Today, the Reserve Bank of Australia (RBA) meets for the first Tuesday in October and will decide the next step for Australia’s interest rates.

Now, some pundits think dividend shares like Telstra (ASX: TLS) and Commonwealth Bank (ASX: CBA) are a good option for income. However as I explain below, it’s not an ‘all in’ decision…

RBA Interest Rate Chart

What The “Experts” Are Saying

According to Fairfax reporting, the major bank chief economists expect the RBA to lower the official interest rate on short term bank lending to 0.75% — meaning a cut of 0.25% is expected.

Keep in mind this is the interest rate that the banks themselves use to lend money to each other overnight. The rate that you and I pay on a mortgage is higher, and the rate on our savings account should be slightly higher as well.

Why Cut Interest Rates?

Right now, Australian house prices are under a little pressure. Keep in mind, it’s perfectly normal — and healthy — for house prices to have down years.

Another thing, many Aussies aren’t getting significant wage increases (aka wages growth), and the underemployment figure (i.e. people working in less fulfilling jobs) are concerning trends impacting our economy.

Combine that with decades of lacklustre government investment in areas like technology infrastructure and throw in industry over-regulation, both of which put a firm handbrake on growth and stymie innovation, and you have a country which is struggling to grow.

If you need evidence of this compare inflation (1.6%) to interest rates (1%). Inflation should be between 2% and 3% but our economy is simply not able to kick-start itself back to meaningful growth. It will one day, of course. But it hasn’t happened yet.

By lowering interest rates, the RBA would be attempting to help the economy along. Economic theory says offering super-cheap debt to households and businesses means they’ll be more likely to invest in things that spur growth. I agree. That works.

For a little while…

Unfortunately, anyone who has used debt to invest will know that interest rates are only one consideration in a good investment decision.

The most important thing for everyone to consider is can this cheap money be invested in meaningful projects, businesses and services to provide benefits for our country for many years?

If all we do is use debt to bloat family budgets and buy bigger houses we’re heading down a path that’s very difficult to come back from.

Low Rates V. Dividend Shares

This morning I woke up to a note that it’s time to buy ASX dividend shares in light of what the RBA might do today.

Australian shares can be one of the best ways to invest money for long-run growth while also receiving some return along the way in the form of dividends.

Over the past 30 years, as interest rates have collapsed from 15% to 1%, Australian shareholders in companies like Telstra, Commonwealth Bank and Westpac (ASX: WBC) have reaped the rewards of generous fully franked dividends.

In the following Rask Finance video I explain franking credits:

Is It Time To Buy Shares Like Telstra?

Right now, Telstra shares trade at a trailing dividend yield of around 3.7% fully franked. If you are eligible for the franking credits that’s a dividend yield pushing 5%.

Compare 5% to interest rates on a bank account and you can see why so many Aussies are shoveling cash into dividend-paying ASX shares.

For example, if you’re a retiree sitting on $200,000 or $500,000 of cash and you’re trying to live a decent lifestyle a bank interest rate of less than 2% isn’t much to go on. At 5% life is looking a lot better (2.5 times better, in fact).

Is It Worth The Risk?

