Well, I guess it wasn’t that bad after all…

Yesterday, I wrote a column discussing why the Aussie share market was being swamped with negativity and why we here at Rask Invest don’t care for it.

And guess what?

With the market staging a modest recovery in early trading today it seems like our positivity was rewarded.

Indeed, if you gritted your teeth and kept your investing chips on the table, chances are you would be better off today than the investor who sold their shares in a panic.

Some things just don’t change…

Better Value Than Before

Not only is it likely that your ASX or international share brokerage account be a little greener today than yesterday — you may be able to take advantage of better valuations.

Note that I said “valuations” and not “prices”.

Rask Invest members who have read our stock/share analysis (which often includes a separate section on valuation) will know there is a fundamental and important difference between price and value.

Here’s how the greatest investor, Warren Buffett, put it in an Annual Letter when he was talking about his investment in The Washington Post Company (WPC):

“Calculating the price/value ratio required no unusual insights. Most security analysts, media brokers, and media executives would have estimated WPC’s intrinsic business value at $400 to $500 million just as we did. And its $100 million stock market valuation was published daily for all to see.”

He continues…

“Through 1973 and 1974, WPC continued to do fine as a business, and intrinsic value grew. What we had thought ridiculously cheap a year earlier had become a good bit cheaper as the market, in its infinite wisdom, marked WPC stock down to well below 20 cents on the dollar of intrinsic value.”

As you can imagine it turned out to be another solid investment for ‘the Sage of Omaha’.

Please note: if you have a few hours to spare and want to learn more about valuation I encourage you to take one of our free valuation courses on Rask Finance. I’m biased but our “Value of Everything” course might just be the best in the country. And it’s free.

1 Stock Investing Valuation Shortcut

I should be clear and say that it’s rare to find shares in a great company — one that can grow its operations at 20%+ for a decade — trading ‘cheap’ when everything is going well.

More often than not you’ll find the best opportunities in stocks come when something uncertain is happening at the company or in the market or economy more broadly.

To make your efforts more rewarding, you should be looking for markets or sectors where irrational extrapolation is rife. This is something I learned from Jacob Mitchell at Antipodes Partners (he founded a global investment firm based in Sydney).

“Irrational extrapolation” might sound complicated but what it means is that you’ll have a better hit rate if you focus your attention on a company or industry that has a few ‘hairs on it’.

Take Flight Centre Travel Group

(ASX: FLT).

Flight Centre is Australia’s best travel agent business by a long shot. However, despite it being a household name, many investors have been saying for years that “online travel bookings are going to disrupt it” or “bricks and mortar retailing is dead”.

Moreover, expert stock analysts may have been extrapolating some irrational fears or beliefs about online and placing valuations on Flight Centre shares that may be unfounded.

The analysts are extrapolating or forecasting profit figures that are based on irrational beliefs about how the travel world actually works.

