The Australian Dollar (AUDUSD) has continued to slip into the 60-cents range today after the Reserve Bank of Australia (RBA) announced it would cut interest rates from a record-low 1.5% to a new record low of 1.25%.

Australian Dollar to US Dollar

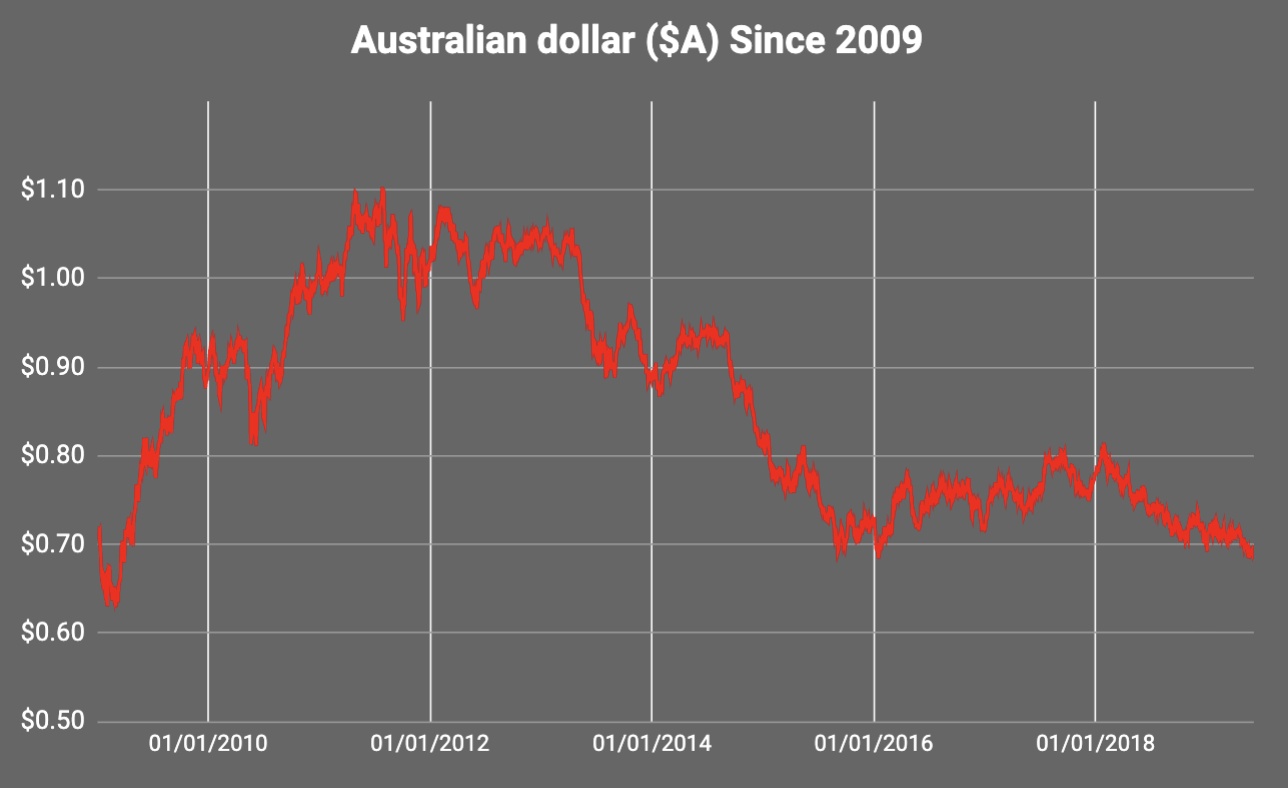

With the Australian dollar falling from its highs of around $1.10 all the way back in 2011 to below US70 cents today, there seem to be more reasons why the AUD could keep falling to 60 cents, rather than reverse its course. Here are three reasons that seem obvious to me:

1. Lower Interest Rates

Falling interest rates typically mean the local currency will face downwards pressure as large investors will seek to ‘sell’ their Australian dollars and ‘buy’ US dollars. Falling interest rates are often perceived as a sign of a weakening economy.

2. Housing

We’ve talked about housing many times before on Rask Media because the market is coming off the boil as credit/loans become harder to get and the underlying economy weakens. I recently sat down with property investing expert Pete Wargent to talk about his story, how he came to be one of Australia’s leading property investors and economists, and his outlook for housing:

Given that Aussies place such a huge emphasis on housing — sometimes making it their only investment and asset — and household debt levels are still sky high, if property prices keep falling then I’d expect the Australian dollar to see more weakness.

3. Trade War

The trade war between the USA and China is hurting both countries and every other country in between, including Australia.

We’re in a precarious position between the two nations when it comes to imports and exports, so further escalation could result in more pressure for the RBA to cut interest rates, as Pendal’s Vimal Gor recently told me on The Australian Investors Podcast:

What I’m Doing Now

Over the past year, I’ve diversified more of my personal share portfolio, which is also known as the Rask Invest Model Portfolio, into companies and currencies outside Australia. Specifically, at this time I have slightly over 20% of my cash sitting in US dollars and almost every one of the companies I own shares in generates much of its sales outside Australian shores.

Why?

I believe investing in countries and companies outside our home country of Australia lowers portfolio risk (as we’re seeing today) and increases the investment opportunities, given that around 98% of the world’s share ideas can be found away from the ASX.

As it stands, I see more reasons to keep investing abroad than focus solely on Australian shares. However, one of the ASX companies I own right now can be found in the free investing report below.

[ls_content_block id=”14947″ para=”paragraphs”]