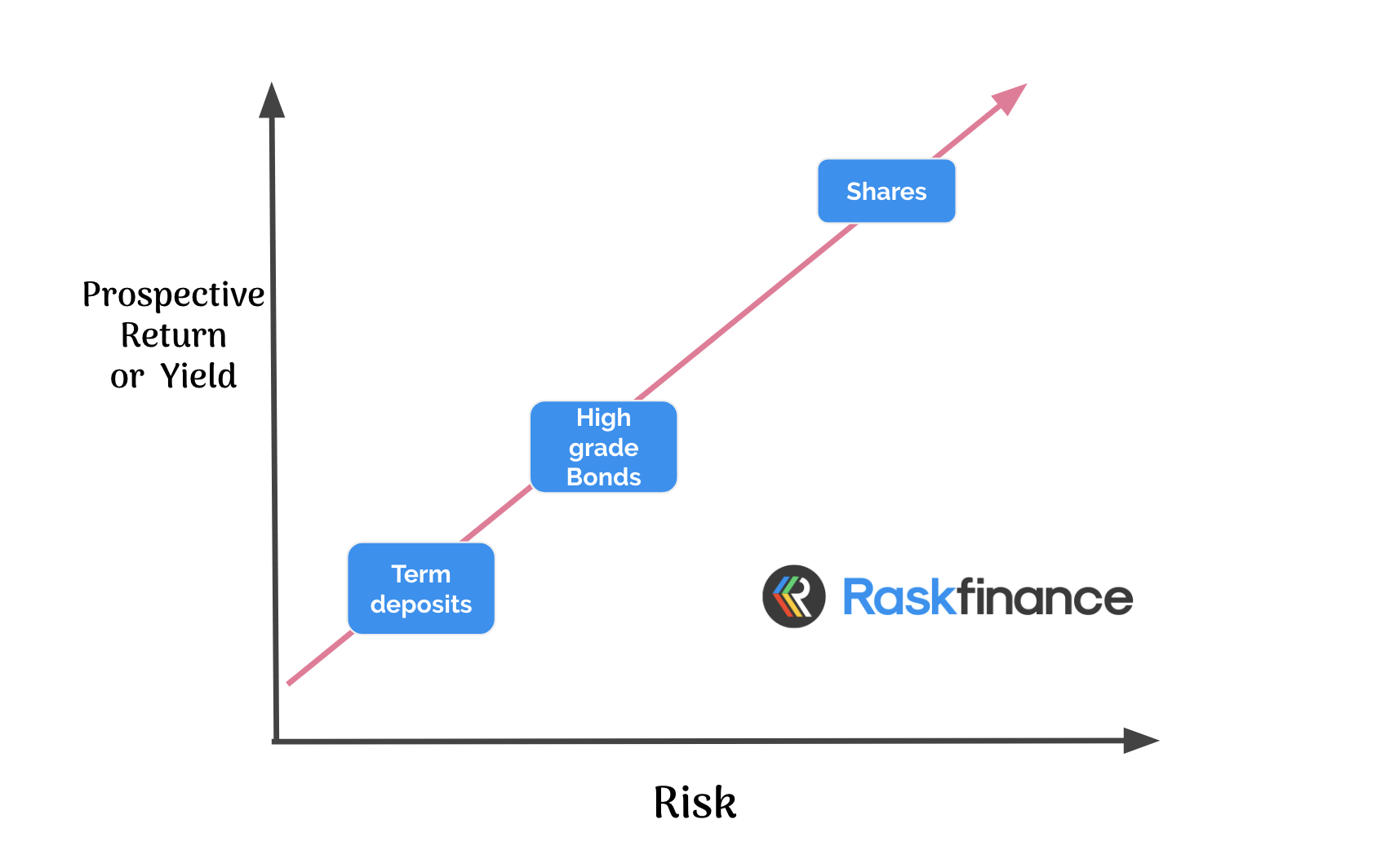

The crucial thing most share investors and investment advisers (like me) forget to mention is the risk of investing. There are lots of different types of risks in investing so the reality is that bank accounts/term deposits are not the same as shares. If you ask me, they are two completely different assets and should be treated as such in a portfolio.

