ASX technology investors have been quick to retreat after a run of softer results, selling first and reassessing later.

Recent pullbacks across Technology One (ASX: TNE), Xero (ASX: XRO), Wisetech (ASX: WTC) and Life360 (ASX: 360) have shown how sensitive the market has become to growth expectations, especially with ongoing debate around AI investment, margins and the durability of earnings.

We wrote about the sinking Technology One share price post their FY25 results. The share price fell almost 17% as investors clamoured over one another for a path to higher ground.

While sentiment has shifted sharply, the company remains one of the ASX’s longest-standing software success stories, serving more than 1,300 customers across government agencies, councils, educational institutions and large organisations. Its modules span finance, HR, supply chain, property management, student management and asset maintenance, forming a critical operational backbone for many public and private institutions.

So, is this an opportunity to pick up some Technology One?

Is Technology One still one of Australia’s most durable software compounders?

Technology One remains one of the ASX’s longest-standing SaaS success stories. The company provides mission-critical enterprise software to government agencies, councils, educational institutions and large organisations. Its platform spans finance, HR, supply chain, property management, student management and asset maintenance, forming a core operating system for many customers.

The model’s real strength lies in customer stickiness and high recurring revenue. Technology One now serves more than 1,300 customers and continues to maintain renewal rates above 97 per cent. With the SaaS transition now complete, the benefits of the model — stronger margins, predictable contracted revenue and very low churn — are flowing through the financials.

For more than a decade, the company has delivered earnings per share (EPS) growth of around 14.5% annually (CAGR), supported by strong cash conversion and a long track record of dividend increases.

Why were Technology One shares sold down?

