The Afterpay Touch Group Ltd (ASX: APT) share price is up 4% in early trade this morning on the back of no news out of the company.

With the AfterYAY 2-day sale in full swing, let’s take a look at two reasons to buy this popular tech stock.

1. US & UK Expansion

Following Afterpay’s local success, the company launched in the much larger US market in May last year. After 13 months of operations in the US, Afterpay acquired over 1.5 million customers who are able to shop with over 3,300 merchants. Since the end of May this year, an additional 3,000 US merchants have integrated, or are in the process of integrating, with the Afterpay platform.

Afterpay has also most recently launched into the UK, albeit under a different name, ClearPay. The UK e-commerce market is the third-largest in the world after China and the US. The addressable retail market opportunity is huge, with online sales representing A$130 billion of a A$720 billion retail market according to the UK House of Commons. By comparison, the total Australian retail market is A$320 billion, with online accounting for roughly A$30 billion.

Once taking into account the A$5 trillion retail market in the US, as reported by the National Retail Federation, Afterpay’s addressable opportunity is significant.

2. Generational & Demographic Shifts

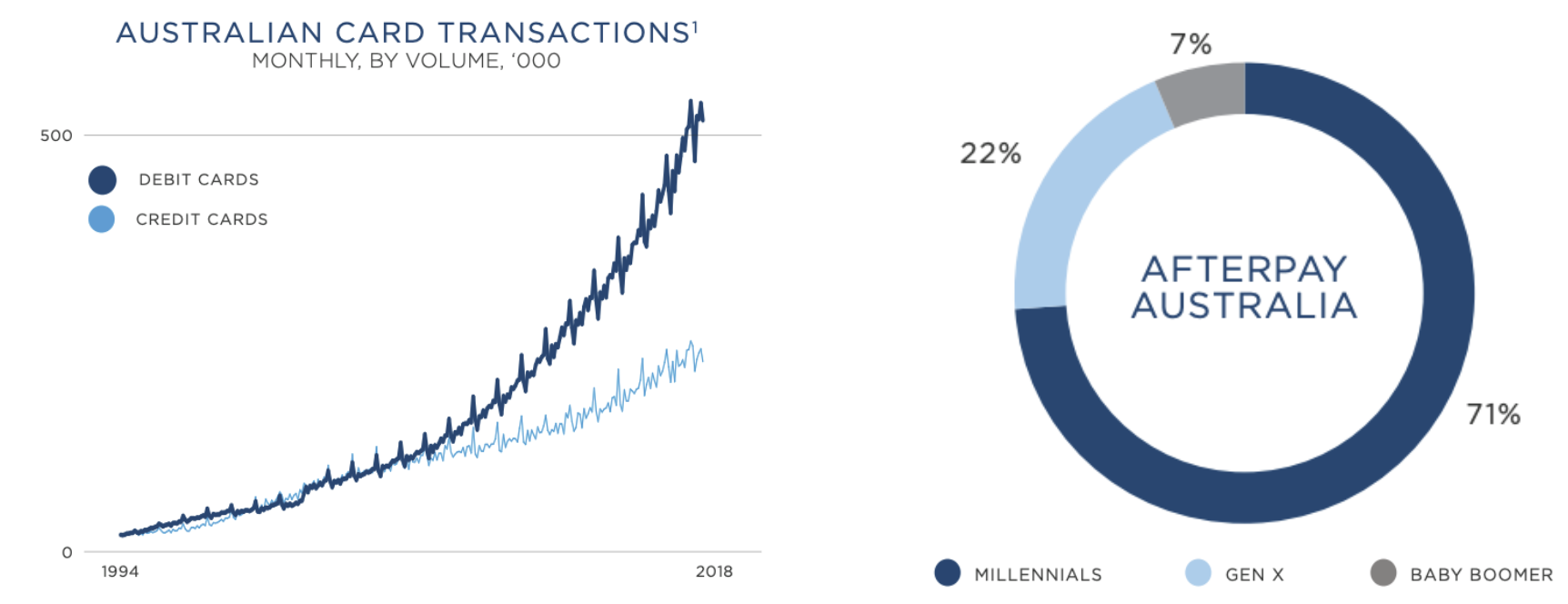

Afterpay is a compelling growth story that has capitalised on a generational shift away from traditional credit products, as well as a demographic shift towards the millennial consumer.

According to research conducted by Macquarie Bank, millennials will earn 2 out of every 3 dollars in Australia by 2030. It just so happens that ~70% of Afterpay’s customers are millennials.

Source: Afterpay Results Presentation H1 FY19

Afterpay has become a lifestyle in its viral growth phase, with its brand name even being used as a verb. The term “just Afterpay it” is constantly thrown around, much like how we “Uber” somewhere or “Photoshop” something.

[ls_content_block id=”14947″ para=”paragraphs”]

At the time of writing, Cathryn owns shares of Afterpay.