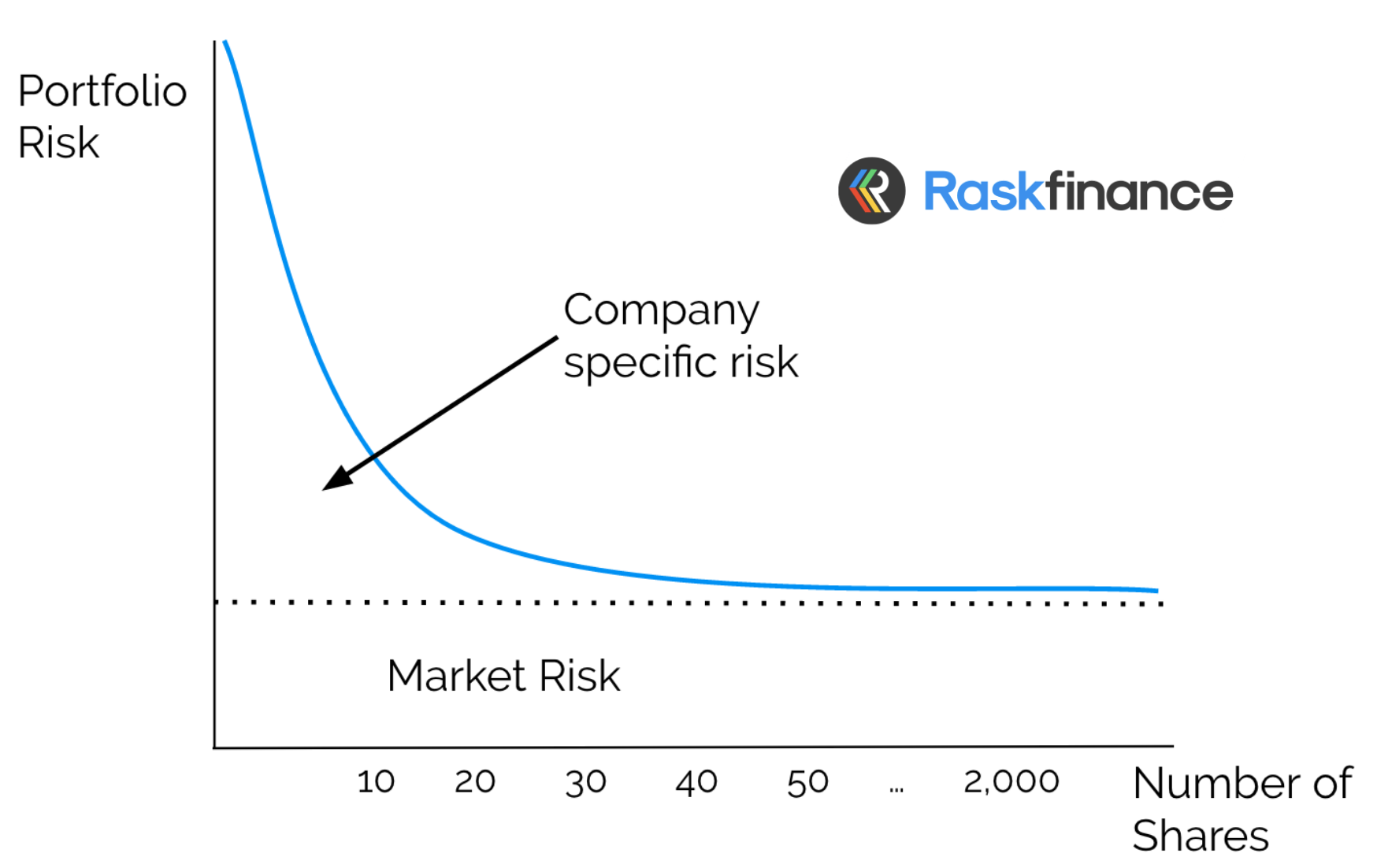

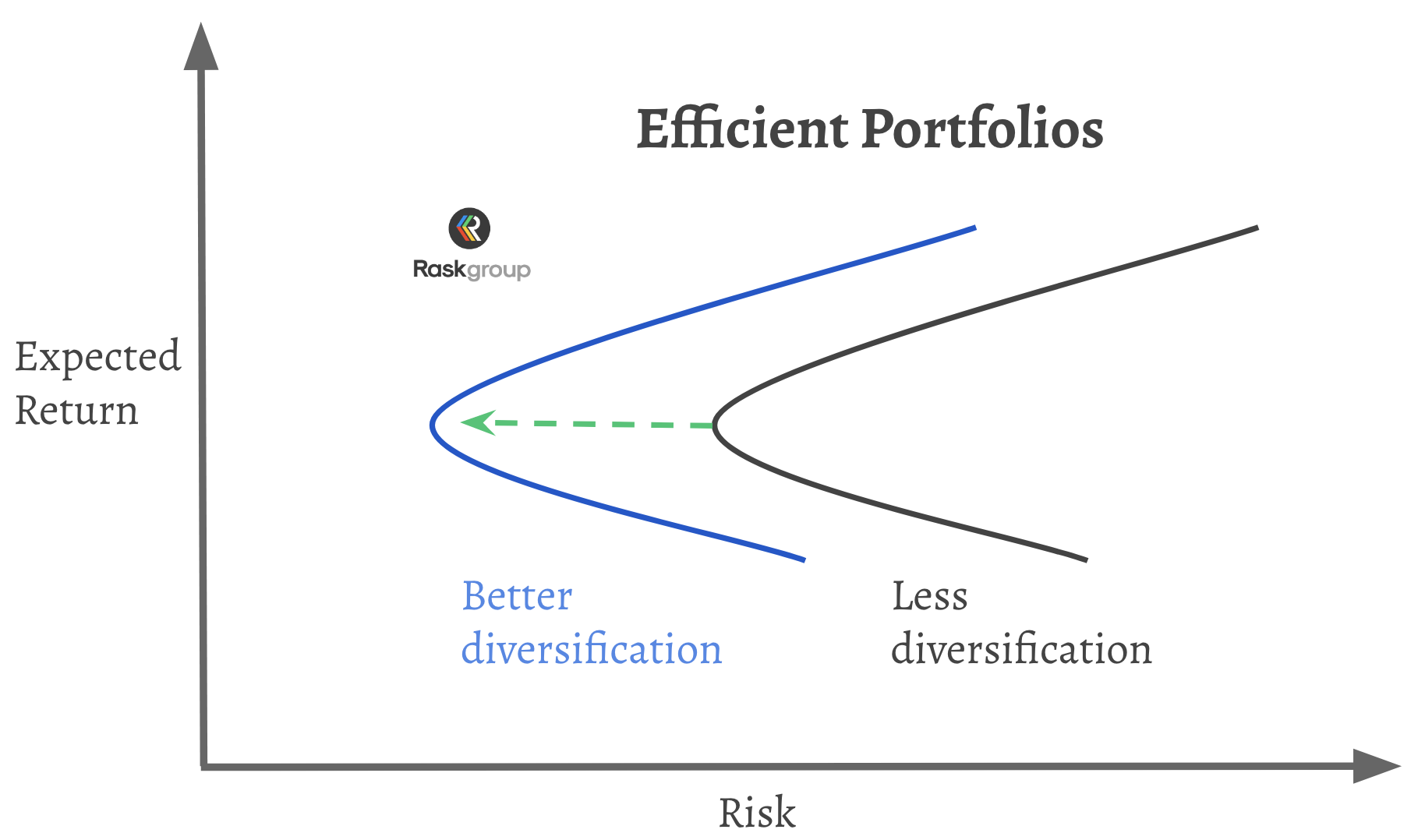

Fortunately, there are some simple tricks that we know (from peer-reviewed studies) can help us build a near goldilocks portfolio.

For example, we know that diversification can lower the risk of a stock portfolio while also allowing us to increase or maintain the potential return or income yield from it.

The chart above illustrates that if investors diversify their money across multiple shares, types of investments (bonds, property, local shares, global shares, cash, etc.) there are benefits.

In practice, that means if you’re considering investing in shares for income don’t buy only one (e.g. Telstra) or two stocks (e.g. Telstra and CBA). Buy quite a few different shares from different sectors (banking, technology, health, telecoms, property, etc.), markets and mix it up with overseas shares (Australia, USA, Europe).

Alternatively, you could do what I did and invest part of your cash into one or two diversified low-cost ETFs like BetaShares A200 (ASX: A200), Vanguard Australian Shares ETF (ASX: VAS) or similar products offered by iShares, SPDR and VanEck.

