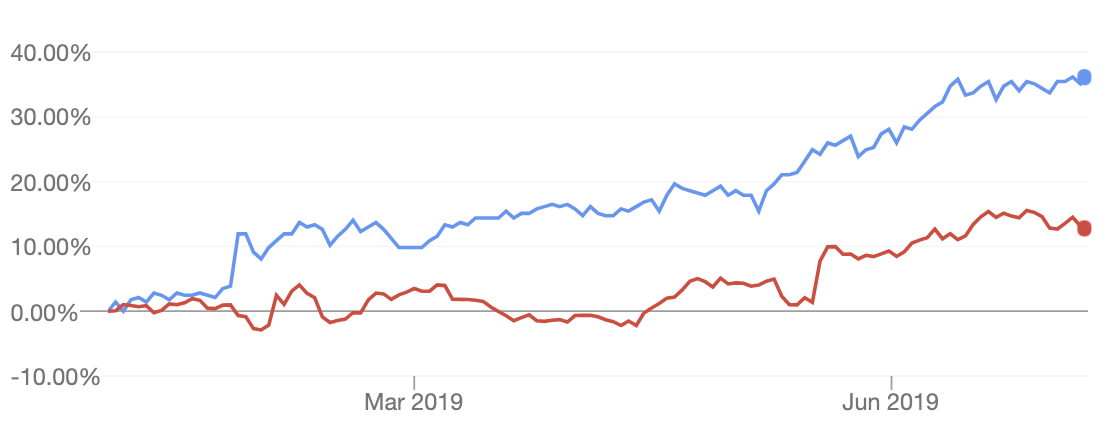

It might be hard to believe but the Telstra Corporation Ltd (ASX: TLS) share price has risen 36% in 2019, far outpacing fellow blue-chip favourites like Commonwealth Bank of Australia (ASX: CBA), up 13%.

Telstra Shares Rallying

The chart above compares shares of Telstra (BLUE LINE) and Commonwealth Bank (RED LINE) in 2019.

About Telstra Corporation

If you live in Australia and have a mobile phone you probably know what Telstra does but for those who don’t, it’s our country’s oldest telecommunications business, having built the first telegraph line in 1854.

Back in 1997 (until 2006), the Australian Government sold Telstra to investors by listing the shares on the ASX. The second batch of Government share sales, called “T2”, was conducted in 1999 at $7.40 per share. It’s now priced at less than $4. Ouch!

In 2019, Telstra provides more than 17 million retail mobile services, around 5 million retail fixed voice services (e.g. home phones) and 3.6 million broadband services. Telstra also has operations in eHealth, network applications and subsea cabling.

30% of Analysts Say Buy Telstra Shares

According to a survey of analyst ratings by The Wall Street Journal, 13 analysts recently issued research ratings or valuation targets for Telstra shares. Of them, four (30%) believe Telstra shares are a buy at their current price of around $3.88. Nearly half say the shares are a ‘hold’.

What I always find interesting about the analyst targets is the average price target or consensus valuation. Our video below explains how to do a share valuation (DCF) for yourself. I used Woolworths Group Ltd (ASX: WOW) as the case study:

Back to Telstra and the average price target or valuation provided by the analysts is $3.74. That compares to the current price of $3.88 and might suggest the current price does not offer “a margin of safety”. In other words, a rough rule of thumb for ‘value investors’ is that they’ll buy shares in a company when believe the shares are 30% undervalued. This is their ‘margin of safety’. If they get the valuation slightly wrong it’s okay — they have 30% leeway.

Why I Don’t Trust Analyst Price Targets

I want to be clear and say that almost always the short-term price targets provided by analysts are wrong. Almost always. Oftentimes unsuspecting or part-time investors are lulled in by the false sense of security provided by expert analyst valuations. You can take it from me, an investment analyst by trade, valuation is 95% art, 5% science.

I believe the skill of investing comes from knowing a company, having an opinion on the future value of the company’s services and holding on to see that vision become a reality. Successful investing is not predicting where the balance sheet will be in five or 10 years from today. Put another way, I’d rather be a better investor than a better analyst.

Don’t believe me when I say valuation is an art?

If you go to a bookstore or search on Amazon and Booktopia you’ll find thousands of books on investing in shares. Why would there be more than 1,000 books on investing and not just one?

Because there’s no one right answer to investing successfully. It’s like parenting, there’s no one book that covers it all.

Is Valuation Worthless?

Having bashed on valuation I should say that I always do some valuation modelling in my investment process.

I always make assumptions for a company’s growth and cash flow and try to put my finger on a reasonable range of prices to pay. More importantly, modelling helps me understand the economics or drivers of a business and how certain levers affect profit and cash flow (or dividends).

However, I don’t take it as gospel (pun intended). I’d rather be generally correct than specifically wrong.

What Now?

Coming full circle to Telstra, I believe its shares are not a bargain today. I’ve written before that the company would need to commit to cutting its huge debt pile before I get more enthused about owning its shares. While having debt works for the company now, I’m sceptical the company will be able to generate the same level of free cash flow as consumers and businesses demand more mobile data, faster internet speeds and the NBN continues to commoditise broadband.

I’d rather look to other proven ASX shares to buy and hold.

[ls_content_block id=”14945″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen does not have a financial interest in any of the companies mentioned.