Reece Ltd (ASX: REH) started in 1919 when its founder Harold Joseph Reece began selling plumbing fittings out the back of a truck.

Today, the business is the Australian leader of selling plumbing and bathroom products. Reece has over 800 stores in Australia, New Zealand and, more recently, the United States.

Coming from a plumbing background, I have seen first-hand the power of brand recognition that Reece has with its customers. You only have to walk onto a work site and see any number of workers with Reece t-shirts or the ‘Reece’ sticker on the back of their utes.

A few years ago, Reece decided to develop an app that plumbers can use to track deliveries, find the nearest branch, check invoices or search for a specific fitting (there are literally 1000s of fittings and hardware options in their system). Additionally, they have their own range of tools (Big Dog brand) and they are constantly seeking out innovative products made by many of their global suppliers, making the job easier for plumbers.

Generally, Reece seem to have pretty happy customers with the main criticisms being their products are “too expensive” or incorrect products being delivered to customers. However, competitors almost don’t compete.

Other plumbing suppliers struggle to stock the huge range of products Reece does, employ fewer service staff and lack stores across metropolitan areas. Reece, on the other hand, provides the products, service and locations to cater to the needs of the industry. In this industry, time is money, so I know I’d rather use Reece than any of the competition.

Growth Plans

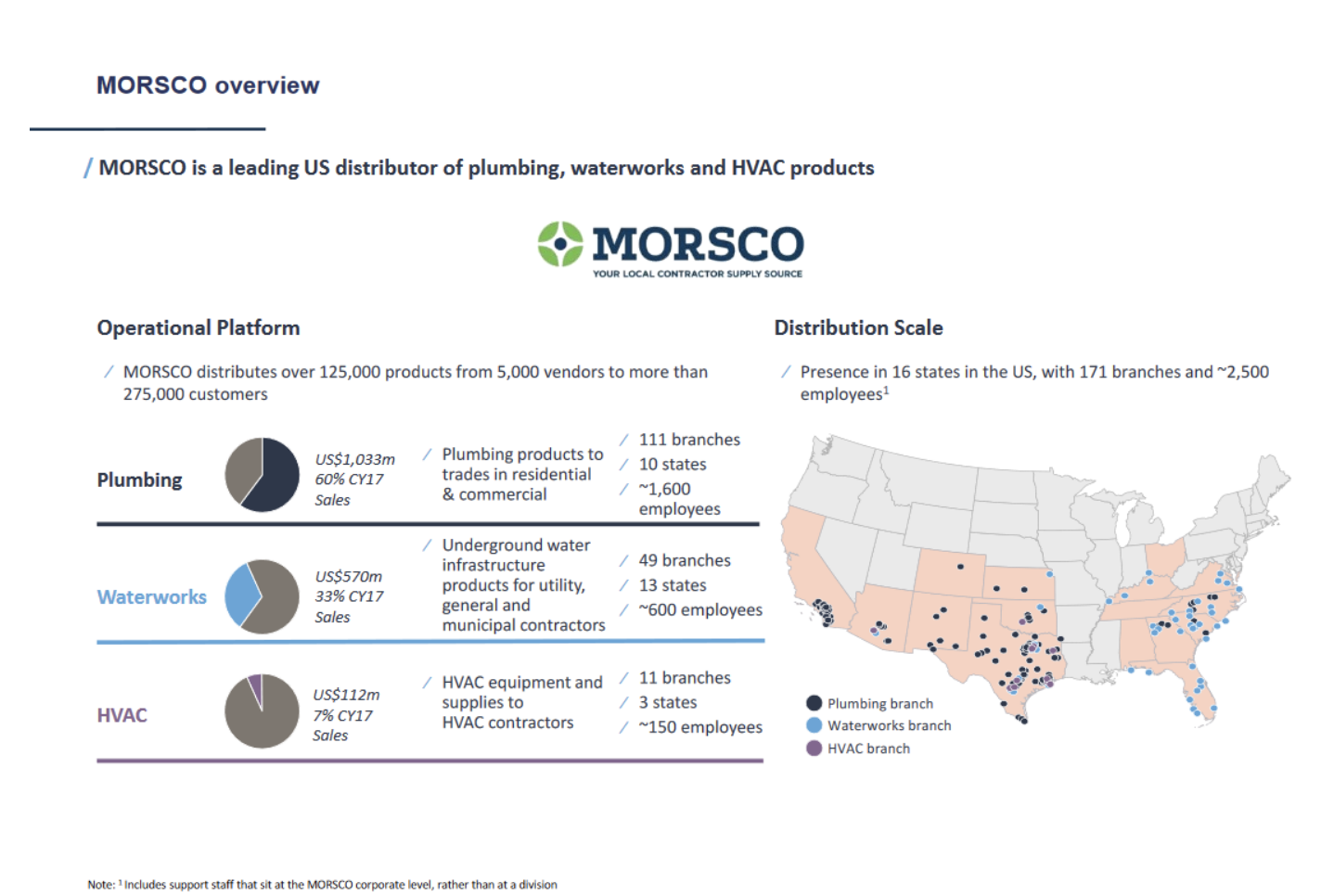

In July last year, Reece completed the acquisition of MORSCO, a leading supplier of plumbing, waterworks and heating and cooling (HVAC) fittings and hardware products in the Sunbelt region of the United States. This acquisition came at a cost of $A1.91 billion, which was funded by a combination of borrowing and capital raising. $300 million of the capital raised came from the current controlling and major shareholder of Reece, the Wilson family.

I’m always fairly cautious when it comes to companies issuing new shares and raising large amounts of capital to make big acquisitions, especially of businesses bought overseas. Australia’s history is littered with the remains of failed global growth ideas. AMP Limited’s (ASX: AMP) expansion into the UK and National Australia Bank Ltd’s (ASX: NAB) former Clydesdale Bank (ASX: CYB) are a couple that spring to mind.

Reece is taking a big risk with expanding into the US, but if it works, well, it will be very rewarding for shareholders long into the future.

A Strong Balance Sheet

Historically, Reece’s balance sheet has been solid, with the company having strong cash flow, little or no debt, an average Return on Equity (RoE) of 17% (over 10 years) and growth in earnings per share (EPS) each year.

The acquisition of MORSCO has changed a few of these things, the capital raising has diluted shareholders, meaning less EPS, increased debt and RoE will also likely decrease. Note: Return on Equity (RoE) is considered a measure of how effectively management is using a company’s assets to create profits for shareholders. Click here to learn more about ROE.

Time To Take The Plunge(r) & Buy Reece?

It will be interesting to see how the acquisition of MORSCO plays out over the next few years. With a strong ‘skin in the game’ management team at the helm I think Reece is a solid long-term stock to hold. My current issue is the valuation of the shares.

If Reece has paid too much for the acquisition of MORSCO and the slowdown in the Australian economy continues, this could be a real drain (pardon the pun) on its sales at home and then we would see Reece trade at a lower price than we are seeing today.

[ls_content_block id=”14945″ para=”paragraphs”]

Disclosure: At the time of publishing, Andrew owns shares of Reece.