

For context, the broader Australian share market or S&P/ASX 200

(ASX: XJO) was trading up 1.91%.

Afterpay Ltd

Afterpay Touch is the owner of the popular “buy now, pay later” app. As of 2020, Afterpay had over 7.5 million registered users worldwide, making it one of Australia’s true technology success stories.

The following video from Rask Australia explains how to value stocks using SaaS metrics.

Afterpay’s COVID-19 investor update

Earlier this week Afterpay gave a reassuring update to its investors who were growing increasingly concerned about the potential for rising bad debts and a dramatic slow-down in consumer spending. This has come at a time when Australians have begun to think more optimistically about a return to a ‘normal’ lifestyle.

On Wednesday Afterpay said it was still too early to estimate the impacts of COVID-19 on the economy but it was acting quickly to respond to any challenges.

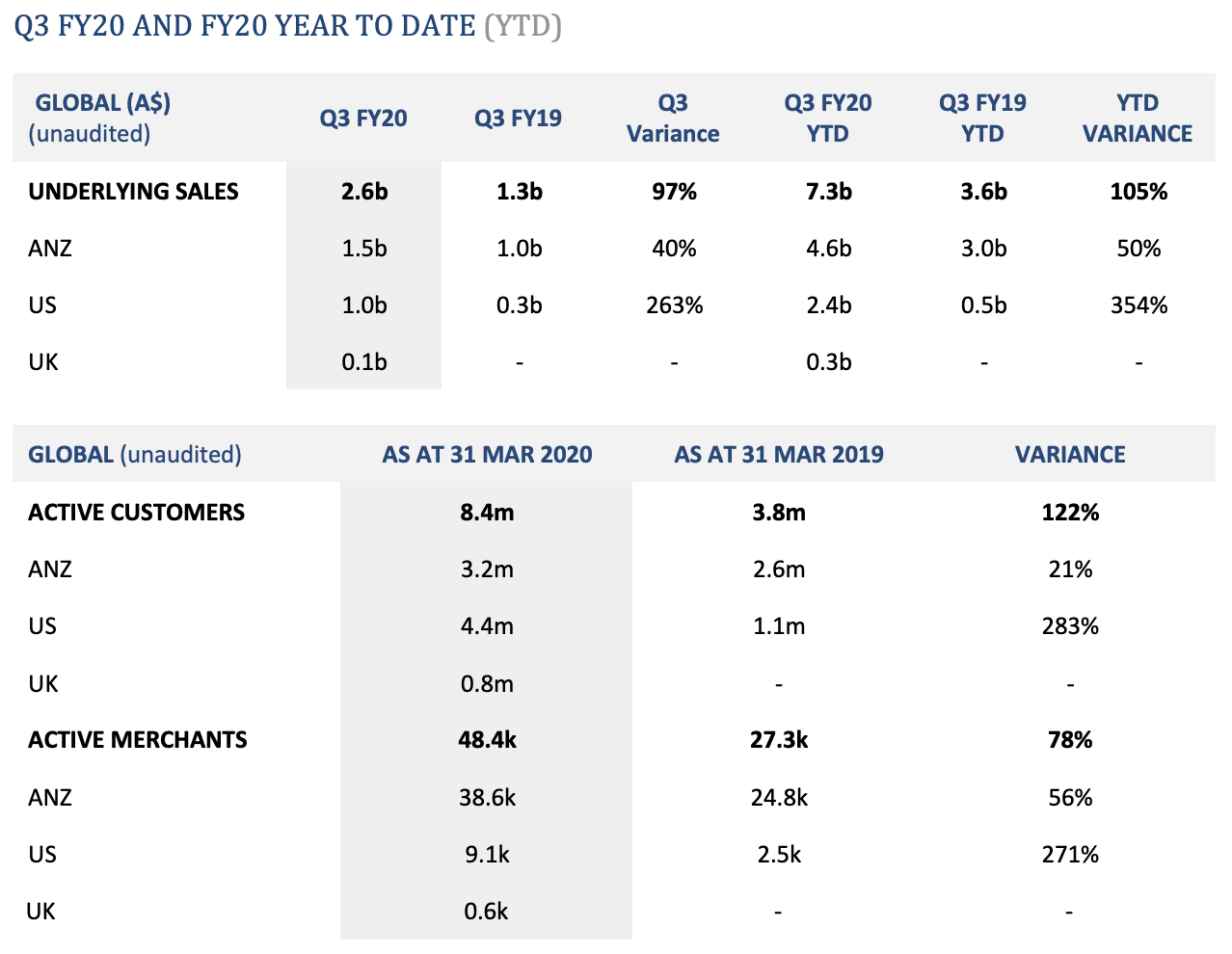

What was particularly promising for the company was the underlying sales result, which tells you how much money is being made by retailers using Afterpay. Afterpay said underlying sales for the year to date were $7.3 billion, up 105% on the same period a year earlier. Afterpay makes its revenue by taking a cut of the sales and managing the credit risk of any short-term customer defaults.

With regards to credit losses as a percent of underlying sales, the company said it was estimated to be around 1%, although these numbers were unaudited. This was in-line with the first half of its 2020 financial year.

With increasing sales, and losses at around 1%, the company said its net transaction margin, which is what Afterpay makes, was around 2%.

Finally, in terms of liquidity and downside risks, Afterpay said it has undertaken modelling which suggested it was capable of supporting operations for years based on its current cash flow and balance sheet. Meaning, if the economy does not return to normal anytime soon and continues ‘as is’, it’s capable of remaining afloat for at least another year.

What Happens Next?

Afterpay Ltd shares were last seen trading at $30, giving the company a market capitalisation more than $8 billion. That’s not exactly dirt cheap. If you’re considering taking a position in Afterpay there are three articles on Rask Media worth reading:

- The real reasons the Afterpay share price fell 70%

- 5 ASX tech shares for your 2020 watchlist

- Is Afterpay still worth $34?

If you’re looking for our analyst’s top three cloud stocks for 2020 and beyond, grab a free report below.

[ls_content_block id=”14948″ para=”paragraphs”]

Disclosure: The author of this article does not have a financial interest in any of the companies mentioned.