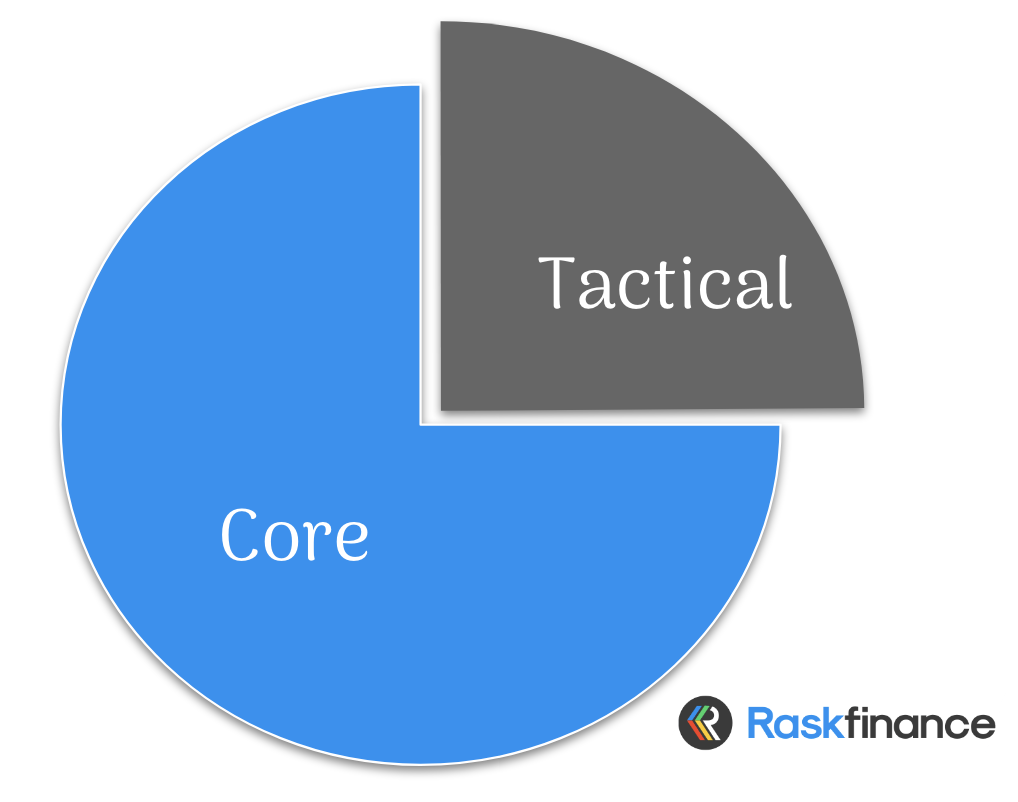

Finally, as you weigh your choices you can do what I think is smart and break your portfolio into risk/return ‘buckets’ called “core” (i.e. defensive positions) and “tactical” (riskier positions).

How much you put in each bucket depends on your risk profile, timeline to invest and needs.

In a nutshell, though, a core position might be an investment property, blue-chip stocks, low-cost index fund ASX ETFs, cash and bonds.

The tactical positions are further up the risk chart (see the first image) and could include higher risk dividend stocks, small-cap stocks, smart beta ETFs (ETFs that aren’t index funds) and some higher growth managed funds.

Buy, Hold Or Sell

No matter what you do you can’t escape all risk in investing. If anyone with a flashy suit and marketing document tries to convince you otherwise, run for the hills.

As you can see, this is a very simple way I think about the trade-off between taking a risk in an attempt to achieve a higher return with money that would normally be in cash.

The bottom line for me is if interest rates keep moving lower, Australians will feel more and more compelled to shift away from defensive assets and cash. Given interest rates are likely to stay lower for longer, at Rask Invest we believe everyone should have some exposure to growth/high-income investments with a view to the long run (5+ years minimum).

However, it’s always important to consider the risks first. Meaning, never let one interest rate decision from the RBA dictate your entire investment strategy. Have a plan and make sure you’re happy with it because you’ll need to stick to it through thick and thin.

If, like me, you have a tactical sleeve, use that to stay in control of the amount of risk you take over time. And if, like me, you are investing in shares, don’t simply buy shares of the companies that went well yesterday. There’s a reason we have a past performance disclaimer.

Try to find ASX shares/companies that have excellent management, long growth runways and profitable business models. That’s what we do at Rask Invest because we believe those are the types of companies that will, one day, pay the best dividends.

Finally, marry those positions with high-yielding ETFs as we do for Rask Invest and you’ve got yourself a simple plan for the future. No matter what the RBA does today!

[ls_content_block id=”19823″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen owns units/shares of the BetaShares A200 ETF.