Adacel Technologies Limited (ASX: ADA) shares fell off a cliff in November and are down from around $2.50 at the beginning of 2018 to around $0.60 today. Yikes!

Who is Adacel?

Adacel Technologies is an air traffic technology company headquartered in Melbourne’s inner south-east. However, it’s really a Canadian/US technology company that does most of its business in the US. It was founded in the 80’s by Silvio Salom.

Adacel sells its hardware and software to airports around the world for training/simulation and in-field use. For example, it supplies a system to members of the Australian aviation industry, installs the system, then provides maintenance and other going “services”.

It’s the old printer and cartridge type model. Meaning, you supply a piece of hardware (e.g. a printer) and you sell an ongoing and highly valuable service (e.g. the printer ink).

It’s a good model for Adacel because if it can just get more sales of its ‘systems’, then it should be able to lock in years of sticky ‘services’ revenue.

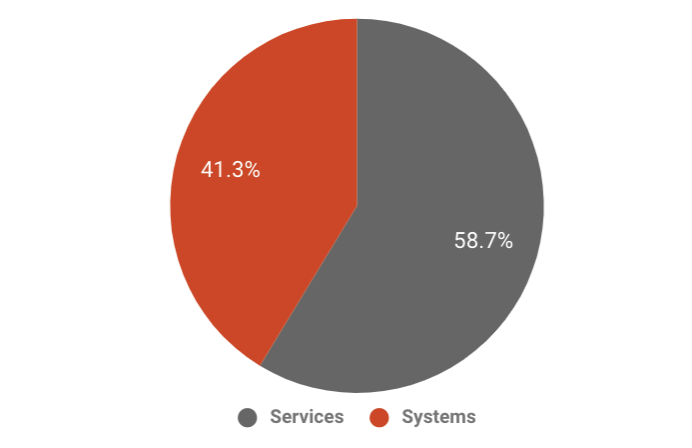

In 2018, you can see most of Adacel’s revenue came from services:

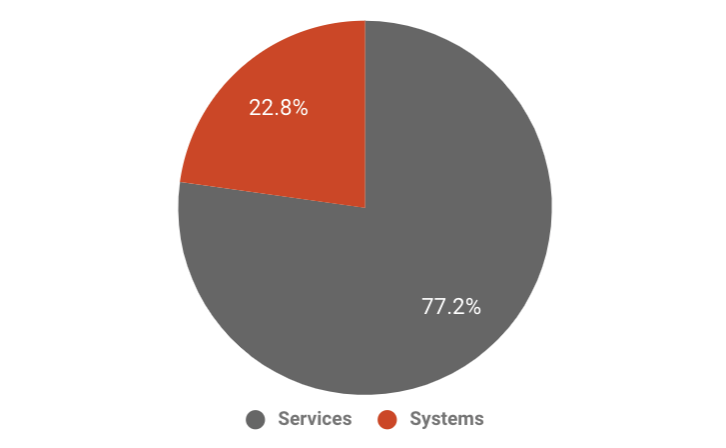

In 2017, it was a similar picture:

Between 2017 and 2018 everything seemed to be going well…

Red flags

Between 2017 and 2018 I ran my eyes over Adacel shares and noticed a few concerning trends.

Firstly, investors were tipped off to a potential “protest” between Adacel and one of its major customers, the USA’s FAA — a major customer.

In my opinion, investors should raise a very high red flag anytime a company “protests” a significant contract loss. People in aviation aren’t silly and big organisations like the FAA have scorns of lawyers who scrutinise legal contracts, so for Adacel to lose a contract to a rival, in my opinion, should tip you off to a few things:

- The balance of power rests with the customers, not the company you own shares in

- The product isn’t a clear industry-leader (if it was, there should be no reason to a lose a customer at all)

Other red (or amber) flags

I love to see the founders involved with good companies for a long period of time. Aside from ‘having your name on the door’, nothing motivates a CEO or management team like a big ownership stake in shares of the companies they run.

In recent times, investors might have noticed some ‘insider share sales’. It’s not always a bad thing that management sell some of their shares, but all things equal I’d rather see the management team buying.

Another thing which struck me as unusual (although this may indeed be typical) was that the Chairman of Adacel wasn’t directly paid a salary. Instead, as it says in the annual report, “Cash Salary and Fees paid to TIGA Trading Pty Ltd.”

TIGA is part of the Thorney Investment Group, which is a significant investor in Adacel shares and has been for a reasonably long time (as far as I know).

Large shareholders installing their own directors on the boards of companies is not unusual in corporate Australia, but I always get a little uneasy when I see it because I focus heavily on incentives before I invest in companies.

I don’t mean to overly negative. I just try to be critical — as all investors should be, in my opinion. And until 2018, management had done a good job of returning cash to shareholders and growing profit.

Having said that, Adacel plays in a market with multi-billion-dollar public, private and semi-private organisations with huge research and development (R&D) budgets. Is this small Aussie company’s decision to pay a few million bucks a year back to shareholders really the best move for the long-term?

Another amber flag for me was the opacity of the industry. Specifically, I found it very difficult to get a read on competitors. Who are they? Are they better or worse? What are they working on? How do they tender for contracts? As a global investor, I couldn’t say why Adacel was the air traffic control company I needed in my share portfolio.

Why did it fall so hard?

In November, Adacel put out a trading update to investors which was concerning, in my opinion. Here’s part of what the company said:

“Whilst the performance in the first half has been impacted by the previously announced loss of the FAA Tower Simulation Support Contract and related issues, the reduced full year forecast includes additional investment in research and development, sales and marketing capabilities as well as foreign exchange movements.”

While legal letters and proceedings seem to be a common occurrence in business, I was concerned to see FY19 profit fall so sharply versus 2018.

What now?

There is a price for everything and I still like Adacel’s core business offering. However, I think the dust needs to settle from this recent share price sell-off before I’ll take another look. What’s more, I’d have to get much more comfortable around some of the ‘flags’ and use a steep discount rate for my valuation.

On the flipside, at around 1x sales and a wide gross profit margin, it mightn’t be a bad place for value investors to start sniffing around. Unfortunately, I’m no good at knowing when I’m wrong or early with beaten-down shares. I’d rather be late and right, and lose a bit of the upside.

In the meantime, I have my eye on plenty of other ASX technology shares…

[ls_content_block id=”14945″ para=”paragraphs”]