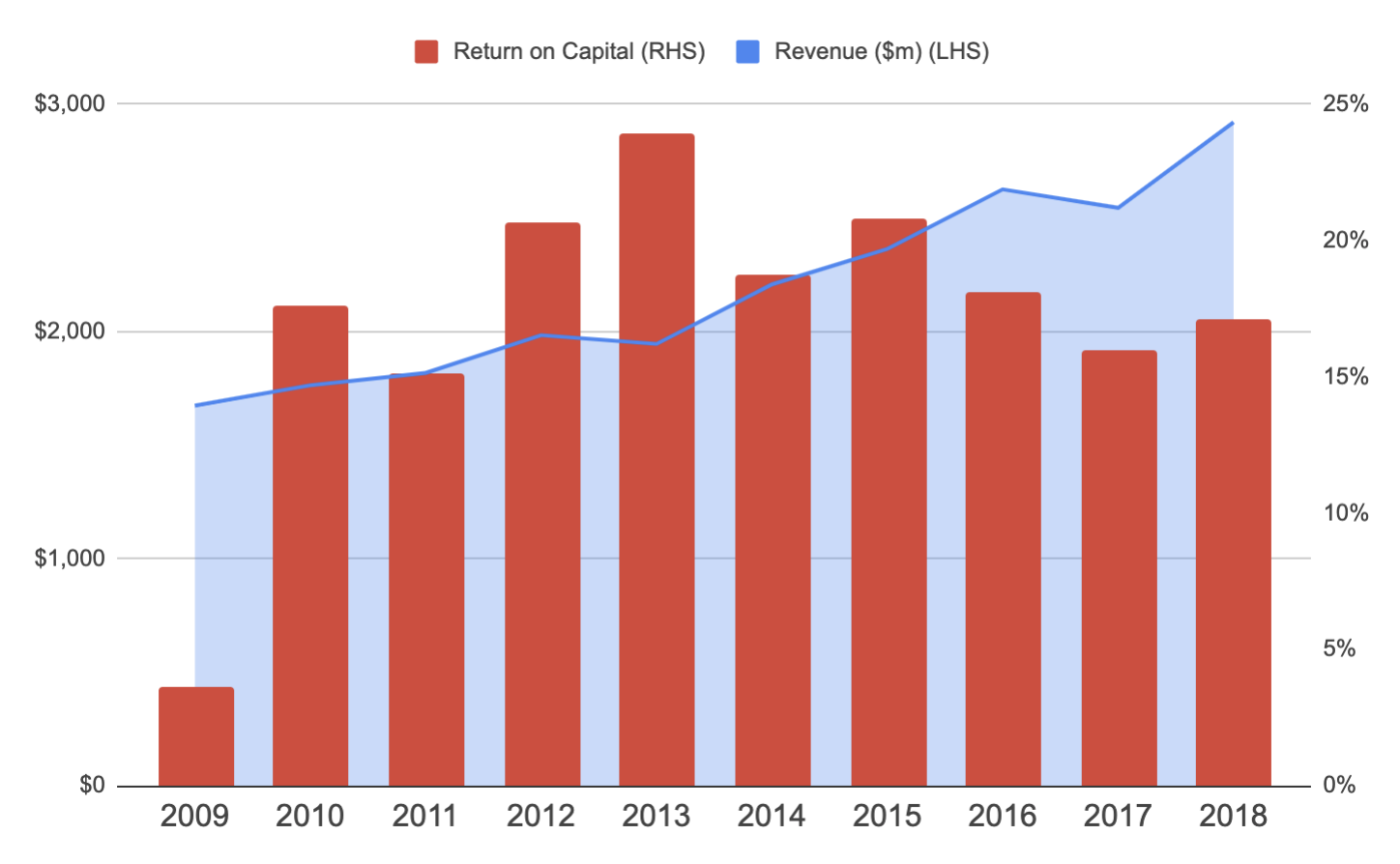

To be sure, bricks and mortar retailing is indeed a tough business and in decline, and I can’t tell you for sure what’s going to happen to Flight Centre next year or the year after. However, what I can tell you for certain is that Flight Centre’s business looks to have grown stronger with every passing year:

What Now?

As far as I’m concerned, valuation is an important tool for long-term investors to understand a business. It’s not the be-all-and-end-all but I think it’s important if you want to achieve the best returns.

But, how about for investors who don’t know all ‘that finance stuff’ and just want to invest for the long haul. Well, I’ve got some good news…

Firstly, forget about the “buy low, sell high” strategy you were taught as a child and try to rewire your brain to think “buy low, then buy again”. This technique will turn you away from being a market timer or strategy, will help you develop a consistent strategy that’s right for you and — most importantly — it could be extremely effective.

Don’t believe me?

