The Afterpay Touch Group Ltd (ASX: APT) share price will remain frozen in a trading halt today as the company undertakes a capital raising and institutional share placement.

Let’s start with the basics…

About Afterpay

Afterpay Touch is the owner of the popular “buy now, pay later” app. As of 2019, Afterpay had over 4 million registered users worldwide, making it one of Australia’s true technology success stories. With operations in the USA and, more recently, the UK, Afterpay is quickly expanding its ‘addressable market’ of potential customers.

What Does Afterpay’s Trading Halt Mean?

In the video above, which comes from our Rask Finance website, I explain the basics of Trading Halts on the ASX.

Based on Afterpay’s statement to the ASX this morning, shareholders and investors will NOT be able to trade their Afterpay shares until June 13th 2019 or sooner, if it gets the institutional capital raising done before then.

What Is Afterpay’s Capital Raising All About?

In the video above I explain the ins-and-outs of Capital Raisings, just like Afterpay’s — and what you can expect to see in coming days.

***

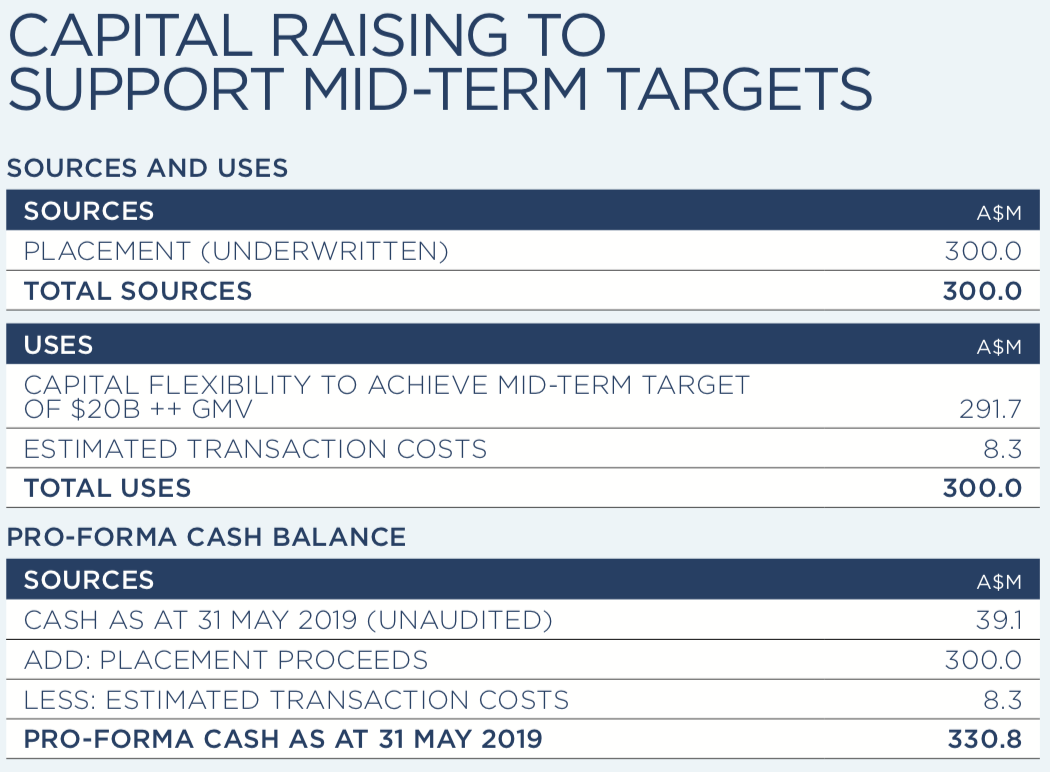

Afterpay will be selling more of its shares to large investors — worth around $300 million in total — at around $21.75 each. Afterpay says it needs this money to expand its short-term lending capability and achieve its mid-term target of allowing $20 billion of retail sales through its app and platform, per year, by the financial year 2022.

Remember, Afterpay uses money from either its bank loans or from cash it has tucked away to make these small quasi ‘loans’ available to shoppers in stores around Australia and abroad. Ultimately, the bigger Afterpay gets, the more cash it may need to fill the orders.

What Is Afterpay’s Share Purchase Plan (SPP)?

In addition to the $300 million of capital that Afterpay is raising from its large institutional investors, it is also offering what I might call a “token” share purchase plan or SPP for smaller investors.

The SPP will allow small investors to purchase up to $15,000 of new Afterpay shares. However, that figure is subject to Afterpay’s discretion (meaning it could well be less than that).

As a ‘small shareholder’ myself, an SPP is good but it’s not exactly fair for everyone.

I’ve never believed that just because you’re smaller than other investors you should be excluded from the same rights to buy shares in the company that you own.

Every shareholder should at least be given the right to “renounce” their rights by trading them away or selling them to other investors. That’s the fair way to raise capital, in my opinion. It’s called a pro-rata renounceable rights issue. It costs the company more but when they’re already spending $8.3 million (see above) it shouldn’t be that big of a deal.

Is Afterpay’s $21.75 Capital Raising A Bargain?

By far the most important question now is: “Is Afterpay’s capital raising worth it?”

This question is answered by asking yourself if you think Afterpay shares are worth around $21.75 or not? If you think they are worth, say, $30 per share then the $21.75 sounds too good to pass up. Conversely, if you think they are worth, say, $19 per share you wouldn’t be in a rush to ‘take up’ your rights under the Share Purchase Plan.

In previous articles, I showed how I’d value Afterpay shares and what expert analysts thought shares were worth. Personally, while some investors have a set ‘fair value’ price on Afterpay, I think it would be unwise to put too much emphasis on someone else’s valuation model with this decision.

I think the decision should come back to two things:

- Do you already have too much invested in Afterpay shares? Remember, diversification is not essential but it will help if Afterpay turns out to be a flop.

- Will Afterpay make it big in the USA or UK? Both of these markets are much larger than Australia. Therefore, if you think Afterpay can capture more than 10% of all e-commerce activity (as it says it has done here in Australia) then the company could experience more success in coming years.

Summary

For shareholders, there’s nothing to do right now but wait and see what happens with the company’s institutional capital raising and get the finer details of the SPP.

The fact that Afterpay’s senior management and founders are selling a chunk of their shares might put some investors off. But that may also be countered by the company’s ongoing growth overseas.

Since I don’t own Afterpay shares I’m very happy to watch this one from the sidelines, for now.

To get the names of one ASX technology share I do own, grab a copy of our free investing report below…

[ls_content_block id=”14947″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen Raszkiewicz does not have a financial interest in any of the companies mentioned.