This afternoon, shares of Qantas Airways Limited (ASX: QAN) were leading the ASX higher, rising 3%, following a foreign investor market update earlier in the day.

Qantas is Australia’s iconic ‘Flying Kangaroo’, a near $9 billion company.

What happened today?

Earlier today, Qantas released a statement to the ASX updating investors on its ‘Foreign Relevant Interest’.

As part of ASX listing rules and the Qantas Sale Act 1992, which was introduced in the early 90’s to prevent foreign powers or competitors from taking control of our largest airline, Qantas is subject to a few unique ownership rules.

For example, foreign interests cannot own more than 49% of the company, with one investor owning no more than 25%, and overseas airlines cannot control more than 35% of shares.

Who cares?

Some foreign airlines are heavily owned by Governments or other airlines, creating an uneven playing field and potential conflicts of interest.

ASX Listing Rule 3.19 requires Qantas to tell investors when foreign investors control more than 44% of shares and if their ownership changes by more than 1%.

Last month, Qantas determined that foreign owners held around 46.7% of all shares. However, a more recent report suggests they own just 43.6%.

Air New Zealand (ASX: AIZ) and Virgin Australia Holdings (ASX: VAH) are both partly-owned by either Government or foreign investors.

In 2016, China’s HNA Group bought a big stake in Virgin. According to Fairfax Media, about 13% of all shares.

Maintaining Qantas’ relative independence provides security and competitive pressure for the industry, which benefits consumers.

However, some analysts argue the rules stymie its ability to be competitive with airlines which may be owned by large foreign investors or Governments.

Qantas Shares

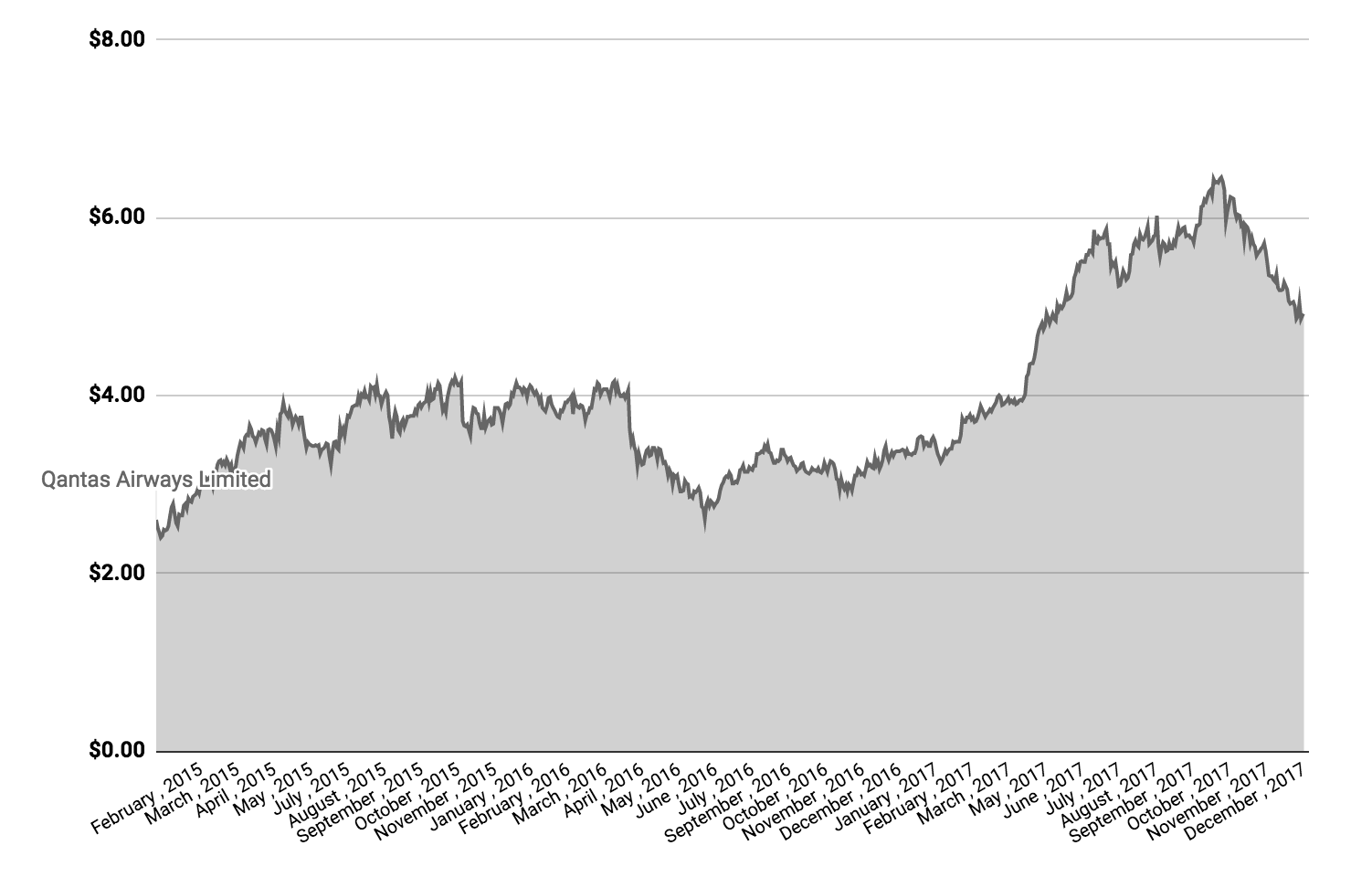

Nonetheless, falls in oil prices and cost savings appear to have boosted the Qantas share price in recent years.

Also, the company paid a dividend of 14 cents per share last year, according to Morningstar, more than double a year earlier.

And according to The Wall Street Journal, five of the seven analysts covering Qantas rate its shares as a “Buy”, with an average price target of $6.17 per share.

Keep Reading