BHP Billiton Ltd (ASX: BHP) or ‘the big Australian’ is a great Australian mining company.

In fact, BHP is a world-leading resources company, extracting and processing minerals (like iron ore and copper), oil and gas, and has more than 62,000 employees and contractors, primarily in Australia and the Americas.

Headquartered in Melbourne, BHP has shares listed on both the ASX and London Stock Exchange as BHP Billiton Plc (LON: BLT).

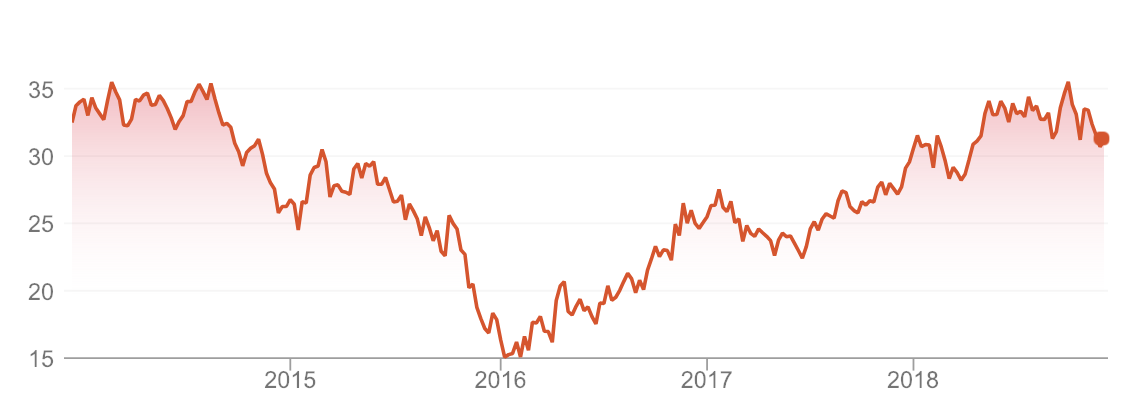

BHP Share Price

Since the iron ore and oil price rout in 2015/2016, which led to a cut in BHP’s dividends and profit, BHP shares have recovered tremendously, as this chart shows:

However, despite being ‘the blue-chip comeback kid’ of 2016, 2017 and 2018, here’s why I’m not a buyer of its shares.

1. Resources is a tough business. Typically, I don’t invest in resources shares because they are capital intensive businesses (e.g. mines aren’t cheap) and they are subject to the whims of commodity prices. We’ve seen this in the share prices of Rio Tinto Limited (ASX: RIO) and Fortescue Metals Group Ltd (ASX: FMG). What’s more, it’s not an industry I know very well.

2. Debt. Given its scale, wide profit margins and diversification, BHP can support debt on its balance sheet. However, I prefer companies without debt. At the very least, I like companies with a positive or net cash position (cash minus debt). BHP has an impressive amount of cash following some big asset sales, but I’d still like to see the debt pile reduced.

3. Valuation. Analysts place a fair value on BHP shares at around $34.70, according to The Wall Street Journal. In my opinion that’s a little too high. Based on its ability to pay dividends I think a fairer value lies somewhere closer to $30. Remember, that’s the price I think it might be worth — so I want to buy the shares substantially below that level (ideally).

Summary

BHP is a great company and could go on to beat the market from here. Especially when we factor in its generous dividend yield, which is currently forecast at over 5% with franking credits.

However, it’s not a business I plan to own at this time — or price. If you’re looking for 3 ASX shares I would own for the right price, keep reading…

[ls_content_block id=”14945″ para=”paragraphs”]