I’m often asked, “is now a good time to invest?” or, “I think I’ll wait for the next crash to buy in, what do you think?”

My response to these types of questions is almost always the same: right now is the best time to invest.

“Of course you would say that,” you’re saying to yourself. “Asking an investment adviser when to invest in shares is like asking a barber if you need a haircut.”

It’s true.

I’m biased.

Very biased.

But, I always eat my own cooking…

Listen Now — How To Invest In Australia (Beginner Version):

Why I Bought ASX Shares Yesterday

Just yesterday I bought shares in Rask Invest’s #1 small cap ASX share idea. It’s a fast-growth ASX technology business that’s hidden from view because it is…

- Worth less than $250 million in market capitalisation — it’s too small to show up on most analyst stock filters

- It doesn’t look like a tech stock because it’s often categorised by brokerage accounts as an ugly servicing company — not the sticky software business it has recently become

- It’s run by an entrepreneurial owner-operator with heaps of skin in the game, and

- It’s primed for long-term growth… especially as investors wake up to its true potential

That sounds pretty convincing, right? Who wouldn’t want to invest in 10-30 companies just like that!

The Forest & The Trees

If you notice, when I talked about the investment I made yesterday I didn’t mention:

- ‘The market’ and where it’s headed

- Interest rates or where they’re headed

- Iron ore

- House prices

- The economy

- Politics, or

- Volatility

I didn’t mention any of those things because they’re not nearly as important as the business itself. I didn’t buy shares in ‘the market’ — I bought shares of a business.

Remember: investments in shares are investments in businesses.

Shares Are Risky

Shares are risky. That’s what conventional wisdom (and the facts) tells us is true.

I get that.

However, there’s one important distinction you must make today because it could change the way you see investing for the rest of your life.

What I’ve learned to be true is that investing is riskiest when it’s done for a short-term gain.

We’ve all heard the stories.

Inverting that logic, what it also means is that the longer you invest (sensibly) the less risky your investments should become.

Stay with me…

For example, if you narrow your focus to one day, month or even one year there are so many risks to investing in shares. Like most advisers who are being honest with you, I agree that no-one knows where share prices will go in the short-term.

That’s why I like to think about investing in businesses/shares over a 3+ year timeframe minimum. Ideally, I use a 10-year investment horizon.

Why 10 years?