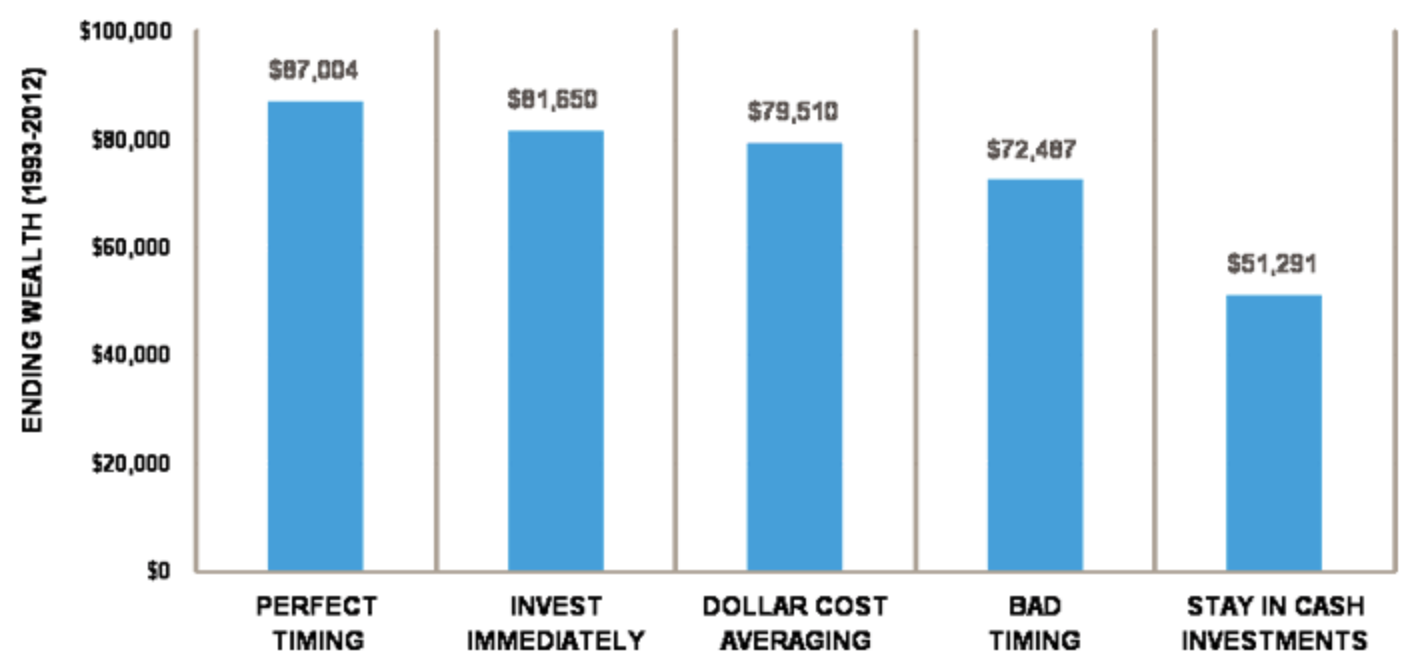

Stock market studies like those conducted by Schwab over the 20 years to 2012 show that even if you have the worst possible timing, your returns might not be that bad.

The chart above shows that $2,000 invested in the US stock market (S&P 500) with perfect timing every year (i.e. you get $2k on January 1st and invest it perfectly at the market bottom that year) would have grown to around $87k after 20 years.

If you had the worst possible timing (as I tend to have) and invested your $2,000 at the market peak every year you would still have grown your portfolio to $72k. Not bad, right?

However, if you simply invested rain, hail or shine (i.e. on the first day you had the cash available) you would have had more than $81k.

Another simple — but effective — approach that we advocate is dollar-cost averaging. Set aside a percentage of your wage (e.g. 10% or 20%), put a calendar reminder in your smartphone that tells you to invest — and just do it. That’s it.

***

So, what’s the takeaway from this story?

If you’re just as optimistic about the future and buying shares in great businesses (as we are) and have years to invest, consider investing now for the long run.

No-one can guarantee results or what tomorrow brings. The future could look totally different.

Nonetheless, I’m betting — via the Rask Invest model portfolio — that shares of impressive businesses will continue to be a good place to keep my extra capital for the long run.

That’s why today we’re sifting through the ASX and global markets to do our best to find and research new share ideas to add to our model portfolio.

Here’s to investing for decades!

Owen Raszkiewicz

P.S. if you want to know where and when I’m investing and get the names of our #1 buy ideas right now, click here to learn more about our Rask Invest research service. It could be the best investment you make in 2019.

[ls_content_block id=”14942″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen does not have a financial interest in any of the companies mentioned.