What’s the best growth stock in Australian history?

I don’t know for sure but I think CSL Limited (ASX: CSL) is Australia’s leading blue-chip growth stock story.

Yesterday, CSL reported its results showing a profit of $US1.92 billion — up $190 million or 11% from last year.

Founded in the late 1900s as the Commonwealth Serum Laboratories, CSL was sold by the Australian Government to Australian investors via the share market in 1994 at $2.30 per share, at which time it doubled its size through an international acquisition.

CSL also split its shares 1-for-3. Meaning the first investors’ true price was just $0.77 each but we’ll exclude that from the following calculations (see my postscript below)…

Nowadays, CSL is a global leader in blood plasma vaccines (think: man flu) and antivenins (think: tiger snake). Its products provide relief for potentially life-threatening medical conditions the world over.

How $10k Becomes $1 Million…

Imagine buying (and holding) CSL shares from their very first offering in 1994 to today…

With the CSL share price striking $234 Wednesday afternoon, you would have made a 100x return on your investment. Meaning, a $10,000 investment would be worth $1 million!

Not only that, for every $2.30 share you purchased you would have received more than $20 in dividends. In other words, another 9x return just in dividends!

I think it’s reasonable to say that CSL is one of those life-changing stocks.

But it’s certainly not the only one on the ASX. Take a look at the financial fortress that is Commonwealth Bank (ASX: CBA). In the past year, it has paid more than 50% of its IPO price just in yearly dividends.

And even smaller companies like TPG Telecom Ltd (ASX: TPM) are up thousands of per cent since the early 2000s. Better still, you could have bought TPG shares for just 10c during the GFC of 2008. Nowadays they are changing hands around $6.70.

Pro Medicus Ltd (ASX: PME), a company we recommended to Rask Invest members last year, is up from 20c in January 2012 to over $25 today. That’s 100x plus return before we count the dividends it’s paid.

How To Spot A Multi-Bagger In The Wild

These are the companies dreams are made of and I’m here to tell you they may not be as rare as you think.

Sure, they might seem like they’re one in a million but there are a few common traits to them that I believe can tilt the odds of success in favour of long-term investors.

- You have to be investing in ASX or global stocks — obviously

- You have to be investing new amounts of money regularly — you’re not going to get every stock pick right but you have to be a buy-to-hold kind of investor and think of investing as ‘accumulating’ not trading

- You have to buy great companies — that is, those which can compound their shareholder capital at extremely high rates of return (ROIC)

- Related to that, you must find companies that scale well — that is, companies which make more profit for every dollar they reinvest and earn, and

- Focus on family or founder run companies

I believe that if every investor simply focused on finding a collection (maybe 30) of the highest quality companies with the view to owning them for decades — not days — the average returns will take care of themselves.

For example, my worst mistake (so far) for Rask Invest is selling half of our Pro Medicus holding at around $13.60. Sure I felt like a genius locking in an 80% gain in less than one year. But then it rallied to its current price over $25!

Fortunately, we’ve got a few more long-term ideas in the Rask Invest model portfolio right now. For example, my two favourite ASX small caps still have a firm Buy rating. But enough of that, back to CSL…

What Happens Next For CSL?

Everyone knows that, like trees, stock prices don’t grow to the sky — eventually gravity kicks in and their growth slows.

Therefore, I don’t think it’s very bold of me to say that I believe CSL’s growth will slow in the coming years.

Yes, it’s still a great business. And, yes, I’d keep owning its shares if I already held some.

But if you ask me, there are two basic stages in the lifecycle of most great companies:

- The operating leverage phase — this is when growth is most raw and explosive. This is when companies can add millions or even billions of dollars of value very quickly.

- The financial leverage phase — this is when CEOs try to ‘engineer’ returns for stock market investors by squeezing the business by adding financial leverage or debt.