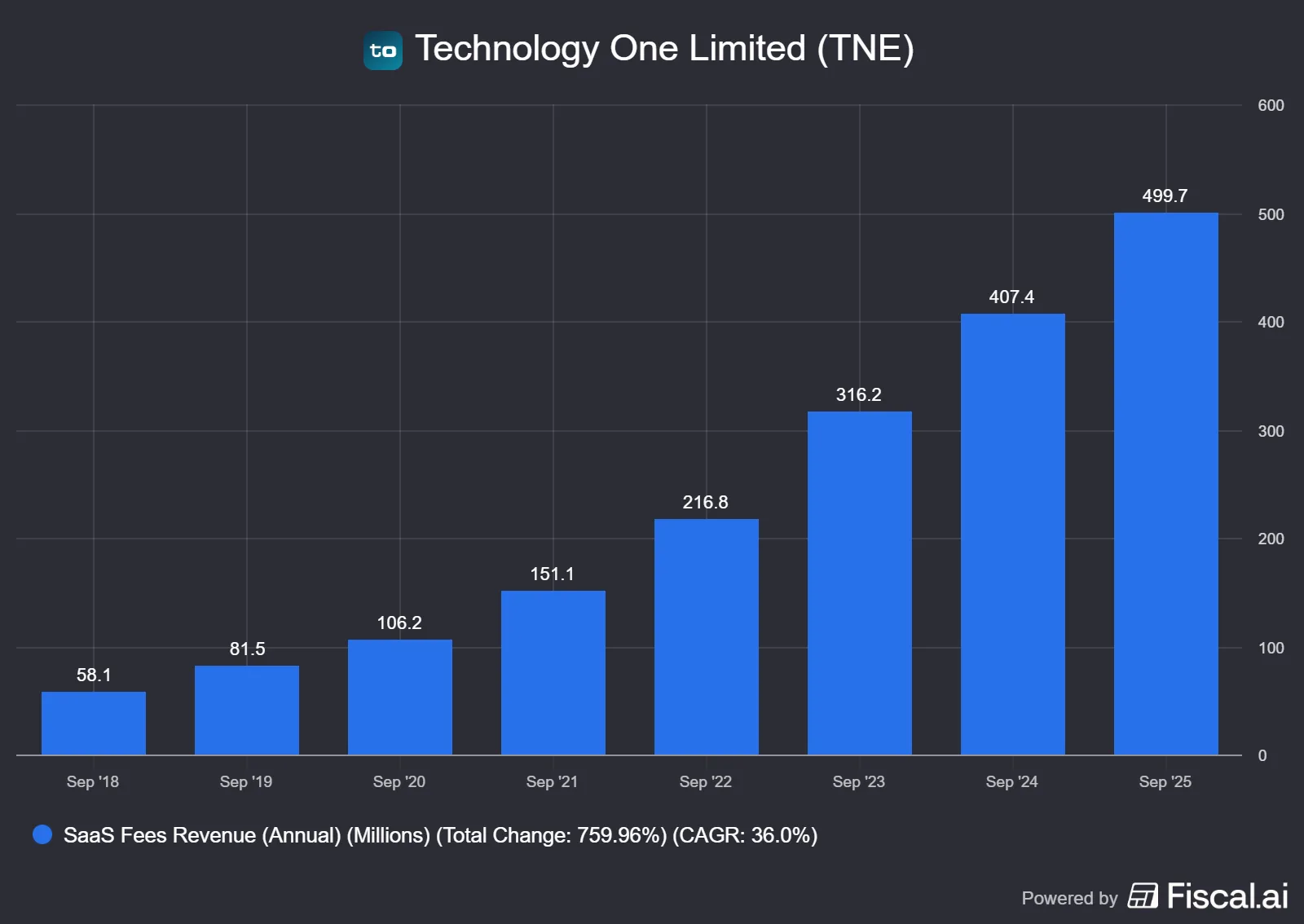

Despite this long-term performance, the market pushed the share price sharply lower after the FY25 result. Annual Recurring Revenue grew 18 per cent to $555 million, which is still strong, but short of the most optimistic expectations and below the 21 per cent growth achieved in the first half. Slower revenue growth, project timing and more cautious customer behaviour all played a role in tempering sentiment.

These issues, however, appear more timing-related than structural. Technology One’s customer base is heavily weighted towards government and other highly stable institutions, and its software sits at the centre of essential operations.

The company still delivered a profit-before-tax beat, declared a 20-cent dividend plus a special dividend, and surpassed its $500 million annual recurring revenue (ARR) target 18 months early. Management has now set a longer-term goal of reaching $1 billion (insert Dr Evil Meme) ARR by 2030.

5 reasons Technology One remains a high quality business

In my view, the company’s long-term value proposition remains intact:

- Compounding ARR: recurring software revenue has compounded at strong rates for years, supported by deeply integrated workflows that create high switching costs.

- Government-heavy customer mix: a significant share of recurring revenue comes from government, councils and universities. These are stable, multi-year relationships with consistent renewal patterns.

- Expanding margins and operational leverage: with the SaaS transition behind it, incremental revenue converts more efficiently into profit. Margins continue to expand and the balance sheet remains strong.

- Disciplined culture and long-term management: Technology One has a reputation for conservative guidance, steady execution and focusing on profitability rather than high-risk growth strategies.

- Strong competitive moat: its vertical focus in Australia and New Zealand gives it a durable edge. Large global ERP players struggle to match its tailored modules and deep domain knowledge. The growing UK footprint adds further potential.

