It seems like the Bellamy’s Australia Ltd

(ASX: BAL) share price and a2 Milk Company Ltd (ASX: A2M) share price have rockets strapped to their backs lately.

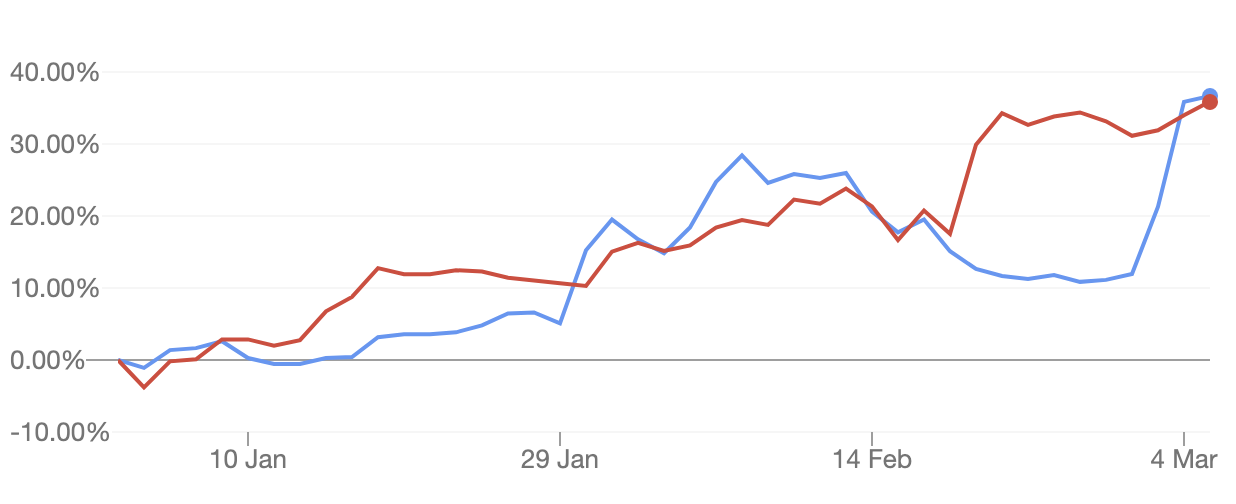

So far in 2019, shares of both Bellamy’s and a2 Milk seem to have gone vertical. Just take a look at this:

Source: Google Finance

Bellamy’s and a2 Milk shares are up about 36% in little over two months. That compares to the S&P/ASX 200 (INDEXASX: XJO) (^AXJO) return of just 10%.

What’s Going On With BAL & A2 Milk?

Last month, Bellamy’s and a2 Milk both reported their financial results to the market.

Bellamy’s is a specialist organic infant formula maker that is targeting the huge Chinese market. Unfortunately, due to repeated setbacks in China and a chronic oversupply of its product, during its recent six-month reporting period, its revenue was down ~25% and profit came in nearly 64% lower, year over year.

As Rask Media’s Jack Magann wrote here, “This has been attributed to the delay in the approval of Bellamy’s SAMR application. SAMR is the accreditation required by Bellamy’s to sell its products in China.”

Obviously the key for Bellamy’s is its China growth story. According to the Weekly Times, Bellamy’s has recently engaged social media “influencers” to support its marketing efforts in China. That news comes after Bellamy’s forecast (for FY19):

“Normalised Group EBITDA of 18-22% of revenue, reflecting lower forecast revenue and increased investment in marketing and the China team over the coming period.”

At the same time as Bellamy’s share price has had some positive momentum, ‘short sellers’ who are betting against the company might be scrambling to buy back shares (pushing prices even higher) to make safe their exposure.

According to Bloomberg, nearly 10% of all Bellamy’s shares are being shorted. Meaning, many punters are tipping the Bellamy’s share price to return to earth soon enough… but, if they continue to be wrong they could get wiped wondering if they were right because shorting is a very risky exercise!

Finally, a2 Milk seems to be riding the wave of optimism though it is hasn’t been plagued by issues with oversupply or brand corrosion like Bellamy’s. The a2 Milk share price seems to have rallied after it revealed a 41% increase in revenue and a 53% increase in profit per share just last month.

Promisingly, a2 Milk’s management plans to double their marketing spend and build-out their organisational structure, hinting at substantial long-term growth prospects.

Buy, Hold or Sell

Bellamy’s shares seem to me to be a very high-risk/high-reward proposition at today’s prices. Similarly, a2 Milk shares do not look cheap.

However, a2 Milk has a track record of delivering for shareholders and, if you take a walk to a local Coles Group Ltd (ASX: COL) or Woolworths Group Ltd (ASX: WOW) supermarket, you’ll see that a2 Platinum tins keeps flying off the shelves and into the hands of Asian customers.

For those reasons, I would back a2 Milk shares over Bellamy’s in 2019 and beyond. But for full disclosure, neither of them are held in my share portfolio today. If you’re looking for an ASX growth stock I do own, I recently bought shares in one of the fast-growth small-caps in the free report below.

[ls_content_block id=”14947″ para=”paragraphs”]