What is financial deficit?

A Financial deficit means the government spends more money than it earns each year. In accounting terms, it shows up as negative numbers in the budget, so it’s also called a financial deficit.

Warren Munger

Want to get started investing in ETFs from Vanguard, ASX shares like Commbank or global stocks like Tesla?

That’s it! You could be an investor, this time tomorrow.

A Financial deficit means the government spends more money than it earns each year. In accounting terms, it shows up as negative numbers in the budget, so it’s also called a financial deficit.

Candlestick charts, also known as K-Line charts, are a commonly used form of charting in financial market technical analysis.

Opportunity cost is an important concept in economics and finance, representing the cost incurred by choosing one valuable option over another when making an economic decision.

Turnover rate is an important indicator in the stock market that reflects the level of buying and selling activities of stocks during a specific period. It is a crucial measure of stock liquidity.

The US stock market circuit breaker mechanism refers to a market protection mechanism designed to prevent excessive volatility in the stock market.

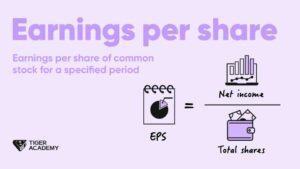

Earnings Per Share (EPS) refers to the earnings of a company per share of common stock during a specific period. In stock investing, EPS is an important financial indicator that helps investors assess a company’s profitability and the value of each share of stock.

Commodities refer to basic raw materials and goods traded in standardized forms on the global market, such as metals, energy, agricultural products, and precious metals.

Share dividends or dividend payouts refer to the distribution of part of a company’s profits to shareholders after the company makes a profit. This is a link between a company’s profits and shareholders’ equity.

Want to level-up your analytical skills and investing insights but don’t know where to start? Join 50,000 Australian investors on our mailing list and we’ll send you our favourite podcasts, courses, resources and investment articles every Sunday morning. Grab a coffee and let Owen and the team bring you the best insights.

Here you go: A $50,000 per year passive income special report

Join more 50,000 Australian investors who read our weekly investing newsletter and we’ll send you our passive income investing report right now.

Simply enter your email address and we’ll send it to you. No tricks. Unsubscribe anytime.

Unsubscribe anytime. Read our Terms, Financial Services Guide, Privacy Policy. We’ll never sell your email address. Our company is Australian owned.