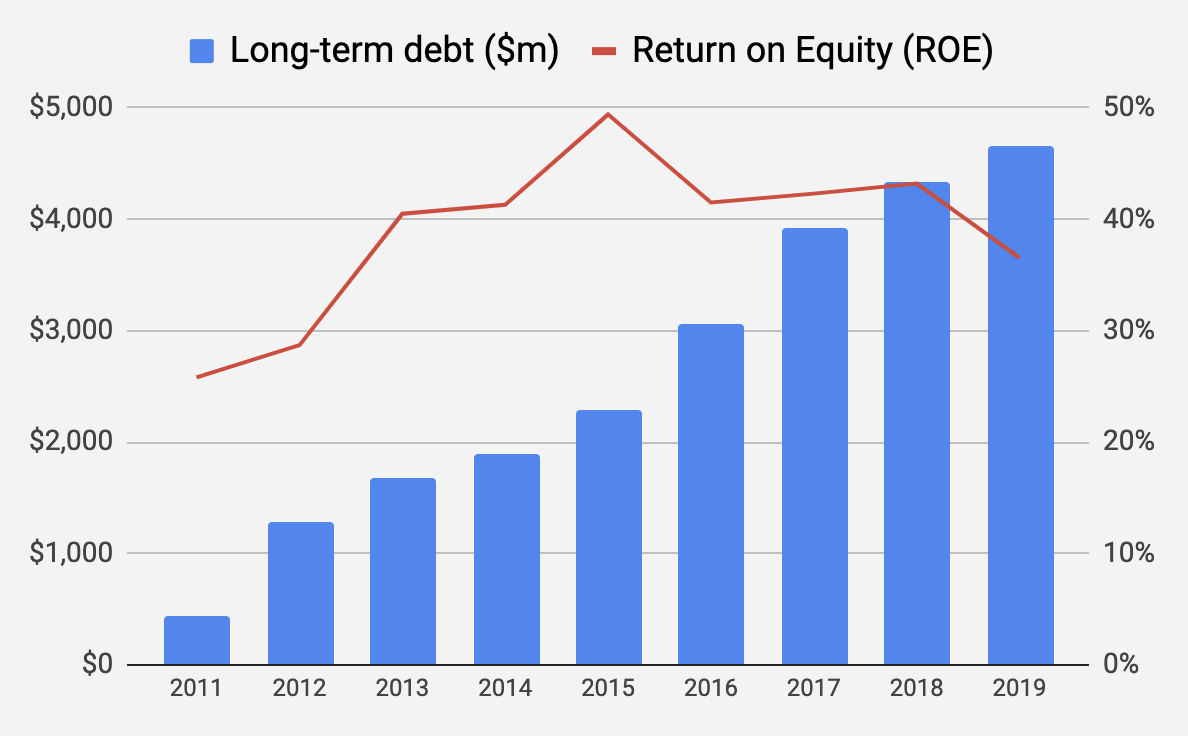

I think CSL has been in Phase 2 for quite a few years, as you can see from the following chart:

What the chart above shows is a dramatic rise in CSL’s total debt.

It’s a potentially concerning trend that global stock analysts like myself have been seeing more in recent years. Indeed, thanks to super low-interest rates, CEOs of big corporates seem more than happy to inject debt and fuel their business.

While a business like CSL can handle lots of debt, thanks to its defensive revenue, the questions for shareholders to consider is how much debt can it handle and what does it mean for returns in the long run?

For us at Rask Invest there’s not one company in our model portfolio that is in a net debt position. We have companies with debt, of course, but all of them have more cash than debt.

Why?

Firstly, we think debt adds unnecessary risk.

Secondly, we spend our days trying to find companies which are extremely well run and in the earliest stages of growth (i.e. “Phase 1” above).

In my opinion, these are the stocks that can change lives.

***

Buying the greatest companies you can find and holding them for as long as possible sounds simple enough, but one thing’s for sure — it’s not easy.

But just imagine if you buy 30 stocks and even one of them achieves just half of what CSL has for its investors…

Here’s to hunting for multi-baggers!

Owen Raszkiewicz

P.S. did you know dogs can’t look up?

P.P.S. What I failed to mention above was that those original CSL investors would actually be sitting on a nest egg far larger than $1 million if they invested $10k. As some Rask Investor Club readers noted, CSL split its shares 1-for-3. Meaning, for every one share purchased at $2.30 the true price of each share after the split was closer to just $0.77 a pop.

Therefore, using yesterday’s closing price of $234 and based on my numbers, CSL shares have returned a capital gain over 300 times and dividends equivalent to more than 26 times the original price of the shares. You wouldn’t have needed to bet the house on CSL shares back then — even $1,000 would do — to be living an extremely comfortable lifestyle today. I’m sure you can do the math, multiplying $1,000 by 300 would make a big difference to most investors’ lives.