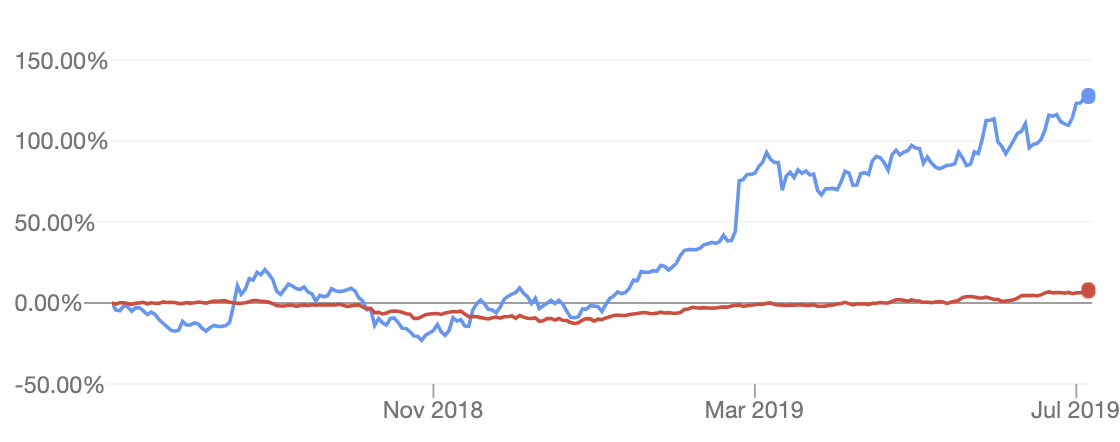

The Appen Ltd (ASX: APX) share price has kept rising, rising and rising to make it one of the ASX’s best performers over the past few years. The following chart compares Appen (blue line) to the broader ASX 200 (INDEXASX: XJO) (red line) over the past year.

Appen Share Price

About Appen

Appen provides data for machine learning and artificial intelligence development. In other words, it provides and improves data for the development of artificial intelligence and machine learning applications like search engines. With more than 20 years of experience and operating in over 130 countries, Appen has established itself as a leader in this space.

Artificial intelligence and machine learning are arguably two of the biggest investing and social trends for the next decade. I recently spoke to Magellan’s Hamish Douglass about the technology trends he’s most excited about:

3 Things To Know About Appen

1. Much of what Appen does is labour hire.

While it sounds sexier to say ‘Appen does artificial intelligence’ the reality is it’s more of a crowd-sourcing company which provides valuable services to machine learning development businesses. For example, if a technology company’s engineers decide they need to improve a search algorithm they’ll approach Appen to send a small research project to ‘field test’ the results of their work. Appen says it has over 1 million people in 130 countries. The field testers will complete the small job and send the results back to Appen which collates the results for the engineer (aka the customer).

I’m not saying it’s a bad thing that Appen fulfils this role in the AI and ML ecosystem, it’s merely an important distinction to make.

2. It has some customer concentration risk.

From my understanding, in 2017 Appen generated more than 80% of its revenue from its top customers, which likely include technology giants Facebook, Microsoft and Google. I believe this concentration risk has fallen in recent years, thanks in part to acquisitions, but I don’t know what the exact figure is.

To identify good long-term investments I try to find companies which take a commoditised input and output a unique product or service. In effect, this can mean the company you’re buying has control over its input prices and can sell into a market where it also has control of prices.

For example, a mining business typically has no control over the prices of its products (e.g. iron ore) because it sells into a free market. However, it’s often the case that a mission-critical software company is able to have some control over input prices (e.g. labour) and output a product well above its costs (subscription fees).

Coming back to Appen, it’s important to understand where the competitive strength lies no only with its customers but also as it navigates labour laws.

Fortunately, as it has grown to service more customers and acquired rivals, Appen’s service has become more valuable. That could allow it to ramp up prices and expand the bottom line faster over time.

3. Appen shares are as expensive as they’ve ever been.

Since 2017 Appen’s enterprise value (EV) to EBITDA (earnings before interest, taxes, depreciation and amortisation) has risen from 14x to a 47x. In other words, its valuation has stretched considerably.

Have Appen shares become three times more valuable? Maybe. Maybe not. The company has definitely gotten larger but whether it’s become more valuable per dollar of market capitalisation is up for debate.

What Now?

I feel I’ve come across a little cynical of Appen in this article but perhaps I’m a bit jaded for not having bought shares when they were less than $10.

Nevertheless, I’ll conclude by saying that no-one knows for sure what will happen to Appen shares next. Appen shares could keep shooting the lights out or they could be the first to flop at the next sign of market volatility.

Given that I think a fair price to pay for Appen shares is likely below today’s current price of ~$30, I’m happy to take the scenic route and watch this one from the sidelines.

[ls_content_block id=”14947″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen Raszkiewicz owns shares in Google/Alphabet and Facebook Inc.