NAB

(ASX: NAB) has reported its FY19 result to investors this morning.

NAB is one of the four largest banks in Australia in terms of market capitalisation, earnings and customers. However, in 2019, it was Australia’s largest lender to businesses and has operations in wealth management and residential lending. It also operates the online-only Ubank.

NAB’s FY19 Result

NAB reported that its net interest income increased by 1.1% to $13.6 billion, but its net operating income (which includes other income and some of the customer remediation) fell by 4.2% to $17.2 billion.

Net interest was able to grow reflecting growth in business lending, partly offset by lower margins. The net interest margin (NIM) fell 0.07% (seven basis points) to 1.78%, home lending competition was an important driver of the NIM reduction.

Cash earnings dropped 10.6% to $5.1 billion, although excluding large notable items like customer remediation cash earnings actually rose by 0.8%.

Statutory net profit fell by 13.6% to $4.8 billion, which includes a net loss after tax of discontinued operations.

NAB Balance Sheet And Loan Arrears

In FY19 NAB’s CET1 ratio increased to 10.38% at 30 September 2019 which is an improvement of 0.18% from FY19. NAB will need to reach 10.5% to be “unquestionably strong” according to APRA’s measures.

NAB saw its credit impairment charge rise by 18% to $919 million and as a percentage of gross loans & acceptances increased 0.02% to 0.15%.

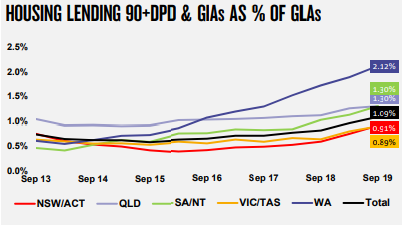

The NAB housing lending in arrears of more than 90 days saw a sizeable increase during FY19, which can be seen on the graph below.

NAB Dividend

The NAB Board decided to cut the final dividend by 16% to $0.83 per share, bringing the full year dividend to $1.66 per share which was also a decrease of 16%.

However, NAB managed to reduce its dividend payout ratio to 91.1% from 94.1% in the previous year. Excluding large notable items the payout ratio was lowered to 70.9% from 82.6%.

Outlook

NAB expects Australian economic growth to be below trend in 2020 and 2021 whilst New Zealand growth has also slowed to a “modest level”.

Weak consumption growth and a decline in dwelling investment are two key drivers, but a rise in exports and strength of public spending could help according to NAB.

The bank said Australian unemployment is forecast to rise slightly and fiscal policy changes & easing of monetary policy is only expected to provide modest support.

[ls_content_block id=”14946″ para=”paragraphs”]

[ls_content_block id=”18380″ para=”paragraphs”]