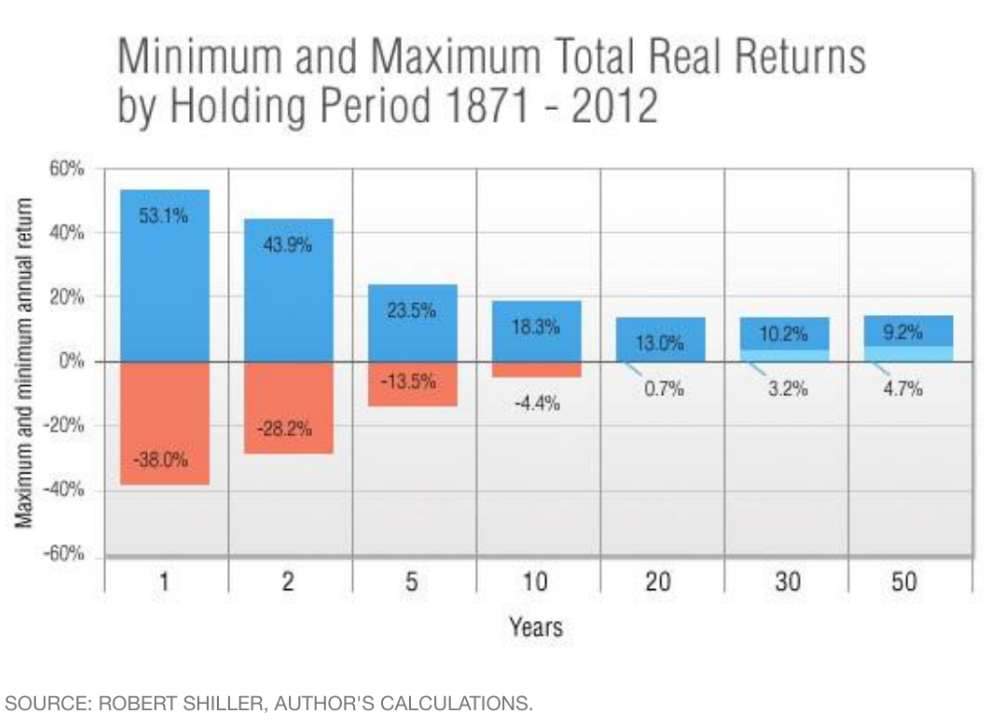

Studies like those by Professor Robert Shiller tell us that if stock investors hold their positions for more than 10 years, the chance of experiencing a negative return could be substantially reduced.

For example, over the worst 10-year holding period between 1871 and 2012 broad market US stock investors would have suffered a maximum loss of 4.4% per year according to Shiller’s numbers. However, the best 10-year return over that period was 18.3% per year.

Zooming out further still, if we use rolling 20-year holding periods the maximum return was an average of 13% per year but the worst return was positive 0.7% per year. In simple terms, the worst 20-year return was still positive!

Closer to home, the Vanguard Australia website provides a handy chart going back until January 1970 which shows that the average yearly return for Aussie shares since then until August 2019 was 9.8% per year.