Where the opportunity may lie

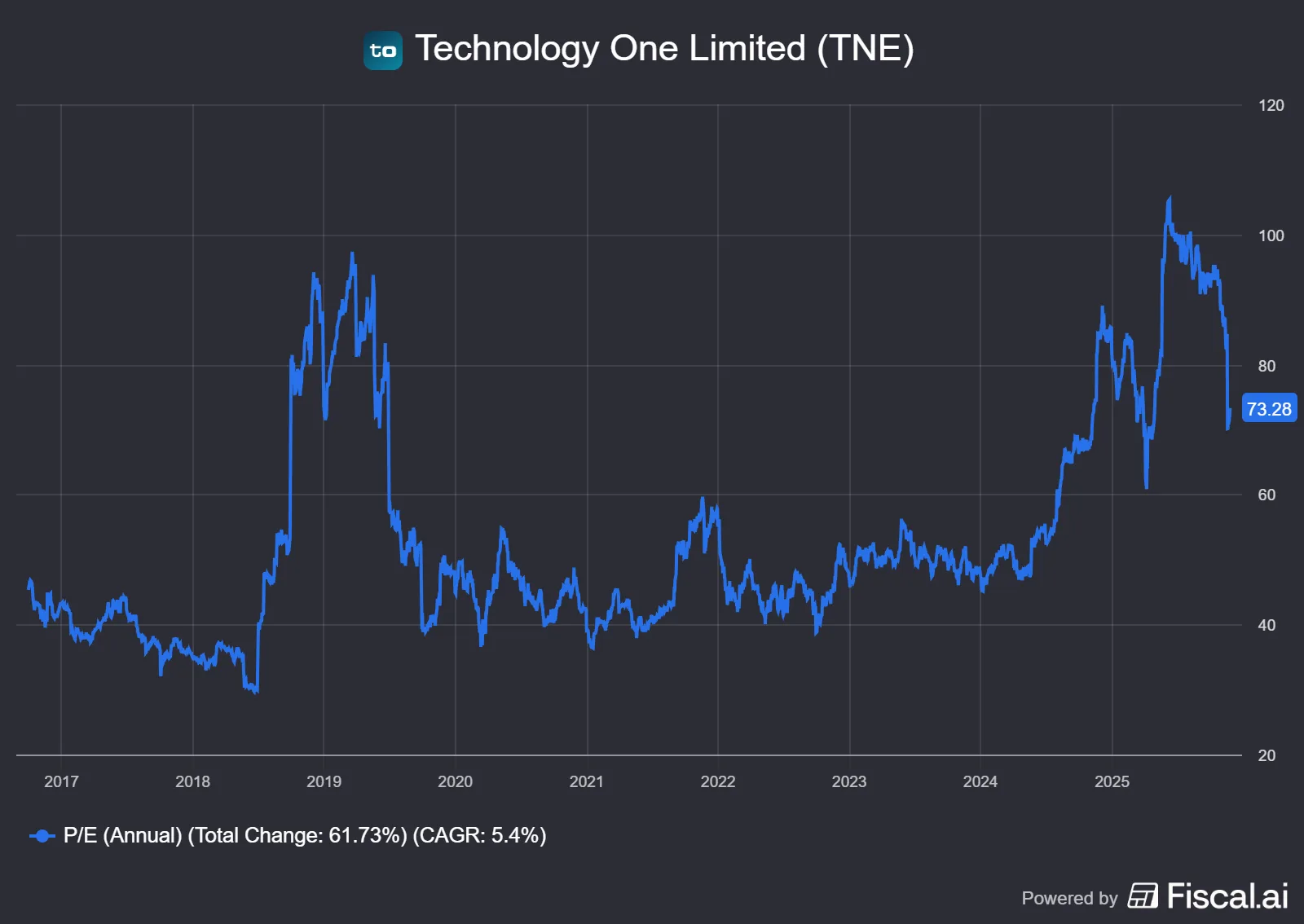

Despite the sell-off, there are still reasons long-term investors may keep Technology One on their radar. The gap between short-term sentiment and long-term business strength has widened, and the recent de-rating brings the valuation closer to long-term norms. Technology One has been a premium-rated business for years, so moments of volatility often draw attention.

The historic price-to-earnings ratio below shows the sharp pullback, a movie we’ve seen before:

The broader backdrop remains supportive. Government digital transformation, cybersecurity compliance, cloud migration and modernisation of asset systems are multi-year themes. Module expansion and deeper penetration into existing customers provide ongoing runway, and the UK business, while still early, could become a meaningful contributor over the medium term.

A temporary setback for a long-term compounder

Technology One has long been considered one of the ASX’s most resilient compounders. The recent share price reaction looks more sentiment-driven than fundamental, and history shows that high-quality, recurring-revenue businesses often experience short-term volatility on the path to long-term growth.

While investors should always make decisions based on their own circumstances and risk tolerance, periods like this can serve as a useful reminder to revisit the underlying business rather than the headline reaction.

You don’t have to hold TNE directly. Within the Rask Invest portfolios, TNE is a top-10 holding in the major ASX technology ETF, ATEC (ASX: ATEC) and a top-50 holding in Vanguard’s VAS ETF (ASX: VAS).