National Australia Bank Ltd (ASX: NAB) shareholders have had a tumultuous past 18 months but with the fallout from the Royal Commission now largely in the rearview mirror is it now time to bag a bargain?

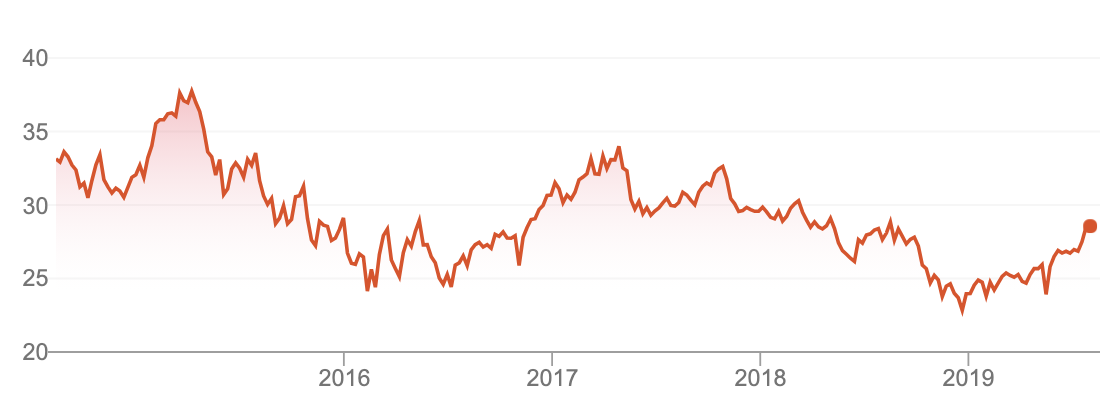

NAB Share Price

What Happened?

In December of last year, speculation was rife as to just how damming the final report of the Royal Commission into banking may be and NAB shares were sold down aggressively, reaching a low of $22.52. The findings were indeed damming and led to then-CEO Andrew Thorburn and Chairman Ken Henry stepping aside.

New Beginnings

With the skeletons finally out of the closet so to speak, NAB could begin the arduous task of regaining the trust of the Australian public. In July of this year, NAB announced the appointment of there new CEO Ross McEwan who will officially take the helm in April of 2020. McEwan was formerly the head of Commonwealth Bank Of Australia’s (ASX: CBA) retail bank and more recently he has been the CEO of The Royal Bank Of Scotland from 2013.

McEwan will have to call on his vast experience to help turnaround NAB’s core banking businesses. But this is something he is no stranger to having led the Royal Bank Of Scotland through very difficult times.

Perhaps his most difficult task will be in leading mass cultural change within the bank after years of unethical and morally questionable behaviour was fostered and allowed to permeate throughout the organisation. This was evidenced by the findings of the Royal Commission and the subsequent resignation of the former CEO and Chairman of the Board.

The market seems to have liked McEwan’s appointment with NAB shares now trading near their 12-month high and more than 23% above the lows of December last year.

Tempting Dividends

NAB’s 6.5% trailing dividend yield is a tempting proposition all by itself given the low-interest-rate environment that appears here to stay for the foreseeable future.

Earlier this week the New Zealand Central Bank joined the rate-cutting party in style, slashing their official cash rate by 0.5% despite relatively strong economic data. It appears highly likely that the RBA will cut again later this year bringing our official cash rate to below 1% for the first time in history. These really are unprecedented times.

Importantly, the NAB dividend now looks more sustainable after the cut to the interim dividend earlier this year.

Would I Buy Now?

I will be watching the progression of NAB shares very closely over the next year as they look to climb out of the rubble caused by the fallout from the Royal Commission. I remain wary of the possibility for further provisions and writedowns that are common when a new CEO takes over the reins and am not fully convinced there isn’t further pain to come in regard to past business conduct.

That being said, a short term pullback in the share price may be seen by many as an opportunity to get in before the turnaround story gathers steam.

[ls_content_block id=”14945″ para=”paragraphs”]

Disclosure: At the time of publishing, Luke has no financial interest in any companies mentioned.