Bill & Jill Versus Simon & Simone

Let me break it down to make this concept simple…

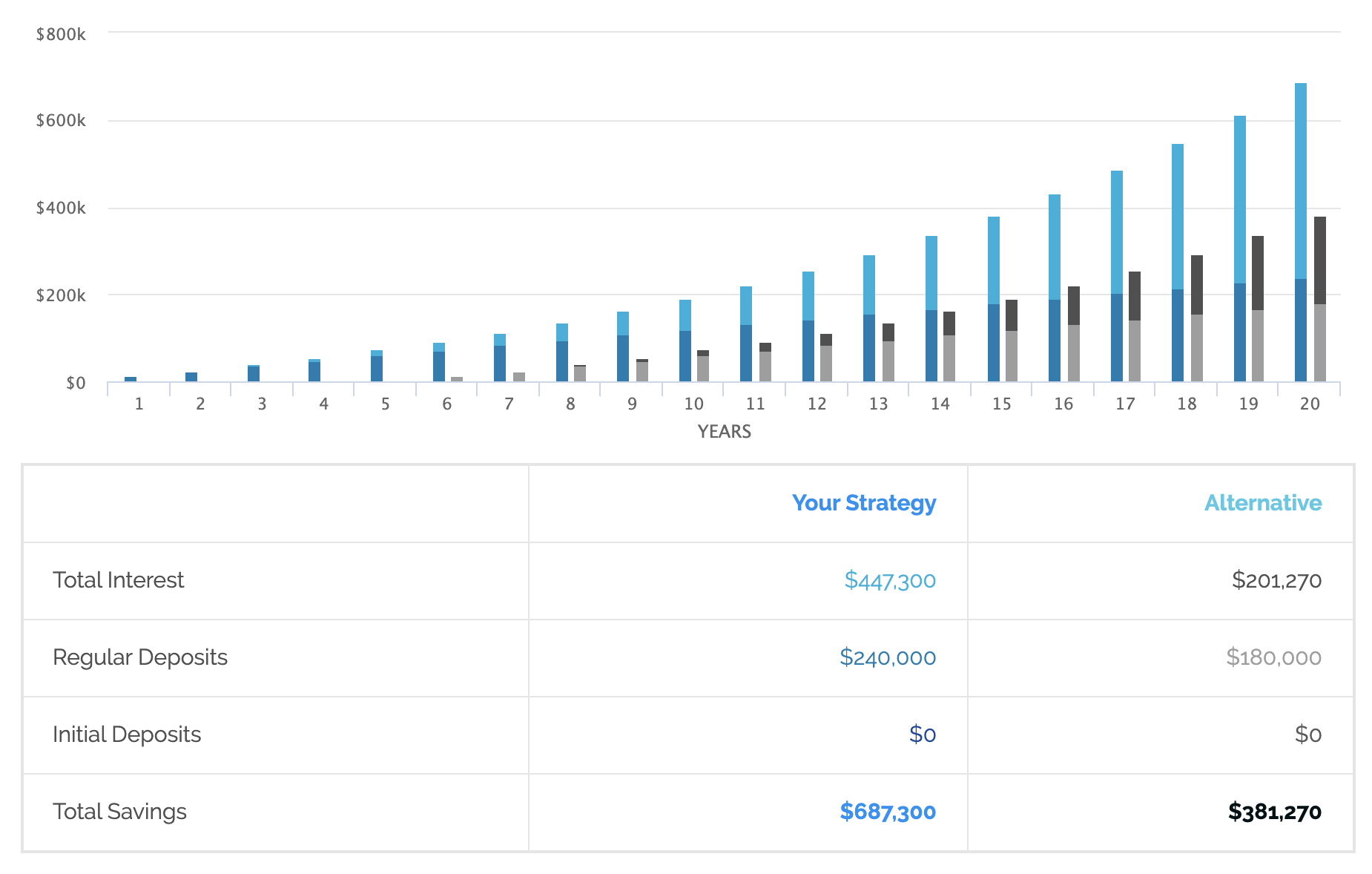

Let’s say we have a couple of great savers/investors, Bill & Jill, who decide today that they can save $1,000 per month to invest. Another couple, Simon & Simone, wait five years then do the same thing.

Note: you can use the Rask Finance tax calculator to estimate your weekly and monthly take-home pay.

For round figures (which exclude fees and taxes) let’s say both couples can compound their investment portfolio at 10% per year and reinvest what they make. That’s above the historical return of shares according to Vanguard but you get the idea…

According to Rask Finance’s compound interest calculator, here’s what the couples will have after 20 years (note: “your strategy” represents Jill & Bill):

You can try the compound interest/investment calculator for yourself.

What the chart above shows us is that Bill & Jill, the couple who start today, have $306,030 more than Simon & Simone, who wait five years. $60,000 of the difference is explained by the extra savings Bill & Jill make compared to Simon & Simone.

But here’s the real kicker: the other ~$240,000 is based solely on the fact that Bill & Jill started five years sooner.

They did nothing different.

But they started sooner.

To be clear: I don’t know if you need a haircut (ask your barber), but I do know one thing for sure — one of the worst things most Aussies do with their money is simply failing to start investing.

Of course, my usual caveats apply and you must be a genuine long-term investor for compounding to work its magic.

You also need to prepare yourself for some shocking years of investing because as I’ve said many times over, stockmarkets have corrected (a 10% fall) on average once every year.

What’s more, I’d never go ‘all-in’ on one stock, ETF or even at one point in time. Meaning, if I had $3,000, $100,000 or $5 million to invest right now I’d probably invest it gradually but consistently over time.

This is called a dollar-cost averaging strategy and I believe it to be one of the best ways to save money and invest it.

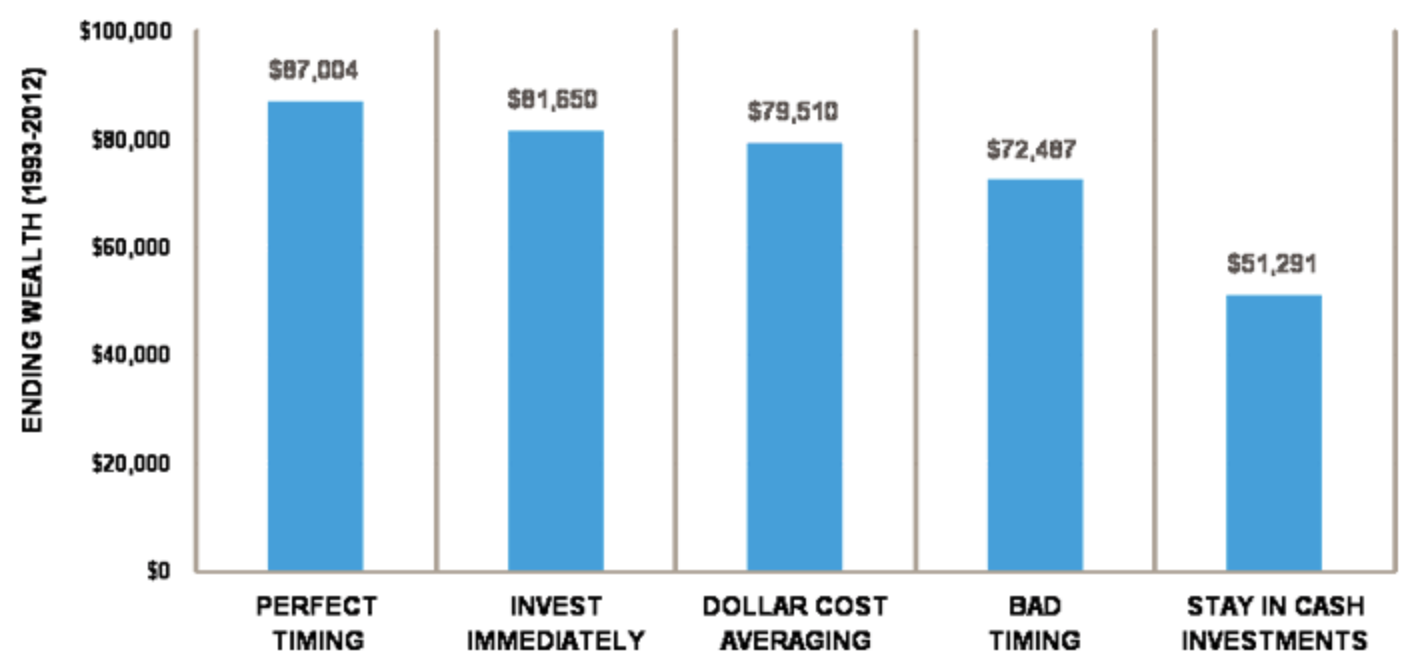

The chart above shows that $2,000 invested in the US stock market (S&P 500) with perfect timing every year (i.e. you get $2k on January 1st and invest it perfectly at the market bottom that year) would have grown to around $87k in the 20 years to 2012.

And if you simply invested rain, hail or shine (i.e. on the first day you had the cash available) you would have had more than $81k. And if you used dollar-cost averaging to set aside a percentage of your wage (e.g. 10% or 20%) and invested it evenly you would have had $79,510.

ETFs, Shares, Super? Just Start!

I’ll finish this update by saying that it doesn’t matter if you buy property, invest in Super, use ETFs — such as those we’ve identified for the Rask Invest ETF strategy — or if you buy individual shares as I do for Rask Invest Complete, the most important thing is to just start investing for the long run.

Whether you’ve got five years or 50, I reckon your future self will thank you for it.

Here’s to preparing for the worst, but expecting the best!

Owen Raszkiewicz

Founder, The Rask Group

P.S. Imagine if you could — and I believe some people can — compound your investment portfolio at 15% for 20 years. Jill & Bill would have $1.2 million using the same numbers above.

P.P.S. As of 2018, Warren Buffett’s Berkshire Hathaway had compounded at 20.5% since 1965!

[ls_content_block id=”14946″ para=”paragraphs”]

Stock disclosure & disclaimer: At the time of publishing, Owen does not have a financial interest in any of the companies mentioned. Past performance is not indicative of future performance. Returns cited are hypothetical and do not include the effect of fees, taxes or inflation — which are real things. The Rask Group Pty Ltd nor the author guarantees an investment return. Investing is risky!